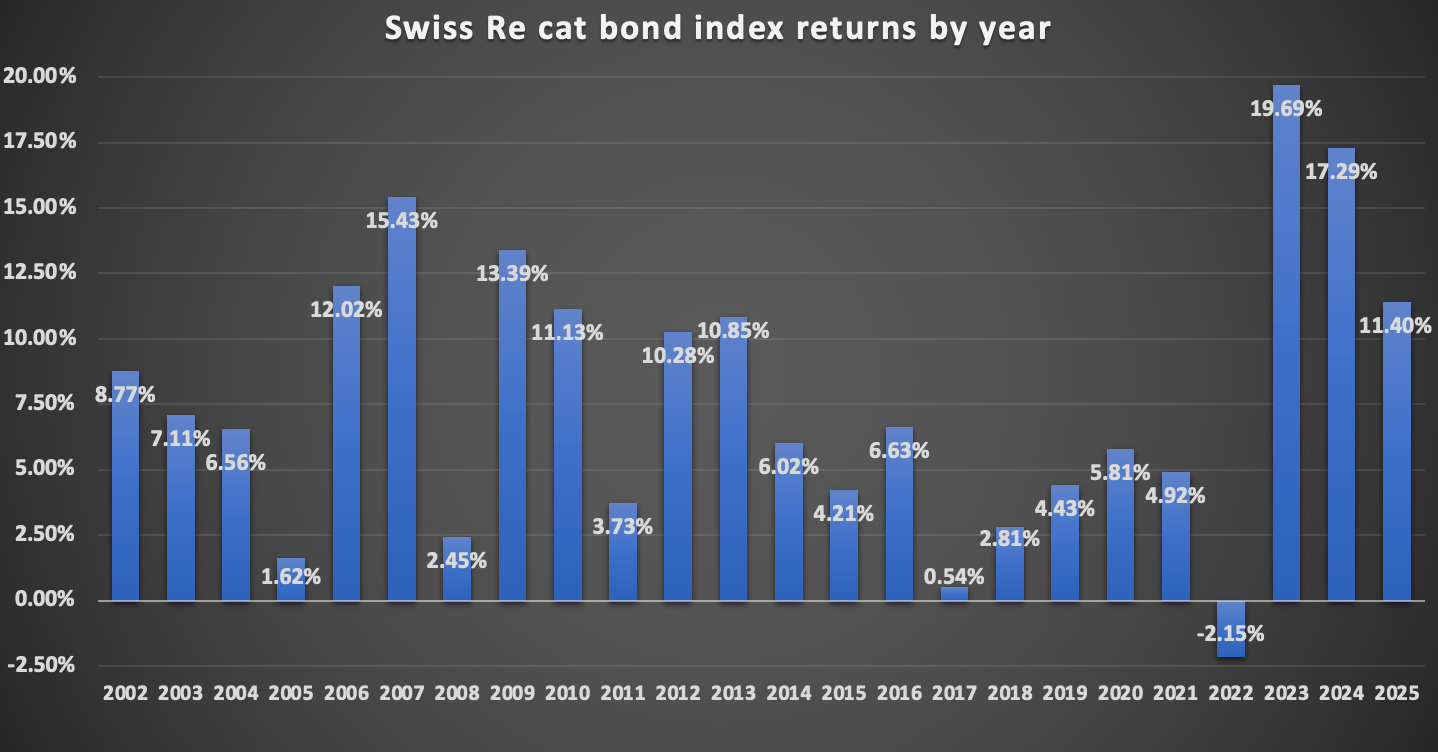

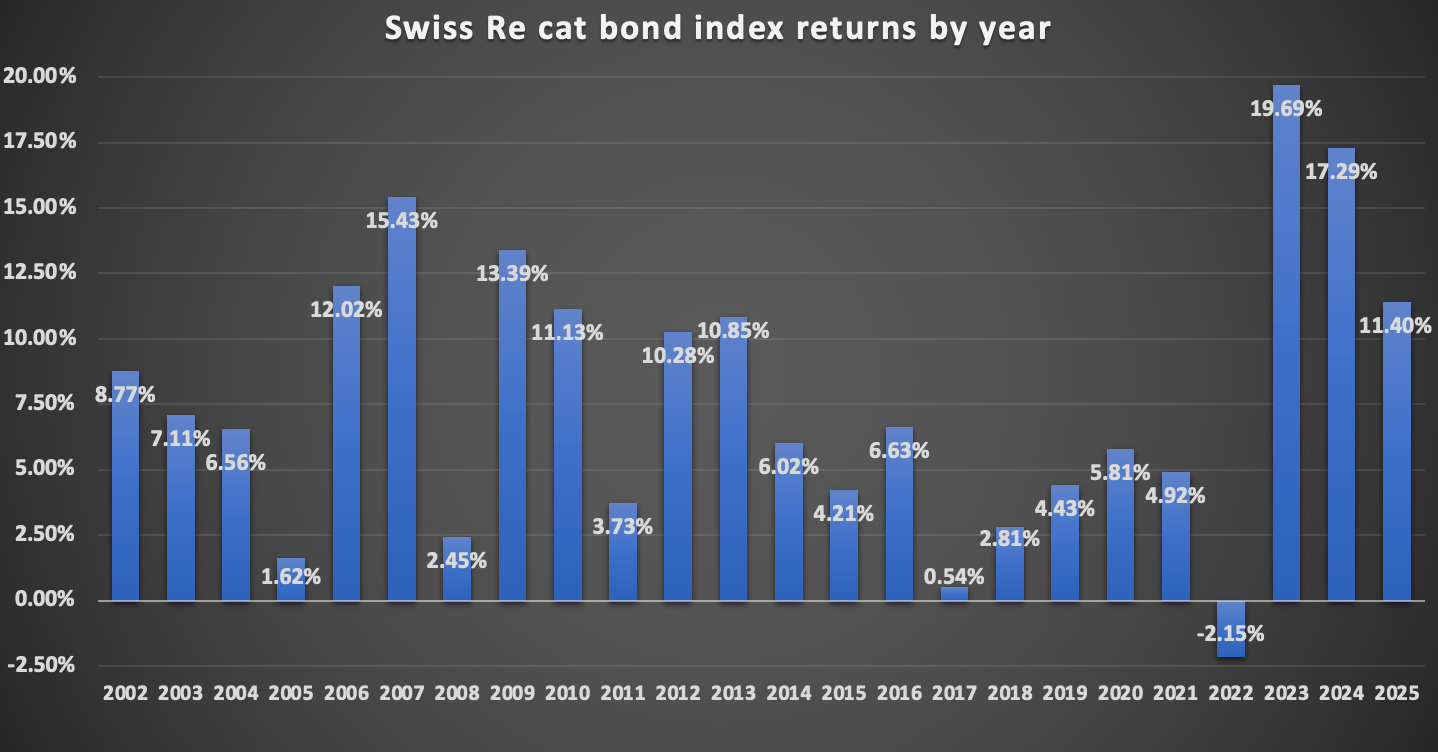

The catastrophe bond market experienced its third consecutive year of double-digit returns in 2025, with perhaps the most widely used benchmark, the Swiss Re Global Cat Bond Performance Index, delivering a total return of 11.40% for the period.

That makes 2025 the sixth best year of returns in the history of this longstanding benchmark index of catastrophe bond market performance.

That makes 2025 the sixth best year of returns in the history of this longstanding benchmark index of catastrophe bond market performance.

At 11.40%, the Swiss Re cat bond index performance for 2025 was impressive given there were a number of losses to catastrophe bonds during the year and negative performance for the month of January after the California wildfires.

It was an interesting year for cat bond investment performance in general, as, for 2025, the market indices have not outpaced the performance of individual cat bond funds by as much as we have seen in some other years.

In a typical year, almost all managed cat bond funds tend not to be able to reach the levels of return that the market Index reports. In fact, in some years they lag the indices by a relatively meaningful amount.

