The catastrophe bond hard market is over and prices have been softening since late 2023, leaving the market back close to the mean, but perhaps just beginning to dip into what Lane Financial calls soft market territory.

The softening of pricing in the catastrophe bond market has been all-too evident across issuance over the last roughly six months, with a steady decline seen in issuance spread multiples.

That decline has been far from uniform though, with differentiation seen according to peril or region, cedent and structure as well.

But consultancy Lane Financial has analysed the consistent expected loss of the catastrophe bond market, on a forward-looking basis and finds that prices for natural catastrophe bonds have softened back towards their historical mean.

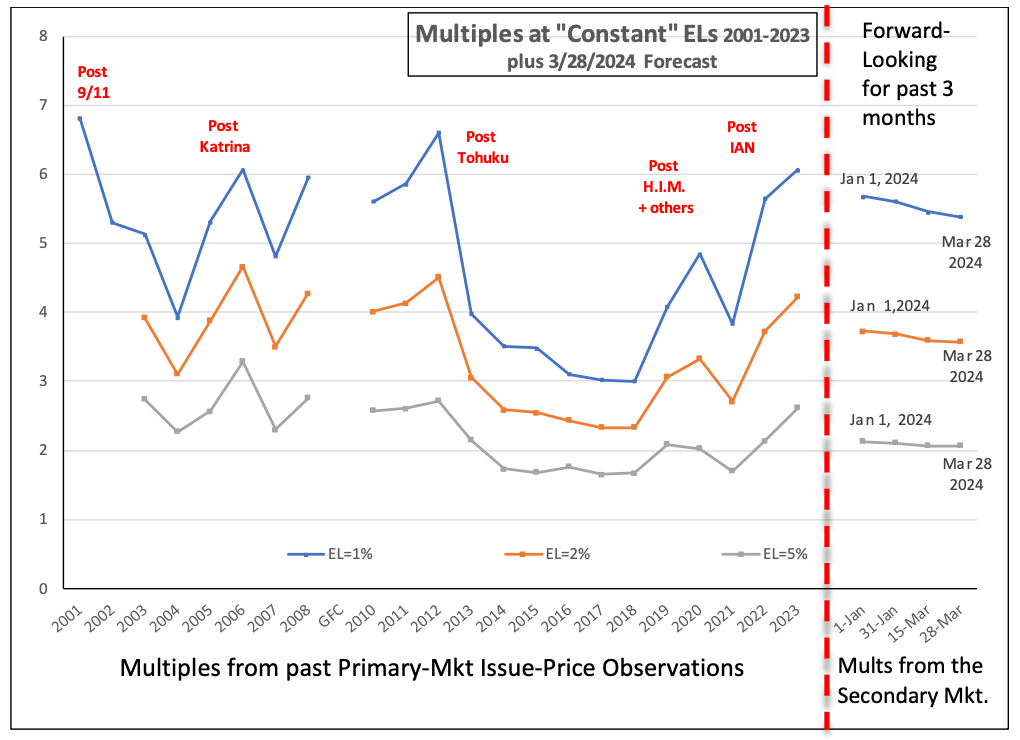

In the chart below, from Lane Financial’s latest trade note, you can see multiples at constant expected loss levels of 1%, 2% and 5% with the pricing based on issuance to the left of the dotted line, but a forward-looking view based on secondary market rates and yields to the right.

Lane Financial explains, “To the left of the vertical dotted line in Figure 1 are measures of the multiples (Coupon/Expected Loss [EL]) each year for the past 23 years. The three lines represent a constant 1% EL, a 2% EL, and a 5% EL Cat Bond. They all show that a) the multiple is volatile and b) has recently been rising. It leaves the impression that multiple could rise further, that the hard market will continue.

“However, the lines to the right of the red line are the readings from the secondary market – they measure the multiple as (Yield/EL).

“Those forward-looking multiples have been falling. The market is no longer hard.”

Lane Financial then provides a helpful comparison of January 2023 and March 28th 2024, which shows a stark difference in the forward-looking multiples of the catastrophe bond market.

Even more useful is the fact the data is plotted against a backdrop showing the range of hard and soft catastrophe bond market price multiples.

This figure “tells the real story,” Lane Financial believes.

Explaining on the image below, “Yield multiples are falling for equivalently risked ILS. Indeed, against the background of the past they are now back at the average of experience.

“The ILS market is neither Hard nor Soft. It is decidedly average or neutral.

“It has been heading that way since October or November of 2023, but it has now reached that statistical mean.”

It certainly looks from the chart above that the cat bond market is dipping into the upper-bounds of what Lane Financial considers soft.

Which leads Lane Financial to state that, for investors in catastrophe bonds this means the returns of 2023 cannot be replicated.

“Instead, with average loss experience and a steady Federal Reserve, they could expect total returns in the 8-12% range. Zero or low losses and further multiple compression into soft market territory will push it towards 12%, above average losses will push it in the opposite direction,” the analysts say.

But, even at these now softer pricing levels, catastrophe bond and insurance-linked securities (ILS) investments remain a compelling opportunity, Lane Financial believes.

Stating, “Still, ILS assets with those kinds of total returns and low correlations with other assets are terrific ones to acquire. ILS investments over 23 years at average prices have produced steady annual underwriting results at 5-6% over the floating rate. It should this year as well.”

Morton Lane and Roger Beckwith of Lane Financial LLC once again provide the analysis to clearly display the experience and current price levels in the catastrophe bond market, offering another valuable data point for those investing or working in the market.

While the softening looks relatively significant, we must remember just how hard pricing had become and question whether that had been overdone, for a wide range of factors.

Also, while expected loss data and multiples thereof goes some way to expressing the risk being assumed in cat bonds, the updates to terms and conditions, such as attachment points, deductibles etc, as well as the decline in aggregate coverage in the market, all have a bearing on how the market would experience losses in specific catastrophe years going forwards as well, and this is much harder to quantify, but does mean an equivalent spread earned today can be much more remote from losses, it seems.

Remember you can look at catastrophe bond market pricing trends, at issuance, using our charts showing the average expected loss and spreads of cat bond & related ILS issuance by year and the average multiple (expected loss to spread) of cat bond & related ILS issuance by year.

Also read: Cat bond performance ahead of expectations, as losses continue to lag: Lane Financial.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.