Weakening hurricane Florence is now pounding the North and South Carolina coast, with the storms slow approach resulting in dangerous storm surge and flooding impacts, as torrential rains, river floods and storm surges of 10 feet are being reported.

Hurricane Florence had originally been expected to make its landfall with 140 mph or higher sustained winds, at which time the wind damage component of the storm would have been considerable.

Now, Florence has weakened to maximum sustained winds of 85 mph at the latest NHC update, making hurricane Florence Category 1, the expected contribution to insurance and reinsurance market losses from wind has dropped somewhat, while the water component threat remains particularly high.

Having surprised meteorologists repeatedly, Florence has slowed significantly before landfall and could rake the North Carolina coast for some time, with surges also expected in South Carolina.

The eventual loss ramifications for the insurance and reinsurance industry remain uncertain and while it is clear that the potential for a major industry loss has dropped somewhat with the winds, Florence will still be costly even though fact flood coverage is not as widespread as property coverage against storm winds.

Hurricane Florence is now category 1 in strength with maximum sustained wind speeds of around 85 mph and higher gusts, but expected to steadily weaken from here on due to increasing land interaction. The eye of Florence is just off the coast now, with landfall expected in the coming hours.

Wind gusts of up to 99 mph have already been reported in the landfall areas and sustained winds of 75 mph have been recorded at Cape Lookout, North Carolina.

The size of the hurricane Florence insurance, reinsurance and any ILS market loss remains difficult to forecast, given the slow movement of the storm, uncertainty over how much wind damage there will be and expectation of widespread flooding across mid-Atlantic states.

Hurricane force winds extend outwards up to 80 miles from the center of hurricane Florence at the latest update, as the storm continues to grow, while tropical storm force winds extend outwards 195 miles. Florence is a very large storm and will impact a wide area, wherever it comes ashore or rakes the coast, hence impacts are expected to be significant.

Hurricane Florence will linger in the area, with effects felt for a significant amount of time (some areas of coast as much as 48 hours), bringing torrential rains to the area and affecting a wide swathe of the North and South Carolina coast with strong hurricane to tropical storm force winds and storm surge over the period.

The good news is that the hurricane force winds will weaken quickly after landfall, but tropical storm force winds could be felt for a number of days in some weather model scenarios.

Storm surge is a significant concern, with up to 11 foot possible and given the convex shape of the Carolina coastline this could be exacerbated if hurricane Florence makes a slow approach, pushing water onto land. Also the surge could get held against the coast for longer, as hurricane Florence slowly approaches the shore, again exacerbating water related impacts.

Inundation of 10.1 feet has already been reported at New Bern, North Carolina, on the Neuse River, with 6.3 feet of

inundation at Emerald Isle.

Meteorological factors continue to have significant ramifications for insurance and reinsurance interests and make forecasting losses extremely difficult with this storm, not just in the immediate wind damage and coastal storm surge flooding that can be expected with a hurricane approaching at slow speed and landfall in that area, but also from the expected deluge of rainfall.

The eventual industry loss to insurance, reinsurance and ILS interests from the water component of hurricane Florence is likely to be particularly significant, given the forecasts show the storm lingering and passing slowly inland which will result in significant rainfall.

Just how impactful (in terms of financial cost) the wind component turns out to be remains much harder to predict, but as Florence has now weakened to Category 1 the potential for major losses from hurricane force winds has reduced in-line and as a result some of the threat to ILS markets is considered lower, given their focus on the peak peril associated with hurricanes.

But either way, hurricane Florence presents a signifiance threat to lives, livelihoods and property and this is a dangerous situation for the affected area.

The NHC says:

