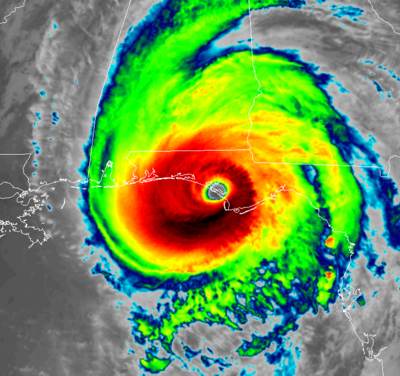

Hurricane Michael loss creeps to $7.44bn, more costly per-claim than Irma

15th November 2019The ongoing creep of insurance and reinsurance market losses associated with hurricanes that have hit Florida continues in the case of hurricane Michael from 2018, with the total rising another over 3% to reach almost $7.44 billion.

Read the full article