As major hurricane Irma continues to track west and the forecast path for the storm predicts the expected turn to the north towards Florida will be later, resulting in the landfall position shifting west, the potential impact to the ILS and catastrophe bond market lessens, according to Ben Brookes RMS Vice President of Capital Markets solutions.

Hurricane Irma is the largest threat to the catastrophe bond and insurance-linked securities (ILS) market in its history, with as much as $14 billion of 144a and private cat bonds potentially exposed to the storm.

Hurricane Irma is the largest threat to the catastrophe bond and insurance-linked securities (ILS) market in its history, with as much as $14 billion of 144a and private cat bonds potentially exposed to the storm.

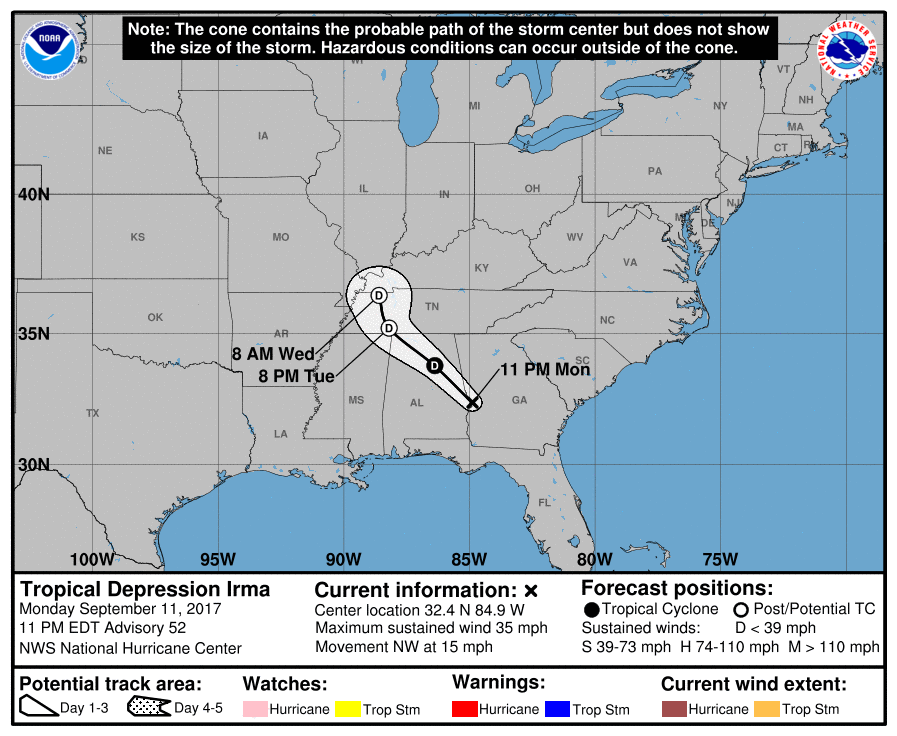

However, the location of landfall is all important and the scenarios shifting the forecast models further west could mean a lighter load for ILS investors.

Ben Brookes explained that, “Florida hurricane risk is dominant in the ILS market portfolio, whether sitting within multi-peril, multi-region bonds or within Florida hurricane-specific issuances.”

But Brookes cautioned that while, “It is clear that we could be seeing a significant impact on the ILS market… The size of that impact on the ILS market will depend heavily on the exact path the storm takes and how it evolves, both in strength and size.”

Analysis on Friday using RMS HWind forecasts suggested that almost half of the outstanding principal in the 144A catastrophe bond market could have been exposed to Irma.

But with the westward shift in the forecast track for hurricane Irma today this number has likely lessened somewhat.

Brookes explained, “If the storm tracks west, the ILS market impact will likely be lower.”

Whatever the outcome though it could be months for the final loss to the ILS market from hurricane Irma to become clear.

“The majority of Florida risk in the market is based on indemnity or industry losses and, as a result, pay-outs will take many months (or years) to be finally determined,” Brookes told Artemis.

Also read:

– Increased use of retro to limit reinsurers’ Irma exposure: A.M. Best.

– Cat bonds drop 16% on hurricane Irma, prices discounted heavily.

– Hurricane Irma track in westward shift, remains on course for Florida.

– Stone Ridge reinsurance and ILS fund drops 8%+ on Irma threat.

– Interest in back-up reinsurance rises on Irma, live cat still quiet (so far).

– Billions of catastrophe bonds at risk from Hurricane Irma.

– CCRIF to pay $15.6m on Hurricane Irma impact to Leeward Islands.

– Hurricane Irma track aims at Miami, a $131bn realistic disaster scenario.

– Blue Capital halts ILS fund buy-backs as hurricane Irma approaches.

– Cat bond trading slight on Irma, Kilimanjaro II Re trades down.

– Hurricane Harvey re/insurance industry loss over $10bn: AIR.

– Irma & Harvey losses combined may still just be an earnings event: Morgan Stanley.

– Citrus Re 2017 cat bond notes trade down 50% on hurricane Irma threat.

– Hurricane Irma live cat activity focused on $40bn+ loss, pricing uncertain.

– Hurricane Irma landfall in Florida would hit reinsurers hard: KBW.

– Hurricane Irma a potential U.S. (Florida) threat this weekend.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.