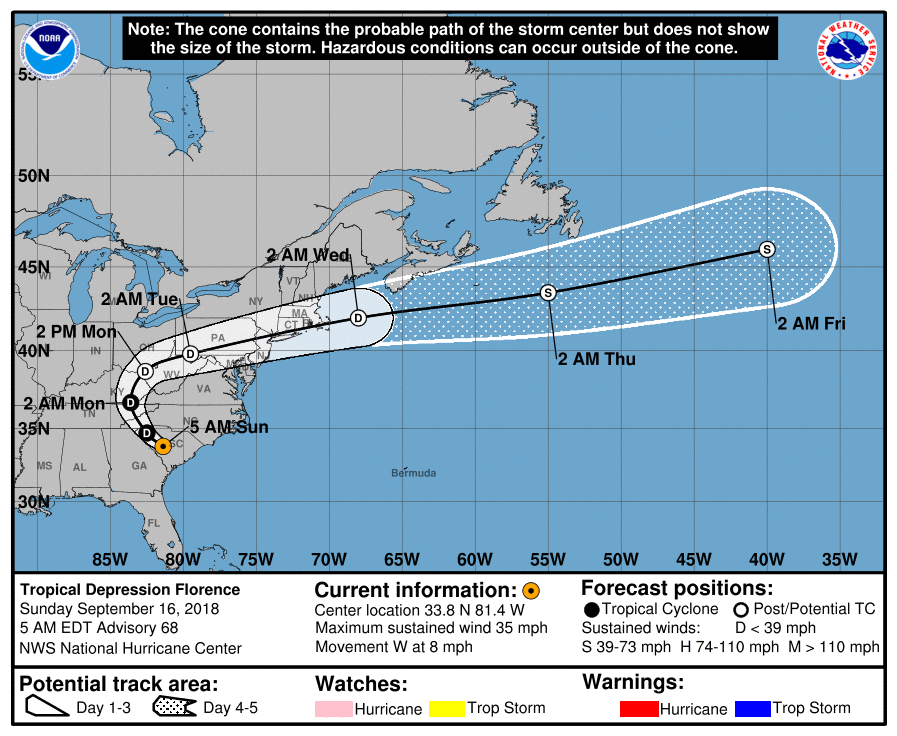

Florence is moving toward the west near 6 mph (9 km/h). A slow westward to west-southwestward motion is expected today through Saturday. On the forecast track, the center of Florence will move further inland across extreme southeastern North Carolina and extreme eastern South Carolina today and Saturday. Florence will then move generally northward across the western Carolinas and the central Appalachian Mountains early next week.

Maximum sustained winds remain near 90 mph (150 km/h) with higher gusts. Gradual weakening is forecast later today and tonight. Significant weakening is expected over the weekend and into early next week while Florence moves farther inland.

1. A life-threatening storm surge is now highly likely along portions of the coastlines of South Carolina and North Carolina, and a Storm Surge Warning is in effect for a portion of this area. All interests from South Carolina into the mid-Atlantic region should complete preparations and follow any advice given by local officials.

2. Life-threatening, catastrophic flash flooding and significant river flooding is likely over portions of the Carolinas and Mid-Atlantic states from late this week into early next week, as Florence is expected to slow down as it approaches the coast and moves inland.

3. Damaging hurricane-force winds are likely along portions of the coasts of South Carolina and North Carolina, and a Hurricane Warning has been issued for a part of this area. Damaging winds could also spread well inland into portions of the Carolinas and Virginia.

The storm surge warning remains most severe for the Cape Fear to Cape Lookout region, although heights have been reduced a little as the hurricane weakened:

– Cape Fear NC to Cape Lookout NC…7-11 ft, with locally higher amounts in the Neuse, Pamlico, Pungo, and Bay Rivers

– Cape Lookout NC to Ocracoke Inlet NC…6-9 ft

– South Santee River SC to Cape Fear NC…4-6 ft

– Ocracoke Inlet NC to Salvo NC…4-6 ft

– Salvo NC to Duck NC…2-4 ft

– Edisto Beach SC to South Santee River SC…2-4 ft

The NHC’s latest forecast now suggests that 20 to 30 inches of rainfall could be widely experienced near Florence’s track over portions of portions of the Carolinas through into early next week, while there could be isolated rainfall totals of as much as 40 inches. More widely in the mid-Atlantic region totals of 6 to 12 inches, and isolated amounts of 15 inches are anticipated.

The NHC said:

Southeastern coastal North Carolina into far northeastern South Carolina…an additional 20 to 25 inches, with isolated storm totals of 30 to 40 inches. This rainfall will produce catastrophic flash flooding and prolonged significant river flooding.

Remainder of South Carolina and North Carolina into southwest Virginia…5 to 10 inches, isolated 15 inches. This rainfall will produce life-threatening flash flooding.

The flood threat remains be particularly severe from hurricane Florence, especially given the slowing movement of the storm and the fact some of the region has already been saturated by rainfall in recent weeks.

This leads us to what is at risk for insurance, reinsurance and cat bond or insurance-linked securities (ILS) markets.

The threat to the catastrophe bond market from hurricane wind property damage remains diminished somewhat with the winds, we’d suggest, given the exposure levels in this region are not the highest.

Still, a number of names are more exposed than others, generally the higher layers of certain bonds providing U.S. wide coverage, or aggregate bonds with exposure in the region. However cat bond exposure will depend largely on the approach and speed of hurricane winds at landfall, as well as the duration of time they last for, given the property damage is the main driver of loss.

