A decline in the volume of rated catastrophe bond and insurance-linked securities (ILS) transactions is a key indicator that ILS has become a more permanent source of risk capital and gained heightened acceptance by capital markets investors, according to Kroll Bond Rating Agency (KBRA).

According to KBRA, 2013 was an inflection point that saw the percentage of rated ILS transactions decline as the marketplace evolved and matured, alongside an increased reliance on third-party and in-house information for pricing and credit risk.

As a result of this increased ability of ILS experts to price transactions on advanced modelling and default probabilities, which has proved sufficient in analysing both risk and return, credit ratings were no longer viewed as necessary as before for many transactions, explains KBRA.

And it’s this transition away from a more rated environment that KBRA feels is a sign that the asset class is no longer an alternative one.

“KBRA believes the decline in rated ILS transactions is a key indicator that ILS has moved from “alternative” capital to more permanent capital as part of the “new normal”, especially for natural cat bonds.

“KBRA believes the decline in volume and rated ILS transactions is an indication of greater investor acceptance and understanding of these securities, likely driven by advanced hurricane catastrophe modelling techniques,” says the firm, in its recent Insurance Research note.

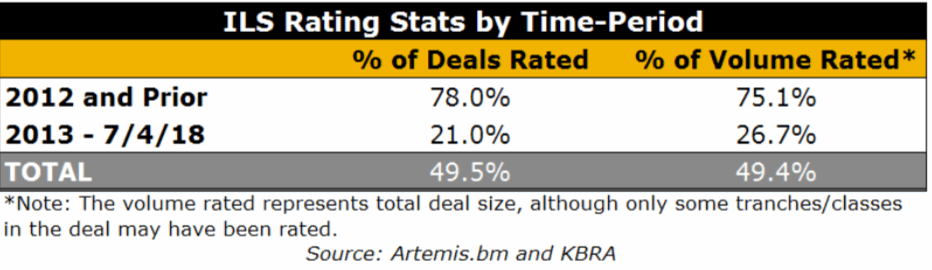

As shown by the above table, the percentage of rated ILS deals has declined from 2013, and KBRA expects this trend to continue, with ratings being assigned to more exotic, emerging, or less understood exposures.

“Going forward, KBRA believes rated ILS issuances may be limited to unique perils and new classes of risks where investors are not as comfortable with the risk and return balance of an unrated transaction,” says KBRA.

In 2017 there were some rated ILS issuances, and, in line with the trend identified by KBRA these deals did protect against some more exotic perils, and also non-natural catastrophe-related exposures.

This includes prolific cat bond sponsor USAA’s Residential Reinsurance 2017 Limited (2017-2) transaction, which protects against a range of U.S. exposures that includes meteorite impact and volcanic eruption.

Outside of the nat cat space, Arch Capital’s rated Bellemeade Re 2017-1 Ltd. deal offered protection against mortgage insurance risks, as shown by the Artemis Deal Directory.

In 2018 so far, out of the more than $11 billion of new catastrophe bond and related ILS transactions we’ve tracked year-to-date, only four mortgage ILS transactions and one pure catastrophe bond have been rated.

That’s mortgage ILS’ the $424.4 million Radnor Re Ltd., the $374.5 million Bellemeade Re 2018-1 Ltd., the $264.6 million Oaktown Re II Ltd, and the still being marketed $653.3 million Bellemeade Re 2018-2 Ltd., as well as the one pure catastrophe bond a $200 million Class 13 tranche from USAA’s latest Residential Re 2018-1 deal.

That equates to around 16% of the issuance volume we’ve tracked so far this year having a rating, but with 100% of the mortgage insurance ILS deals rated if we cut it down to just property catastrophe bonds the percentage is tiny at just 2% of volume issuance having a rating in 2018 so far.

So, it’s clear the volume of rated transactions has declined over the last eight years or so and perhaps continues to with only a minimal amount of property catastrophe bonds rated at all now. So clearly investors no longer feel the need for property cat bonds to be rated at all.

But, it appears that ratings are necessary for certain lines of business (mortgage reinsurance in particular), which is likely due to the investor profile for those specific deals, although this could also change over time as investor comfort, understanding and acceptance of this newer risk increases.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.