It’s very early days to speculate on landfall for major hurricane Irma, which became a Category 5 monster storm this afternoon with winds of 180 mph, but should the forecast track prove correct and Irma make landfall in Florida it is expected that it would hit reinsurance interests hard, according to KBW.

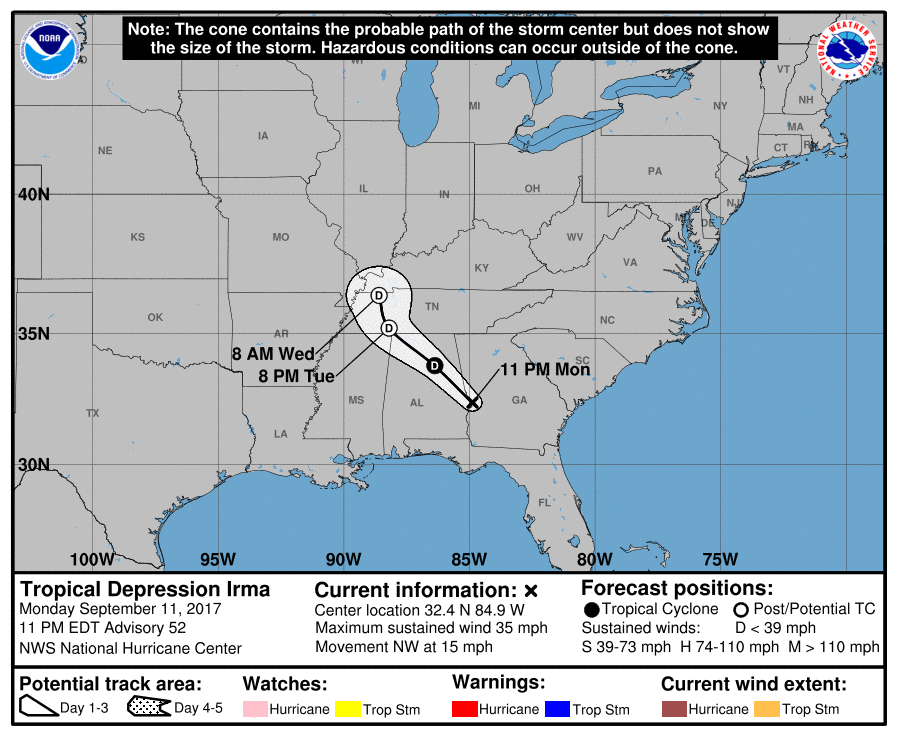

Hurricane Irma is tracking towards the northern Leeward Islands of the Caribbean, where catastrophic impacts are possible and lives at risk. Following that Irma will track towards southern Florida, where it is forecast to make a turn towards the north and come ashore, with experts suggesting it will still be a very major storm at that stage.

Hurricane Irma is tracking towards the northern Leeward Islands of the Caribbean, where catastrophic impacts are possible and lives at risk. Following that Irma will track towards southern Florida, where it is forecast to make a turn towards the north and come ashore, with experts suggesting it will still be a very major storm at that stage.

While recent hurricane Harvey is not expected to be the catastrophe event that could turn reinsurance industry pricing, hurricane Irma looks like its worst case scenario (based on the latest forecasts) could at least put a much firmer floor in place.

Harvey has largely been an event for the insurers, with reinsurers expected to pick up a share, but less significant than other hurricane events due to the water driven nature of most of the losses.

Hurricane Irma’s potential impact could actually increase the losses for the industry from Harvey, KBW’s analysts suggest, explaining that a second hurricane impact in such quick succession could drive up the cost of repairs and materials, causing inflation to Harvey claims.

But more of concern is the direct Florida landfall from a major hurricane Irma, which would; “Probably impact the reinsurers more than would landfall in any other state,” KBW’s analysts explain.

As a result the analysts expect that reinsurers, such as the Bermudian companies, will underperform the broader markets this week due to Irma uncertainty. In fact the Dow Jones reinsurance index fell near 2% in trading early today and has yet to recover, while the share prices of the major European reinsurers have also declined today, which is likely due to the Irma threat.

But really showing how the markets view the threat from hurricane Irma, Floridian primary insurers stock prices dropped as much as 15% today, as nervous investors took in the latest forecasts.

Florida’s homeowners insurers are major buyers of reinsurance, meaning they also have a lot of collateralized reinsurance, ILS and catastrophe bond covers in force, and also have lower retention rates than the U.S. nationwide insurers, which KBW says means; “Their reinsurance partners should incur the lion’s share of hurricane losses.”

KBW says that investors may start to “bake in higher catastrophe loss provisions now that the decade-plus streak of no major hurricanes has ended,” which will pressure valuations and also further pressure reinsurers facing soft market challenges.

That’s becoming evident in the share price movements seen in the Floridian primary insurers today and is something we should watch out for in Bermudian and other reinsurance firms over the coming days (Renaissance Re and Everest Re are both down 4.5% so far today).

Reinsurers have seen their catastrophe budgets eroded somewhat by Harvey and now hurricane Irma threatens to potentially wipe them out entirely, which could see many reinsurance firms tipping into negative return territory for 2017.

It should also be remembered that it is only early September and there are nearly three months of the 2017 U.S. hurricane season still to run, which given the activity seen it is possible we will see further storm threats in the weeks to come.

We’re already hearing reports of live cat ILW trading activity on hurricane Irma, at least quoting if not buying at this stage and we understand some secondary cat bond positions are starting to see interest as well.

But, it remains early for forecasts of loss and hurricane Irma could shift its path or weaken still, however the longer it goes without such a shift or weakening pattern the more potential there is that the reinsurance and ILS sector will take a hit.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.