That’s because it is challenging to fully-replicate the Swiss Re cat bond index, while the majority of cat bond fund managers prefer to try and generate their own shape of returns, based on their specific management and trading philosophy, rather than replicate a cat bond market beta.

But, in 2025, a number of cat bond funds do look set to come closer to the market indices than they might in a typical year and we believe this is due to the type of losses experienced, having been to cat bonds that some investment managers underweight or do not invest in at all (such as wildfire or more secondary peril aggregate focused cat bonds).

2025’s cat bond index performance is lower than the last two years for numerous reasons, chief of which are the reduction in risk-free collateral returns, reduced insurance risk spreads, as well as the aforementioned loss activity.

But still, 2025 being the third consecutive year of double-digit returns is impressive given it is the first time ever that the catastrophe bond market benchmark has exceeded 10% in total returns three years in a row.

It’s also notable that at 11.40%, the catastrophe bond market remains a very attractive source of relatively uncorrelated returns for investors seeking diversifying alternatives, exceeding many other investment categories in fixed income alternatives and hedge funds.

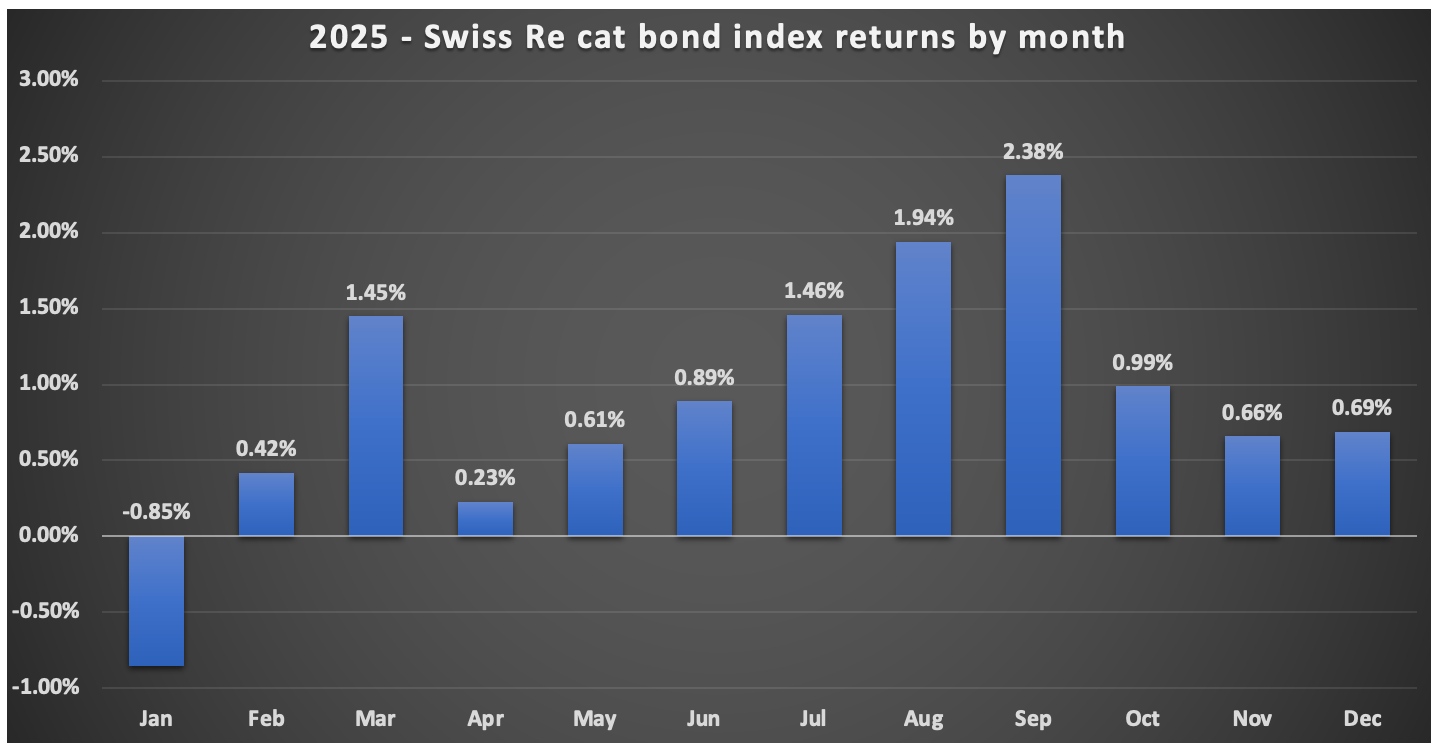

January 2025 began the year with a negative month for the catastrophe bond market due to the initially mark-to-market losses from the Los Angeles wildfires in California.

Interestingly though, many pure cat bond funds managed positive performance that month as they had underweighted, or not invested in at all, wildfire exposed catastrophe bond positions. That is the first example of how 2025 was a little different, in the way actual cat bond fund performance compared to the market indices, as many cat bond funds were positive in January.

February was a fairly typical performance, albeit with wildfire effects to pricing of certain positions, but March then saw a particularly strong month for the Swiss Re Global Cat Bond Performance Index, presumably with some recoveries in value from the negative January and a slightly depressed February return.

Severe US weather events then dented returns for April, as certain annual aggregate catastrophe bonds were affected. Again, this meant some pure cat bond fund strategies beat the index for this month as well, given their underweighting of aggregate cat bond notes.

Quieter months followed, albeit with some more severe weather events and adjustments to pricing for certain cat bonds as a result.

Then wind seasonality kicked in and the catastrophe bond market experienced a particularly strong few months of returns, as you can see in the chart below.

In fact, with no loss activity to any US hurricane catastrophe bonds in 2025, the performance of insurance-linked securities and other reinsurance investments through the summer months was particularly impressive.

