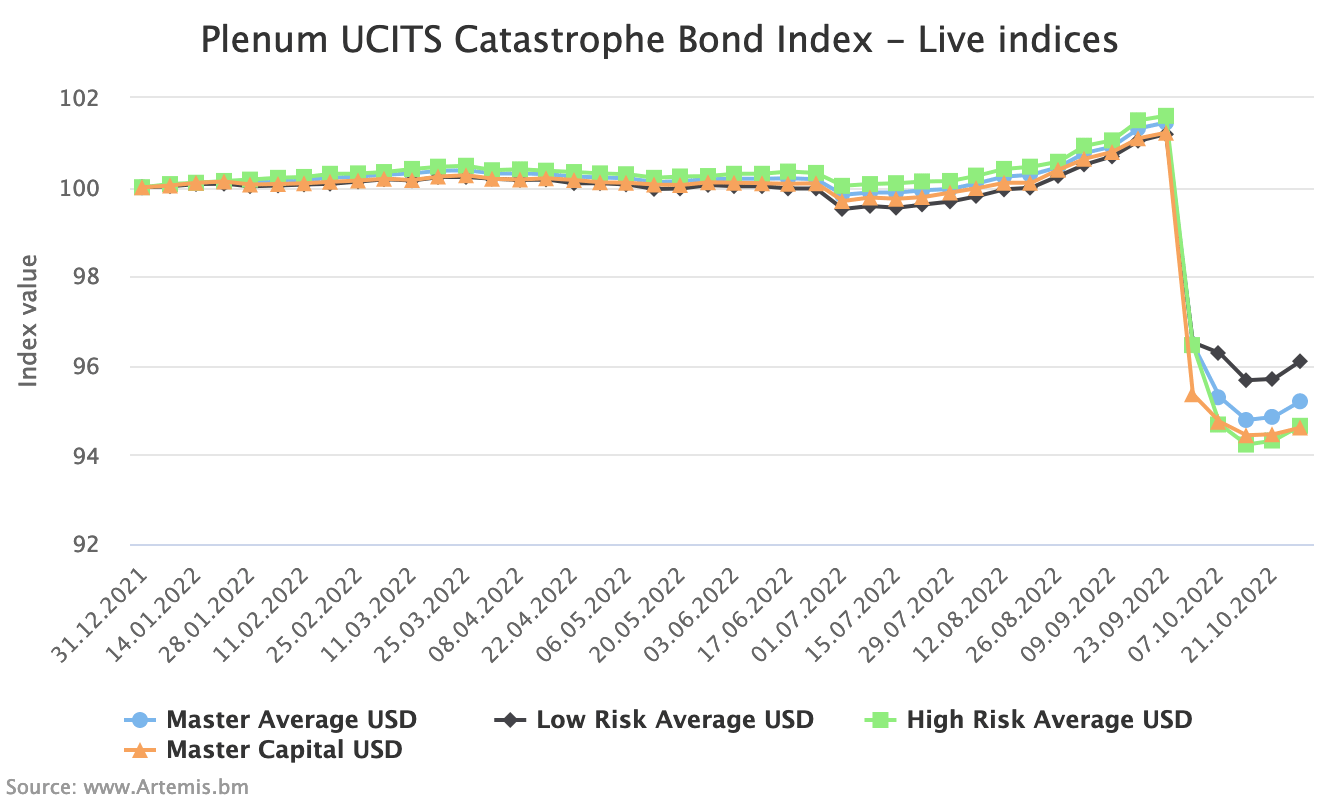

As anticipated, catastrophe bond funds, as measured by the Plenum CAT Bond UCITS Fund Indices, have recovered some more ground that had been lost due to hurricane Ian in the last week reported.

Having fallen by as much as -6.58% on average after hurricane Ian impacted Florida, these UCITS cat bond fund indices are now -6.1% down over that same period, as some recovery has been made.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a valuable source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

It’s a little surprising the recovery wasn’t more significant, at the last calculation point of October 28th 2022, as we’d noticed some relatively significant recoveries in catastrophe bond prices in the secondary market and also a jump by the Swiss Re cat bond index as of that date.

The average gain across the UCITS cat bond fund indices over the week to October 28th was 0.37%, with the low risk Index rising 0.41% and the high risk Index 0.35%.

Since hurricane Ian’s landfall, these cat bond fund indices are now -6.1% down on average, but the low risk Index is now at -5%, while the high-risk cat bond fund Index is now at -6.84% since Ian.

We are seeing the effects of different valuation strategies becoming evident in individual cat bond fund performance, with some taking the mid-point of bids, others the actual bid levels quotes, while the differences between secondary cat bond pricing sheets also makes for some disparate reporting, it seems.

As a result, it could take a little time for the reporting to level out, but we’re likely to see additional positive movements for these cat bond fund Indices going forwards, unless the outlook for Ian losses worsens.

Also, it’s worth considering how higher spread levels will factor into cat bond fund performance and their ability to recover the lost value after Ian, as investor Plenum had said last week that the catastrophe bond market and its investors could earn back losses from hurricane Ian in as fast as 6 to 8 months, given the higher yield environment.

Analyse the UCITS catastrophe bond fund index here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.