Decline in ILS ratings shows the asset class isn’t so alternative: KBRA

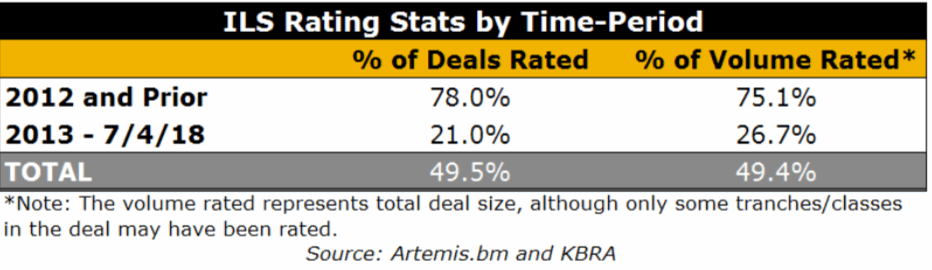

17th August 2018A decline in the volume of rated catastrophe bond and insurance-linked securities (ILS) transactions is a key indicator that ILS has become a more permanent source of risk capital and gained heightened acceptance by capital markets investors, according to Kroll Bond Rating Agency (KBRA).

Read the full article