July, August and September 2025 saw the total return of the Swiss Re catastrophe bond index at or near record highs for those months, delivering a welcome boost to cat bond investment performance through a welcome and uneventful US hurricane season for the market. A number of pure cat bond funds saw their record highest month of performance during the summer of 2025.

October saw another catastrophe bond loss event, as hurricane Melissa triggered a full payout of Jamaica’s parametric World Bank supported cat bond issuance.

However, that provided another example of how this year saw cat bond funds differing to the market index, as many fund managers underweight parametric deals or did not allocate to this bond at all. This was another small reason for the closer differential between the index and certain higher-performing cat bond funds in 2025.

The final two months of the year saw much more typical performance, while at the same time the softening of cat bond spreads at issuance was accelerating, effectively taking some return-potential out of the marketplace.

But the year ended with the 11.40% total return for the Swiss Re Global Cat Bond Performance Index and the now three years in double-digits in a row will likely raise the profile of cat bonds to even more investors.

Of course, with the market having softened at pace in recent months, across catastrophe bonds, ILS and reinsurance renewals, the return-potential has declined and at this stage, absent some kind of market price-moving event, double-digit total returns seems a far less likely outcome for the market benchmarks in 2026.

Even a completely loss free year for the catastrophe bond market may not deliver double-digit total returns, with the risk-free rate lower now than it was for much of 2025 and risk spreads greatly reduced in the stock of new cat bond issuance.

But, 2026 does have the potential to result in returns that would still be deemed attractive, compared to the long-term market averages.

As we reported recently, consultancy Lane Financial said a total return for 2026 after accounting for an expected level of losses could be around 6%.

But, that is based on 2.59% in losses, the modelled expected average, over the course of the year.

So, if 2026 is another year where catastrophe bonds are less exposed to the types of severe events that do occur, or managers are underweight or not invested in any bonds that are impacted, it could potentially result in certain cat bond funds doing better than that 6% projection.

We will, of course, keep you updated as the new year progresses.

You can analyse pricing in the market in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by years and quarters, and in data from Plenum Investments on the catastrophe bond market yield.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.