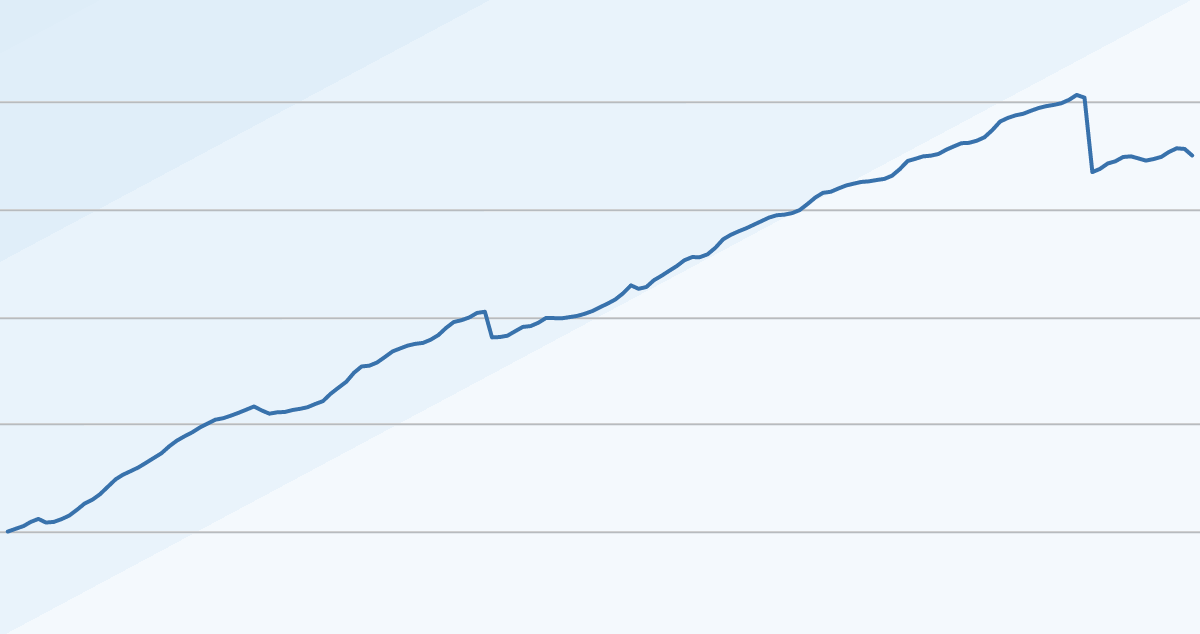

Insurance-linked securities (ILS) and reinsurance linked investment funds fell to a negative December, thanks to continued loss development and loss creep from catastrophe events in prior months, which added to the already negative year and drove 2018’s ILS Index return to -3.92%.

December 2018 is now the worst December on record for the Eurekahedge ILS Advisers Index, with the average return of ILS funds tracked under the Index falling to -0.97% for the month.

December 2018 is now the worst December on record for the Eurekahedge ILS Advisers Index, with the average return of ILS funds tracked under the Index falling to -0.97% for the month.

That negative end to the year drove the full-year ILS Index return to a negative -3.92%, the second worst year on record, ranking only after 2017’s -5.6%.

We warned a few weeks ago that ILS fund returns were once again suffering due to ongoing loss creep and that December would likely prove another negative month for the market.

This is confirmed with the latest figures from ILS Advisors today, who highlight that only 7 of the 33 ILS funds that it tracks under the Index managed a positive return in December 2018.

“Interestingly, there are no major events in December and the losses for the month mainly stemmed from loss development of previous events,” ILS Advisors Founder Stefan Kräuchi explained to Artemis.

Explaining the performance of the ILS fund market in December 2018, Kräuchi told us that pure catastrophe bond funds saw a negative -0.40% return for the month, while ILS funds that also invest in private ILS and collateralized reinsurance fell -1.39%.

Private ILS funds and those focused on collateralized reinsurance underperformed pure cat bond funds for the year, which is rare and reflects the higher risk/reward strategy of many of these funds.

Cat bonds delivered a total return of 2.53% for the full-year 2018, according to the Swiss Re Index, which while lower than the average is still impressive given the losses, loss creep and aggregation.

However, that’s without fees and other costs related to managing cat bond funds, and the ILS Advisors Index shows pure cat bond funds made a positive return of 1% for the year, on average.

Meanwhile private ILS funds as a group fell to a -6.15% loss, although the differences within this group will have been stark and some private ILS strategies will have reported positive full year returns (others very negative).

On an annualised basis, private ILS funds underperformed pure cat bond funds by -8.43%.

But once again, it wasn’t every ILS fund that suffered in December, in fact there were some who managed particularly impressive returns for the month.

The best performing ILS fund managed a 1.26% positive return in December 2018, an impressive performance given the impacts others felt from previous catastrophe loss events that saw their estimates continue to creep higher in the period.

On the other hand, there was one ILS fund (focused on private collateralized reinsurance deals) that reported a -12.55% decline for December, reflecting the huge range between strategies and how impacts of catastrophe events are far from equally shared across the ILS fund market.

This is of course very positive for investors though, as it demonstrates the wide-range of risk and return profiles that are available to allocate capital to.

As a result, the gap between best and worst performing ILS fund was wide again, at 13.81%.

ILS Advisers noted the fact that private ILS funds have to establish side pockets to deal with loss events, to protect newer investors from exposure to old losses.

As well as fresh catastrophe events, such as the wildfires in California, typhoons Jebi and Trami in Japan, hurricane Michael and hurricane Florence, both private ILS and catastrophe bonds suffered from losses to aggregate reinsurance and cat bond contracts during 2018, which delivered much of the loss and ongoing loss creep.

Kräuchi said, “It’s noteworthy that side pockets of some ILS funds could amount to a significant portion of the total AUM. As we mentioned previously, some private ILS funds are obligated to make side pockets due to the complexity of the events and that collateral needs to be kept until commutation. Industry wide, some estimates say 20% of the capital could be trapped. However, cat bond funds usually don’t make side pockets. This means side pockets mainly come from private ILS funds and the actual percentage could be higher than that estimate.”

This is a very good point, as the estimates of trapped collateral look across the range of ILS fund strategies and it is only the private ILS and collateralized reinsurance or retrocession strategies that use side-pockets as a feature.

Cat bond funds benefit from weekly pricing marks that help them to mark down the value of their positions regularly, where as the greater level of uncertainty and lower transparency in a reinsurance or retro contract means fund managers have to make a reserve based on their best estimates at the time.

There could be and likely are some ILS funds with upwards of 40% of collateral trapped, while at the same time there will be others with low single digit percentages held, once again reflecting the wide-range of risk and return strategies now available in the ILS fund market.

So 2018 was another challenging year, resulting in a negative return for the ILS fund market as measured by the ILS Advisors Index. But looking ahead, higher rates and also price recovery could drive some better months for ILS fund investors, with January already beginning to look more promising based on the ILS funds that have reported their returns so far (also read Cat bond portfolios benefit from January price recovery).

You can track the Eurekahedge ILS Advisers Index on Artemis here, including the new USD hedged version of the index. It comprises an equally weighted index of 33 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.