As Irma tracks west, impact to ILS market lessens: Brookes, RMS

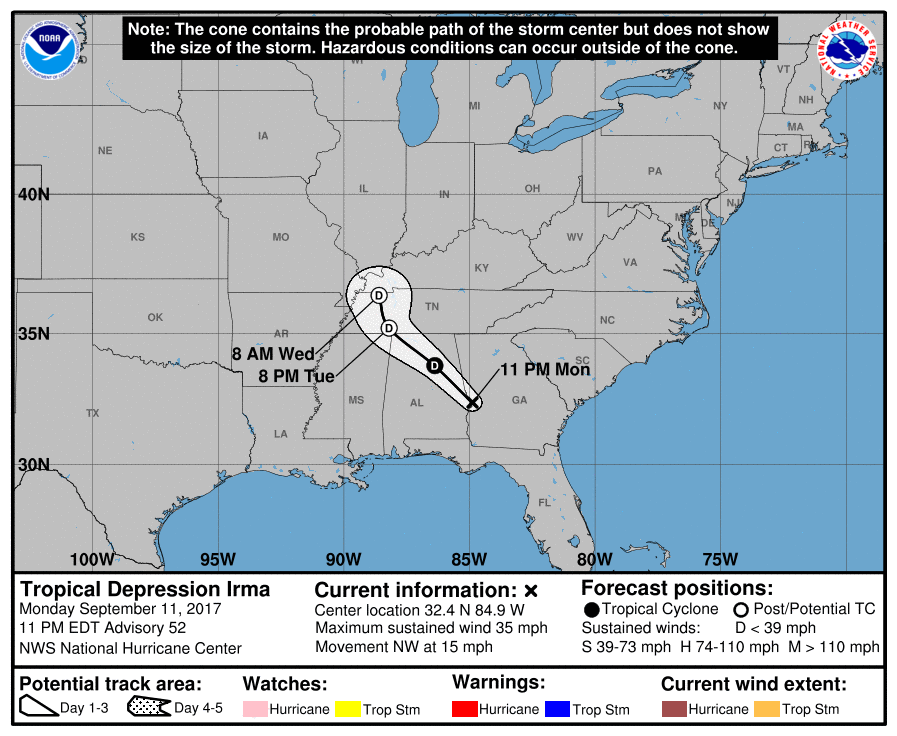

9th September 2017As major hurricane Irma continues to track west and the forecast path for the storm predicts the expected turn to the north towards Florida will be later, resulting in the landfall position shifting west, the potential impact to the ILS and catastrophe bond market lessens, according to Ben Brookes RMS Vice President of Capital Markets […]

Read the full article