There are catastrophe bond layers in the Residential Re series sponsored by USAA that are some of the highest expected losses in the area. Another bond highlighted has been Blue Halo Re, from Allianz, which being a novel term aggregate cat bond (meaning losses can accumulate across the duration of the deal) is likely carrying aggregate deductible erosion from last year still. It also may be worth watching cat bonds in the Kilimanjaro (from Everest Re) and Galileo or Galilei range from XL. Frontline Re has also been highlighted, but carries most of its risk in Florida.

But it’s worth reiterating that the weakened storm situation, does mean hurricane Florence may not be as impactful to most exposed cat bonds as it could have been.

FEMA’s FloodSmart Re cat bond here is the exception, given the slower Florence’s approach, the more rainfall will be produced in the area and the greater the potential for the NFIP’s reinsurance program to be triggered.

In fact the whole FEMA NFIP reinsurance program including the $500 million FloodSmart Re cat bond will be seen as particularly at risk by the market right now, given the forecasts for extreme amounts of rain over a number of days, as we’ll explain below.

Sources updated us and said that bid and offer spreads remain wide in the secondary market and aside from some light trading on less exposed names from sellers who just don’t want to hold through a storm after last year, not much is changing hands in the secondary cat bond market.

We’d expect that situation, of buyers and sellers struggling to make their price ambitions meet to continue, given the uncertainty over landfall windspeeds and continued shift towards water related impacts rather than wind.

Some diversifying cat bonds, covering risks other than U.S. hurricane, have been sold as ILS funds wanted to free up capital in advance of a potential major industry loss event such as this. But that dynamic may also stop now, given the uncertainty over the coastal approach and potential wobble/weakening.

Plenum Investments explained the lessened threat to catastrophe bonds in its latest update,”Based on our internal modelling, we currently believe that the expected losses of hurricane Florence will not result in losses in the Plenum CAT Bond Fund’s portfolio. This assessment is also supported by the fact that hurricane Florence is significantly weaker than hurricane Hazel in 1954 and hurricane Hugo in 1989, which each hit the area threatened by Florence as category 4 storms and for which we also model only minor losses on the portfolio.”

Yesterday ILS manager Twelve Capital suggested that the hit to ILS funds could be 0% to 4% of NAV, based on the forecast at the time. That will have reduced somewhat by now and most ILS funds will be expecting largely attritional levels of losses, although some higher risk strategies and retro plays could be a little more affected.

Live cat trading has remained light to non-existent, brokers said.

We’re told live cat capacity was strongly priced through and Wednesday, with some pricing activity seen as hurricane Florence approached on Wednesday with her higher winds. But we’d expect very little was traded due to Florence’s weakening yesterday.

Given the rainfall forecast the NFIP reinsurance program is particularly exposed and may come into play. It provides $1.46 billion of flood reinsurance coverage and attaches covering 18.6% of losses between $4 billion and $6 billion, and 54.3% of losses between $6 billion and $8 billion.

There are roughly 450,000 NFIP flood insurance policies in force in North Carolina, South Carolina, and Virginia alone. Florence’s wide impact could see significant payouts, we’d imagine.

The NFIP’s new FloodSmart Re catastrophe bond sits higher up in the reinsurance program, covering 3.5% of its losses between an attachment point of $5 billion and exhaustion of $10 billion through a riskier $175 million tranche of Class B notes, and 13% of its losses between $7.5 billion and $10 billion through a $325 million tranche of Class A notes.

It’s impossible to say how impactful Florence will be to flood insurance policies from the NFIP, but this is definitely a factor to watch out for and could produce another large flood related market loss, given the current forecast for extreme levels of rainfall over a number of days in the region most affected and also inland as Florence slowly moves onshore.

Reinsurance treaties more broadly could be triggered if hurricane Florence’s impacts are particularly bad in the region, including from private and commercial flood insurance. Quota share reinsurance arrangements could also result in some losses leaking into ILS and collateralized reinsurance markets.

Certain areas of retrocessional coverage, including collateralized and pillared, will also be exposed to Florence, as well as industry loss warranties (ILW’s) at low trigger levels. However the weakened winds now mean a lower eventual market-wide loss from wind, so the chances of triggering these instruments is more remote now.

Overall, for the ILS fund and investor market, it is collateralized reinsurance and retrocession that will bear the brunt of any industry losses from hurricane Florence, rather than catastrophe bonds.

As a result, the industry-wide loss forecasts of a few days ago are becoming less relevant at the higher end. Still hurricane Florence is thought to be likely to result in an industry loss in a range from mid to high single digit billions upwards to a maximum of $15 billion. But it is hard to see the eventual losses nearing Harvey levels at this time.

Flood and storm surge, so water, is the factor adding uncertainty though, as it’s harder to look through the industry to see how that could affect the eventual loss potential.

The probability that there will be an impact to reinsurance and some ILS interests remains high, but for the ILS market the threat of a major loss does appear to have fallen slightly with the wind speeds.

