Allstate’s Sanders Re II 2020 cat bond marked for losses of up to 70%

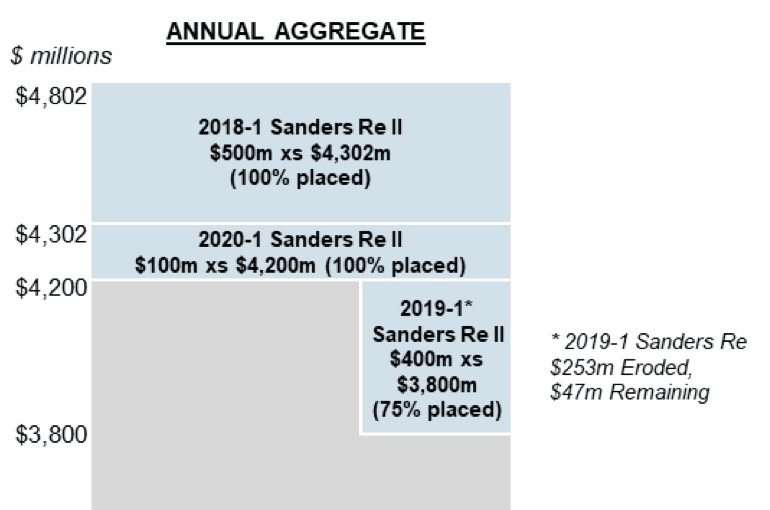

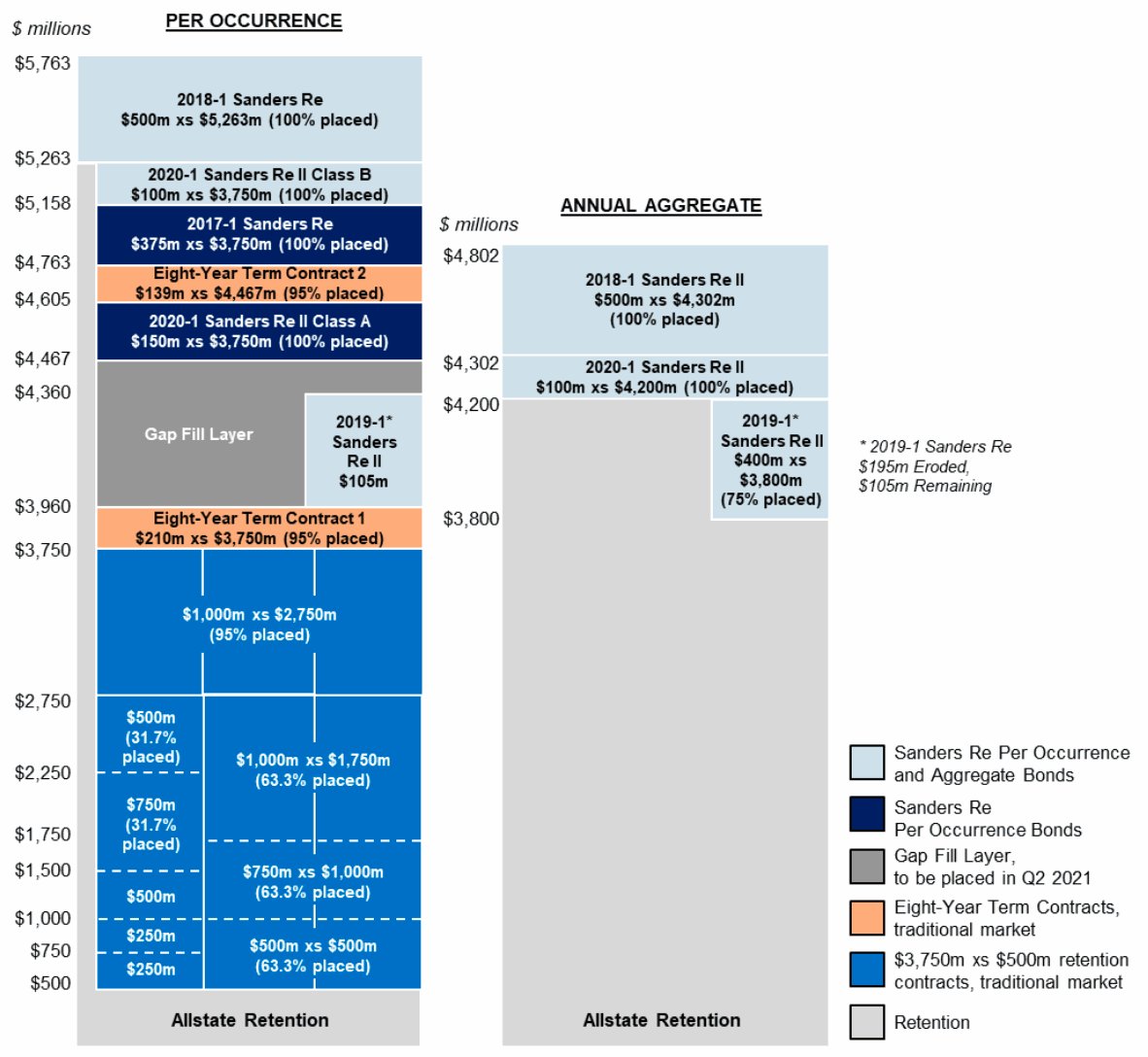

1st March 2022It’s become apparent that US primary insurance carrier Allstate is set to make more reinsurance recoveries from its catastrophe bonds for aggregate losses, as the firm has made a small recovery from the $100 million Class B notes of its Sanders Re II Ltd. (Series 2020-1) transaction and the market expects more erosion to that […]

Read the full article