The wind and storm surge related insurance industry loss from hurricane Michael is estimated to be between $2 billion and $4.5 billion by Corelogic, based on a pre-landfall data assessment of the storms impacts to insured assets.

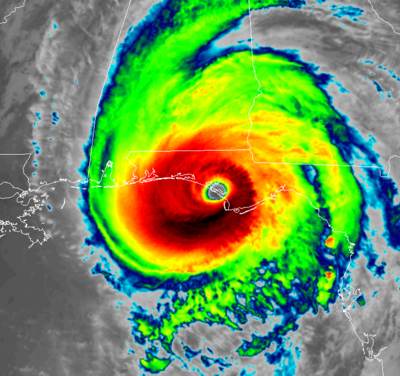

Hurricane Michael made landfall in the Florida Panhandle earlier today as a strong Category 4 hurricane with sustained winds of 155 mph, just 2 mph away from being a Category 5.

Hurricane Michael made landfall in the Florida Panhandle earlier today as a strong Category 4 hurricane with sustained winds of 155 mph, just 2 mph away from being a Category 5.

This is the most intense hurricane to ever recorded to strike the Panhandle area of the Florida Gulf Coast, but the eventual impacts to insurance and reinsurance interests are not expected to be market-moving. It is also the strongest hurricane to strike anywhere in Florida since Andrew in 1992.

Catastrophe risk modelling and analysis firm Corelogic has just released an estimate of the insured losses from storm surge and hurricane force winds, which is based on the landfall factors hence this is not a post-landfall estimate of industry losses.

Corelogic noted the compact nature of hurricane Michael, which will have limited the size of the swathe of damage on landfall, but the storm surge has impacted a wide area from Mobile, AL to Tampa, FL, with the maximum storm surge anticipated to be east of Panama City to coastal cities south of Tallahassee, the firm said.

Hurricane Michael is also a fast-moving storm and so rainfall related flooding is not expected to be a large component of loss for the immediate landfall areas, although localised flooding is to be expected and flooding inland as Michael travels north and east could also extend the eventual impacts to insurance and reinsurance interests.

Corelogic’s initial pre-landfall estimate of the industry loss is for a range of $2 billion to as much as $4.5 billion, from wind and storm surge damage.

This breaks down as between $1.5 billion and $3 billion from residential property insurance lines and $0.5 billion to $1.5 billion from commercial lines of business.

The company highlighted that there is a great deal of uncertainty in this loss estimate, with respect to the path of the storm and its intensity.

Until we have a much clearer picture of damage in the immediate landfall area, surge flooding along the coast to either side of that and the wind and flood damage further inland, the full size of the insurance and reinsurance industry loss remains difficult to forecast.

The latest update from the NHC cites still Category 3 sustained winds and at this time hurricane Michael is moving towards Georgia, which is unusual but due to the late intensification and fast movement of the storm not entirely unexpected.

So it will take some time for the full scale of the property damage from hurricane Michael to be understood.

For insurance-linked security (ILS) and catastrophe bond interests though, this initial estimate perhaps will give some comfort that the impacts to the sector will not be particularly significant, compared to a similarly severe storm impacting an area of Florida with higher levels of property density and exposure.

At this moment hurricane Michael is still impacting areas such as Tallahasee and onwards into Georgia with hurricane force winds and hence damage potential continues and loss amounts will still be increasing as Michael tracks further inland.

Given the ongoing impacts, hurricane Michael still has 90 mph winds now almost 5 hours after landall as we update this article, establishing the actual damage impacts and industry loss is going to take some time. This storm could also have some profound effects on how the sector thinks about (and models) loss potential from Gulf Coast hurricanes as a result of the pre-landfall intensification and distance inland that hurricane force winds have been measured.

Also read:

– Hurricane Michael landfall site a key factor for ILS & cat bond exposure.

– More intense hurricane Michael potentially doubles economic impacts.

– Hurricane Michael a very different storm to Florence: RMS.

– Florida primary & national insurers most exposed to hurricane Michael.

– $13.4bn of property value exposed to hurricane Michael storm surge.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.