The market will remain on watch but any ILS trading activity may only be light, due to the uncertainty associated with hurricane Florence.

Analysts at KBW highlighted that the shift in the forecast may imply higher losses for auto insurance, suggesting that primary insurers will retain more of the eventual hurricane Florence loss, which means a little less could flow through to reinsurance and ILS interests as a result.

KBW said the industry loss from Florence “almost certainly won’t raise property catastrophe reinsurance pricing” but warned that any “subsequent storm losses could increase Florence’s losses by raising construction and/or loss adjustment expenses.”

KBW and Goldman Sachs both said today that they expect an earnings event for the insurance industry in the main from Florence, with auto insurers likely to take a big hit, while most of the losses will be retained and reinsurance markets not be hit overly hard.

These are good points and the shift to water does suggest less impact on reinsurance markets generally, hence ILS as well.

As for which areas of the market are at risk, Fitch Ratings said:

“Primary property/casualty insurance writers across the multi-state forecast landfall area are expected to incur losses primarily from the high winds that are accompanying the storm toward the coast. The threat of extreme flooding has implications for the National Flood Insurance Program (NFIP), private market flood insurers, personal and commercial automobile writers, traditional reinsurers, and Insurance Linked Securities (ILS) markets.”

Florence could have a meaningful impact on the commercial property and business interruption markets in the region but the extent of losses would increase significantly if the storm tracks through a major metropolitan area as Harvey did in Houston.

Top-five homeowners writers as measured by statutory direct written premiums in NC, SC, GA and VA include State Farm Mutual Insurance Group, United Services Automobile Association (USAA), The Allstate Corporation, Nationwide Mutual Insurance Group and Travelers Companies, Inc.

Top-five commercial writers (Inland Marine, Allied Lines, Fire, Commercial Multi-peril non-liability) as measured by statutory direct written premiums in NC, SC, GA and VA include Liberty Mutual Insurance Group, CNA Financial Corporation, Travelers, Nationwide, and American International Group, Inc. (AIG).

Top-five private flood writers as measured by statutory direct written premiums in NC, SC, GA and VA include FM Global Group, AIG, Assurant, Inc., Zurich American Insurance Group and Swiss Re America Group.

In terms of pricing impacts, we’d suggest Florence was never likely to produce a market changing loss on its own, but the impacts to aggregate layers could exacerbate losses for some markets, creating more impetus to stem price declines.

Gary Marchitello, Head of Property Broking at Willis Towers Watson, also provided some insight:

Even if losses reach the high side of the range, a $20 Billion loss is not going to necessarily rock the industry. I would estimate a loss of this size to be more of an earnings-event for insurance carriers, not a capital event. And, barring successive storms this year, this should not lead to a prolonged hardening of the market.

However, we fully expect these losses to create some immediate disruption and short term challenges in the marketplace. Many underwriters will be pressured to raise rates, at least in the short term, and organizations involved in renewals will likely face capacity and rate challenges, particularly for catastrophe-exposed property programs. Often times it can take several months for losses to be calculated and market adjustments to play out.

Claims volume could be significant and we anticipate that like all major catastrophes, coverage issues will arise. An oft –seen coverage issue relates to “wind” versus “flood” and how the policy addresses flooding which accompanies Named Wind, storm surge or excessive rainfall as part of an insured’s hurricane limit/deductible or its flood sublimit/deductible. There are many variations in policies with significant recovery implications. Typically for coverage to trigger, the claim must derive from physical damage to “covered” property and “perils insured” under the policy.

Business interruption claims, which help companies replace lost income during shutdowns, are also expected to be significant – and could amount to roughly 20% -25% of the overall insured property losses. Here too, there is a high potential for significant coverage issues, particularly around the coverages’ trigger. For example, there are extensions of coverage which almost always come into play for each policy. These include business interruption and/or shutdowns due to a range of issues, including: civil and military authority, ingress/egress, protection and preservation of property, contingent business interruption and service interruption.

Also noteworthy is that if the NFIP reinsurance program and cat bond did pay out (making it the second year the program was triggered), this is a discrete risk and it will be a good test of the market to see whether it reprices upwards at a future renewal or replacement, giving us a sign of how much discipline remains in the marketplace.

But to really understand the industry loss it will need the hurricane eye to come ashore and to see how long hurricane force winds last, while the flooding will last for some days making estimates near impossible at this time.

Overall though, the key message should remain that hurricane Florence presents a very dangerous situation to the region and at this time thoughts should be with those in the storm’s path.

We’ll update you as information becomes available and by visiting our 2018 Atlantic Hurricane Season page you can view our interactive tracking map for all Atlantic storms.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.