Hurricane Matthew remains a major storm with 145mph winds as it barrels towards a potentially devastating strike on Haiti and Cuba. The Bahamas are next in its path and the risk of a U.S. landfall has risen, according to the forecast, with Florida and the Carolinas now in the forecast cone.

Update 15:20 BST / 10:20 ET, Oct 5th 2016: Hurricane Matthew has the potential to be a significant loss event for the insurance and reinsurance industry. It could also cause issues to some catastrophe bonds, eroding aggregate retention and increasing their attachment probabilities, according to Ben Brookes of RMS..

Update 11:15 BST / 06:15 ET, Oct 5th 2016: The so-called “live cat” market has come to life, albeit perhaps tentatively, as hurricane Matthew’s approach towards the U.S. has increased the certainty of what looks set to be a relatively major impact (at this time) with a number of ILW’s trading and as much as $100m of limit placed.

Update 16:15 BST / 11:15 ET, Oct 4th 2016: Florida has now been put on hurricane watch for Matthew. Read our latest on catastrophe bond and ILS exposure to hurricane Matthew and a discussion of how the market is reacting so far.

Firstly, the impact of hurricane Matthew in Haiti and Cuba could be devastating, with widespread destruction expected from sustained winds of 145mph, stronger gusts, as much as 40 inches of rainfall with resulting flooding and landslides, and a potentially deadly storm surge to boot.

The Bahamas then face a still major Category 3 or stronger hurricane, with Matthew set to track along the path of the islands and the storm surge there potentially higher than experienced by Haiti or Cuba, with a forecast suggesting up to 15 foot of surge to go with the extreme winds.

But for the insurance, reinsurance and insurance-linked securities (ILS) industry, all eyes will be on hurricane Matthew today to see how the interaction with land, as it crosses the western end of Haiti and Cuba, affects its forecast path, as right now both Florida and the Carolinas are in the cone.

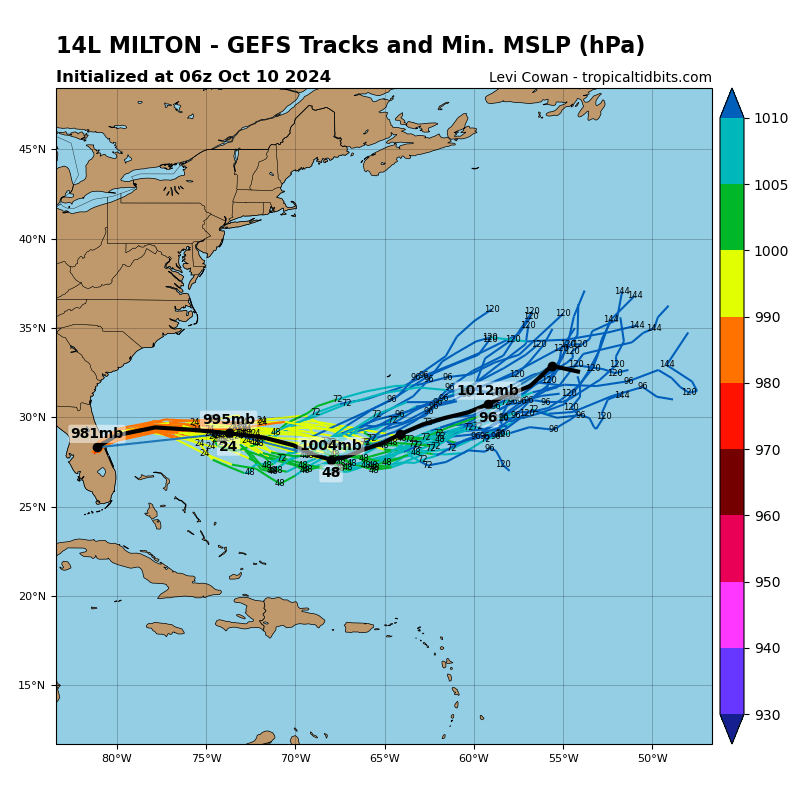

Hurricane Matthew track and forecast path

The forecast path for hurricane Matthew has been gradually moving to the east, taking the expected path closer to the U.S. coastline. That movement continues and the latest forecast cone of uncertainty, above, shows Matthew making a very close pass by Florida and a potential North Carolina landfall on Saturday night.

Significant uncertainty remains at this time, as hurricane Matthew’s path could deviate as it interacts with land in the Caribbean. But the models are largely calling for a scenario like the above and it wouldn’t take much to see Matthew striking or side-swiping the Florida peninsula.

Analysts at KBW point out that the current path hurricane Matthew is forecast to take is very similar to hurricane Irene from 2011, which hit the Carolinas and caused an insurance and reinsurance industry loss of around $6 billion.

“Depending on the storm’s strength at landfall, loss potential could be high and could pierce into reinsurance layers. Reinsurance geographic retentions are difficult to know before losses are announced, but companies that could have exposure include Arch Capital, AXIS Capital, Endurance, Everest Re, RenaissanceRe, Validus, XL,” the analysts wrote this morning.

