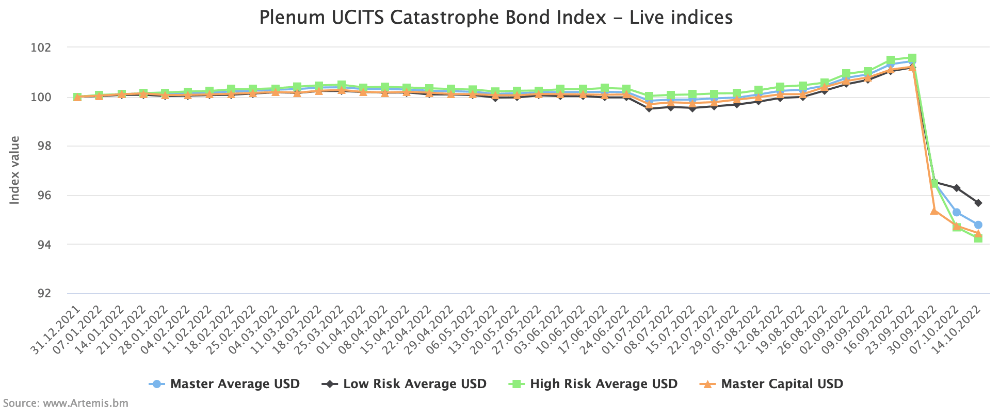

Catastrophe bond funds, as measured by the Plenum CAT Bond UCITS Fund Indices, continued to decline in the last week, falling another average of nearly half a percent, bringing them to a -6.5% decline on average since hurricane Ian made landfall.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a valuable source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Immediately after hurricane Ian, these UCITS cat bond fund indices suffered their biggest declines in history due to the expected market impacts.

The underlying basket of 14 UCITS cat bond funds experienced a wide performance spread from negative -1.5% to -9% before the index data was calculated for September 30th.

On that date, the cat bond fund index saw an average decline of just over -5%, the biggest single decline in their history.

Then, as of October 7th, the indices fell further, with the average decline across the cat bond indices since before hurricane Ian struck, increasing to -6.04%.

Now, as of October 14th, the indices have decline again, as prices continue to move around in the secondary cat bond market and cat bond fund managers adjust their portfolios to allow for pricing expectations, as well as loss expectations from hurricane Ian.

You can see the Plenum UCITS Catastrophe Bond Index – Live Indices below (click the image for an interactive version):

Interestingly, the adjustments are not as evenly spread across the markets risk-return strategies as you might have expected in the last week.

The high risk UCITS cat bond index fell by another -0.47% this week, but the low-risk cat bond fund index fell by -0.63%, so has caught it up a little.

This is potentially due to the widespread marking down of non-hurricane exposed cat bonds, with diversifiers becoming discounted in the secondary market to account for future higher expected levels of new cat bond issuance pricing.

The average decline across the four live UCITS cat bond fund indices was nearly -0.5% in the last week.

This took the average decline since hurricane Ian to -6.5%, with the high-risk cat bond fund index now down -7.25% since Ian and the low-risk down -5.46%.

For a visualisation of the impact hurricane Ian has had on the catastrophe bond fund market, the historical indices that track UCITS cat bond fund performance back to 2011, provide a clearer view (view the interactive version).

As we explained last week, the decline in catastrophe bond prices for those names not exposed to hurricane Ian does imply a very hard market is coming, as pricing sheets are factoring in rising yields for new issuances.

As we also reported last week, it’s suggested that the actual hurricane Ian loss of the cat bond market could turn out to be around half the initial mark-to-market impact, which was around 10% at first.

For that to be correct we will need to see some recovery in these indices over time, so it will be interesting to see how these cat bond fund indices move over the coming weeks.

Analyse these UCITS catastrophe bond fund indices here.

Read all of our coverage of hurricane Ian, and our analysis on the potential market losses, here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.