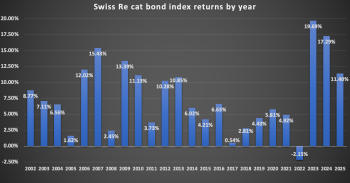

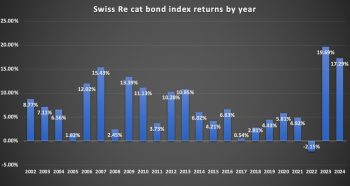

Aon’s Catastrophe Bond Total Return Index delivered 11.6% return in 2025

28th January 2026Coming off a substantial year for the catastrophe bond market, Aon Securities, the capital markets and insurance-linked securities division of the insurance and reinsurance broker, reported that its Catastrophe Bond Total Return Index generated a return of 11.6% for 2025.

Read the full article