However the insurance and reinsurance industry remains well-capitalised and easily able to absorb such a loss, KBW points out. The chances of reinsurance capital coming into play are higher in Florida, where primary insurers tend to have reinsurance that attaches lower down, but any landfall of a similar magnitude to Irene’s in the Carolinas could also result in some reinsurance impact.

The worst case scenario for insurance, reinsurance and also ILS or catastrophe bond interests would be for hurricane Matthew to track into Florida as a still major hurricane after passing along the Bahamas island chain.

The latest update from the NHC brings hurricane Matthew perilously close to the Florida coastline somewhere to the north of West Palm Beach area.

That would bring Matthew ashore in a high-value, highly populated area of Florida coastline, resulting an a significant loss to insurance, reinsurance and collateralised reinsurance contracts potentially some impact to catastrophe bond holdings as well.

Given the exposure of the catastrophe bond and collateralised reinsurance markets to Florida, any major hurricane strike could create losses that impact across the ILS fund, sidecar and reinsurance linked investment sector.

Florida Gov. Rick Scott has published a statement warning of the potential impacts Florida would face if hurricane Matthew tracked towards the state.

He said; “This is a serious and life threatening storm. This storm is catastrophic, and if it hits our state, we could see impacts that we have not seen in many years. Even though the storm’s projected path is just east of our state, no one should take this lightly. Storms change fast and Hurricane Matthew could hit Florida as early as Wednesday.”

Impact Forecasting, the risk modelling experts at reinsurance broker Aon Benfield, also highlighted the uncertainty ahead; “While all of the deterministic track models currently keep Matthew east of Florida, there is still enough uncertainty in the global model ensembles that potential direct impacts in Florida cannot be ruled out at this time. In addition, it is still too soon to determine whether, or how, Matthew could affect the remainder of the U.S. East Coast.”

Risk modelling firm AIR Worldwide also highlighted the chances of a U.S. landfall as well as the uncertainty surrounding this; “Projections beyond the Bahamas remain uncertain. Although some models suggest a strong U.S. mainland impact—perhaps even landfall on Florida—most models show the storm easing eastward as it approaches the United States mainland. Nonetheless, Florida Governor Rick Scott has called the storm “catastrophic” and is encouraging residents to prepare.”

Meanwhile, Kroll Bond Rating Agency highlighted the risk to the re/insurance industry; “If Hurricane Matthew were to make landfall as a major hurricane in Florida or elsewhere on the east coast of the United States, the financial losses could be substantial to policyholders, investors, and insurers with this geographic exposure.

“Most P/C experts agree that as an industry, the insurance market is prepared to withstand a 100-year storm. However, some are concerned that several of the newer Florida carriers are untested and have risk concentrations that could expose them to severe losses and possibly insolvency.”

But right now the main concern is for lives and livelihoods in Haiti and Cuba, which are both going to bear the brunt of category 4 hurricane Matthew’s 145mph winds, storm surge and torrential rainfall. The latest warnings from the NHC are below.

hazards affecting land

———————-

wind: hurricane conditions are expected to reach the southwestern portion of haiti within the next several hours. hurricane conditions are expected to reach eastern cuba later today, the southeastern bahamas tuesday evening, and the central bahamas on wednesday. tropical storm conditions are expected to continue spreading across haiti tonight, eastern cuba later this morning, the southeastern bahamas later today, and the central bahamas tuesday night, making outside preparations difficult or dangerous.

preparations to protect life and property should be rushed to completion.tropical storm conditions are expected in portions of jamaica and along the southern coast of the dominican republic within the warning area today.

hurricane conditions are possible in the northwestern bahamas on thursday, with tropical storm conditions possible on wednesday. hurricane conditions are possible in the hurricane watch areas in

cuba and the turks and caicos islands by tuesday night with tropical storm conditions possible on tuesday.rainfall: matthew is expected to produce total rainfall amounts in the following areas:

southern haiti and southwestern dominican republic, 15 to 25 inches, isolated 40 inches

eastern cuba and northwestern haiti, 8 to 12 inches, isolated 20 inches

eastern jamaica, 5 to 10 inches, isolated 15 to 20 inches

the bahamas, 8 to 12 inches, isolated 15 inches

turks and caicos islands, 2 to 5 inches, isolated 8 inches

northeastern haiti and the northern dominican republic, 1 to 3 inches, isolated 5 inches

western jamaica, 1 to 3 inches, isolated 6 incheslife-threatening flash floods and mudslides are likely from this rainfall in southern and northwestern haiti, the southwestern dominican republic, and eastern cuba.

storm surge: the combination of a dangerous storm surge and large and destructive waves could raise water levels by as much as the following amounts above normal tide levels…

southern coast of cuba east of cabo cruz, 7 to 11 feet

south coast of haiti, 7 to 10 feet

northern coast of cuba east of camaguey, 4 to 6 feet

jamaica, 2 to 4 feet

gulf of gonave in haiti, 3 to 5 feet

southern coast of the dominican republic, 1 to 3 feet

the bahamas, 10 to 15 feet

Two of the latest forecast model spaghetti runs for hurricane Matthew can be seen below:

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.

Global & hurricane model forecast tracks for hurricane Matthew - From Tropical Tidbits

GFS model ensemble forecasts for hurricane Matthew - from Tropical Tidbits