Catastrophe bond and insurance-linked security (ILS) rates-on-line continue to accelerate away as the hard market persists, rising another 11% in the second-quarter of 2020, according to the synthetic ILS rate-on-line Index calculated by Lane Financial.

Cat bond and ILS rates and pricing continue to sit in what Lane Financial would call hard market territory, having first said the market was entering such a state towards the latter stages of 2018.

Over a year ago the consultancy said that catastrophe bond rates were the highest they had been since 2012/13.

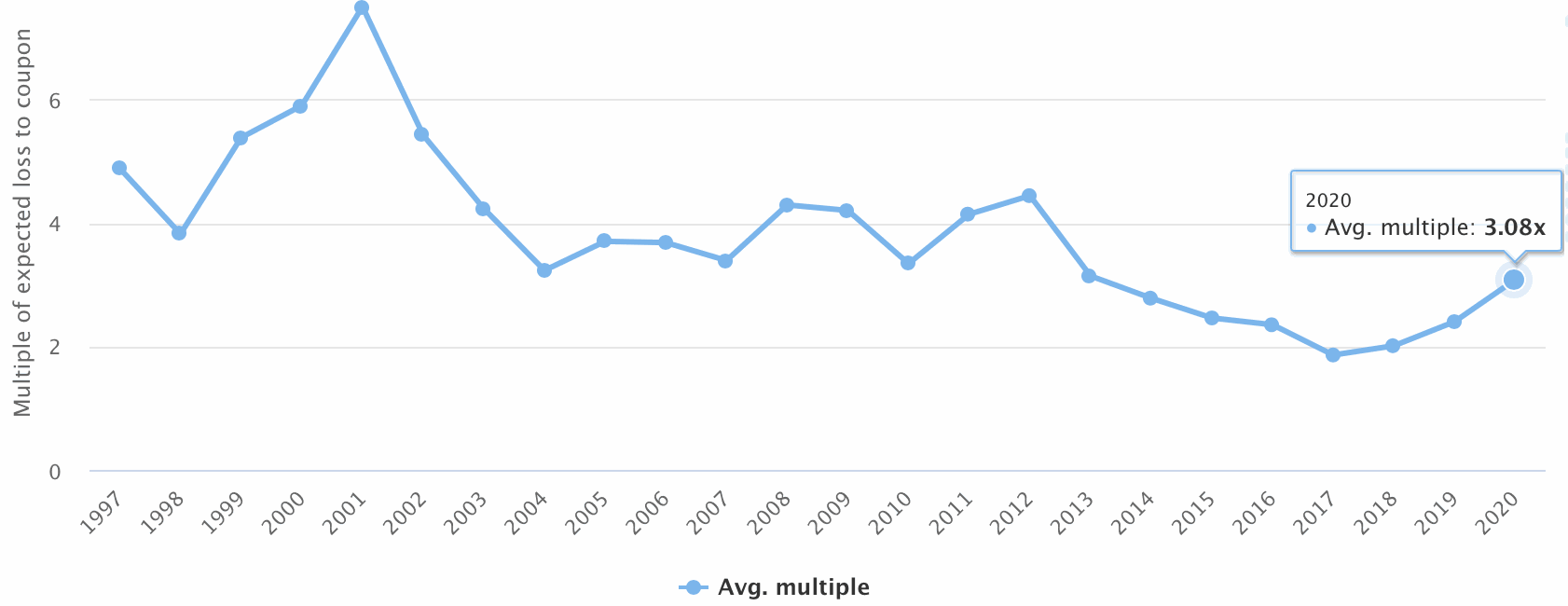

Now, as the Lane Financial LLC synthetic ILS rate-on-line Index has risen a further almost 11% in the last quarter, it actually appears catastrophe bond rates are now back at levels not seen mid-2012.

More impressive is the now over 25% gain in catastrophe bond and ILS rates-on-line in the first-half of 2020, as the index clearly demonstrates the significant investor opportunity in cat bonds right now.

It clearly shows the demand for higher returns among ILS funds and their investors, as investment returns from reinsurance linked instruments rise sharply following the losses of recent years, as well as cat bond spread increases in the secondary market as well.

Of course the Covid-19 pandemic has concentrated investor appetite for higher returns, driving rates-on-line even higher and might make this cat bond hard market more sustainable over the longer-term than previous examples.

Lane Financial’s synthetic rate-on-line Index makes use of data from catastrophe bond, insurance-linked security (ILS) and industry-loss warranty (ILW) markets, offering an approximation of premiums being paid (or rate-on-line) for ILS and cat bond backed reinsurance and retrocession. It is considered one of the ILS sectors bellweather benchmarks.

The firming of rates has been clearly reflected in multiples at market of recent issuance, with the average multiple of catastrophe bonds issued in 2020 now standing back near levels last seen in 2013.

This firming trend of reinsurance rates and the catastrophe bond hard market may persist right through into 2021, as ILS capacity in general remains lower than it was in previous years and investor’s costs-of-capital have clearly risen because of the pandemic.

Lane Financial’s chart showing ILS hard market periods reveals that we may already be in the longest-lasting catastrophe bond and ILS hard market period on record, which now looks firmly entrenched (at least for the moment).

It will be interesting to see how long this level of rates can be sustained, but for investors it is clear that the opportunity to enter or upsize allocations to this market at this time is significant.

You can download all of Artemis’ quarterly catastrophe bond market reports here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.