The average return of the insurance-linked securities (ILS) fund market was only 0.13% in January 2021, as pure catastrophe bond funds outpaced those invested in private ILS, according to the Eurekahedge ILS Advisers Index.

Pure cat bond funds returned 0.29% as a group in January, which was a reasonable start to the year for these strategies.

Pure cat bond funds returned 0.29% as a group in January, which was a reasonable start to the year for these strategies.

But the group of ILS funds that invest in private ILS contracts and collateralised reinsurance was only up by 0.02% in January, as a number of funds reported negative performance.

We understand some adjustments to reserves and side pockets for prior period loss events, including reserves made against potential COVID-19 business interruption loss effects were a driver, as too were new estimations of recent natural catastrophe events.

These contributed to some collateralised reinsurance focused ILS managers starting the year off on a negative footing.

In total, 24 of the ILS funds tracked by the Eurekahedge ILS Advisers Index reported positive returns for the month of January 2021.

However, 6 ILS funds were negative, with these the ones facing re-estimations of prior period losses, we understand.

However, while some ILS funds faced negative performance to start the year, overall the range of performance across the ILS funds tracked was tight, spreading from -1.5% to +0.7% for the month.

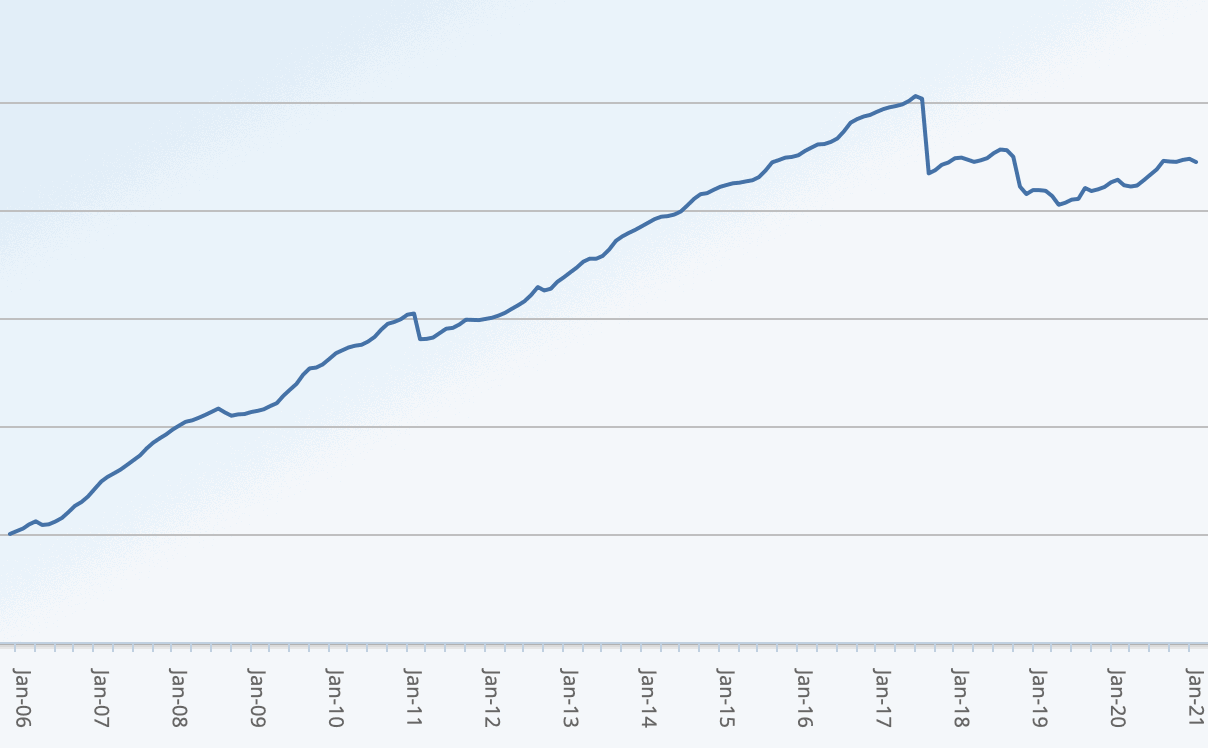

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.