The Texas Windstorm Insurance Association (TWIA) has successfully secured the $2.1 billion of reinsurance protection it was targeting for the 2020 storm season, with its new catastrophe bond and its doubling in size a key piece of the renewal for the residual market insurer.

As we explained before, TWIA had been aiming to have $4.2 billion of total funding ready for the 2020 hurricane season, made up of reinsurance, catastrophe bonds and its other funding sources.

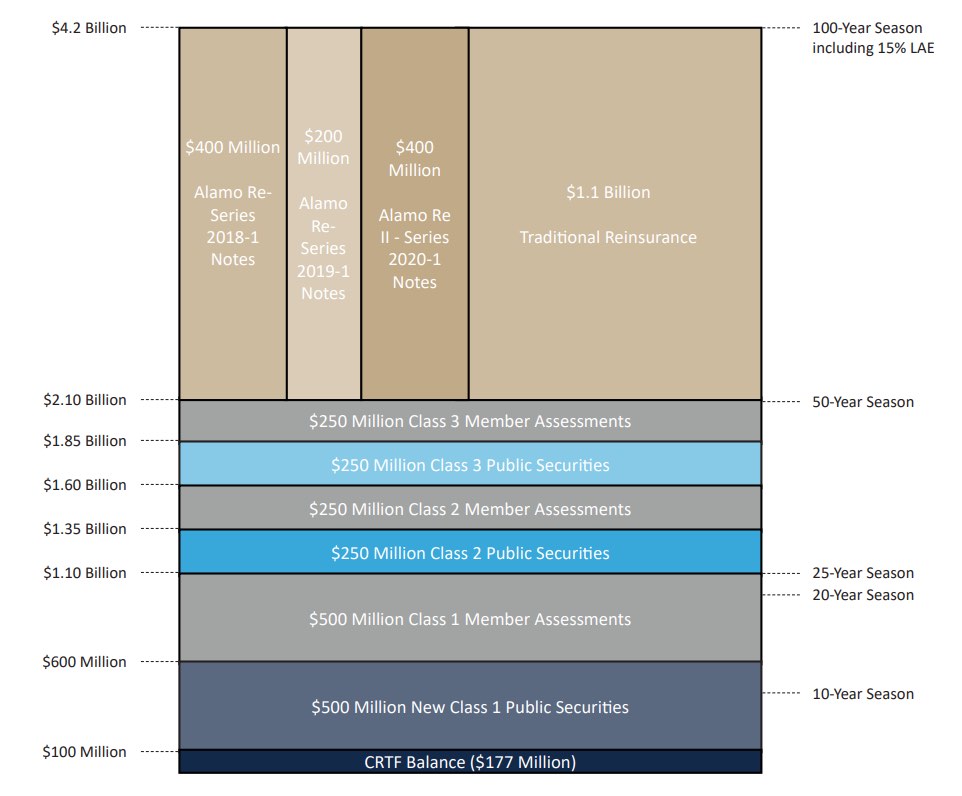

Already in place was $2.1 billion of funding from TWIA’s Catastrophe Reserve Trust Fund, member assessments on insurers and pre or post-event debt funding sources.

In addition, TWIA went to this renewal with $600 million of still in-force catastrophe bonds, made up of $400 million of Alamo Re Ltd. (Series 2018-1) cat bonds and $200 million of Alamo Re Ltd. (Series 2019-1) cat bonds.

Having that $600 million of reinsurance already locked in at prior year pricing will have helped the overall cost-efficiency of TWIA’s reinsurance related funding significantly this year, given the firming of rates broadly in the market.

TWIA began by targeting $1.3 billion of new traditional reinsurance and a new $200 million catastrophe bond issuance for the 2020 wind season, but thanks to investor appetite and TWIA’s willingness to lock-in more long-term coverage, the new Alamo Re II Pte. Ltd. (Series 2020-1) catastrophe bond issuance was successfully doubled in size to provide $400 million of reinsurance protection.

So that left TWIA needing just $1.1 billion of fresh reinsurance from traditional and other markets including ILS funds, or collateralised players, which it has now secured.

All of its $2.1 billion of reinsurance protection, from cat bonds and traditional coverages, is on an annual aggregate basis, so protects TWIA against multiple smaller storms occurring and eroding its finances.

TWIA enters the 2020 hurricane season with a funding structure that is practically identical to the prior year, with full coverage up to the 1-in-100 year loss it aimed to protect itself against thanks to the use of cat bonds and reinsurance.

TWIA’s 2020 funding tower can be seen below.

END.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.