Catastrophe bond funds in the UCITS format are averaging approximately 6.20% returns year-to-date in 2023, while over a 12-month horizon the average return is now 3.57%, even accounting for major hurricane Ian’s losses in Florida.

May 2023 saw a slightly slower month in cat bond fund performance, with the group of UCITS catastrophe bond funds delivering an average 0.67% returns for the month.

The lower-risk UCITS cat bond funds averaged 0.64% in May, while the higher-risk cat bond funds returned 0.70% for the month.

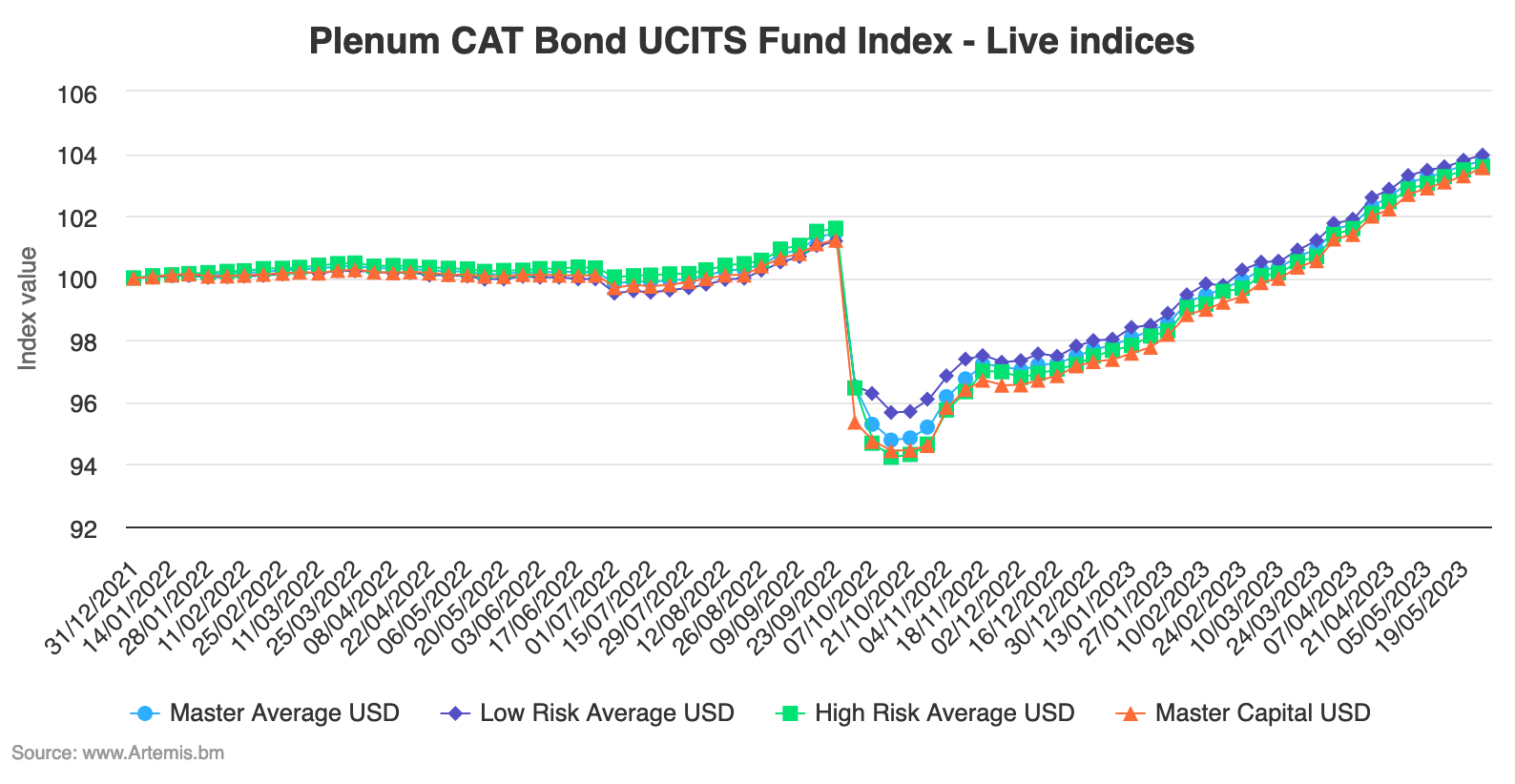

The Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

The slow-down in returns in May, being well-below the 1.5% average from April, is possibly a sign of the recovery from spread effects slowing, as well as the impending start of the Atlantic hurricane season beginning to exert some pressure.

But the year-to-date performance remains extremely healthy, as 6.20% on average across the group of UCITS catastrophe bond funds that Plenum Investments tracks.

Over the first five months of the year, the lower-risk group of UCITS cat bond funds has now delivered an almost 6.10% return, while the higher-risk cat bond fund cohort has delivered 6.25%.

It’s interesting that the delta between the two is so small this year, having typically been wider in the past. It seems the recovery in prices since the excessive spread widening seen last year.

The average 12-month return for the UCITS cat bond fund Index is now 3.57%, with lower-risk funds averaging 3.91% and higher-risk 3.32%, and the delta there indicating the larger impact of hurricane Ian to the higher-risk UCITS cat bond funds.

But, since the lowest-point this Index hit soon after hurricane Ian, the recovery has now seen the average cat bond fund return reach a very impressive almost 9.50%, with the higher-risk cat bond funds now having delivered 9.92% in returns, on average, since they bottomed out after the major storm hit Florida.

That’s a particularly impressive recovery and performance since that date and the fact all investors that have been in cat bonds for a year will be well into positive return territory, despite hurricane Ian, says a lot for the forward return-potential of the catastrophe bond market at this time.

Of course, it also says a lot for the changes to terms and conditions, such as attachment points, that a major hurricane in Florida did not cause the massive cat bond market losses that had been envisaged right after Ian hit.

Again, that bodes well for the forward-looking returns cat bond fund investors can hope to make, even where there to be a repeat of hurricane Ian in 2023.

As an aside, we are aware of some cat bond fund strategies delivering more than 6.5% in unhedged returns so far this year, a really stunning performance from an asset class where that might have been looked on as a very attractive full-year return in many recent years.

Analyse interactive charts for this UCITS catastrophe bond fund index.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.