Analysts from investment bank Berenberg are estimating as much as $8 billion of alternative reinsurance and insurance-linked securities (ILS) capital has been raised year-to-date, which is a significant amount and far overshadows new capital entering the traditional market.

In total, Berenberg’s analyst team believe that around $9.5 billion of new reinsurance focused capital had been raised across the first five months of 2023.

$8 billion is estimated to be alternative, or related to the ILS fund and structure marketplace, with the remaining $1.5 billion associated with traditional reinsurance equity capital raises.

As ever, it’s very hard to put an accurate figure on capital raising in ILS, you need to rely on rumour as much as fact to get to a figure.

But when you consider the rapid growth being experienced in the catastrophe bond market over the same period, the $8 billion estimate begins to seem a reasonable approximation.

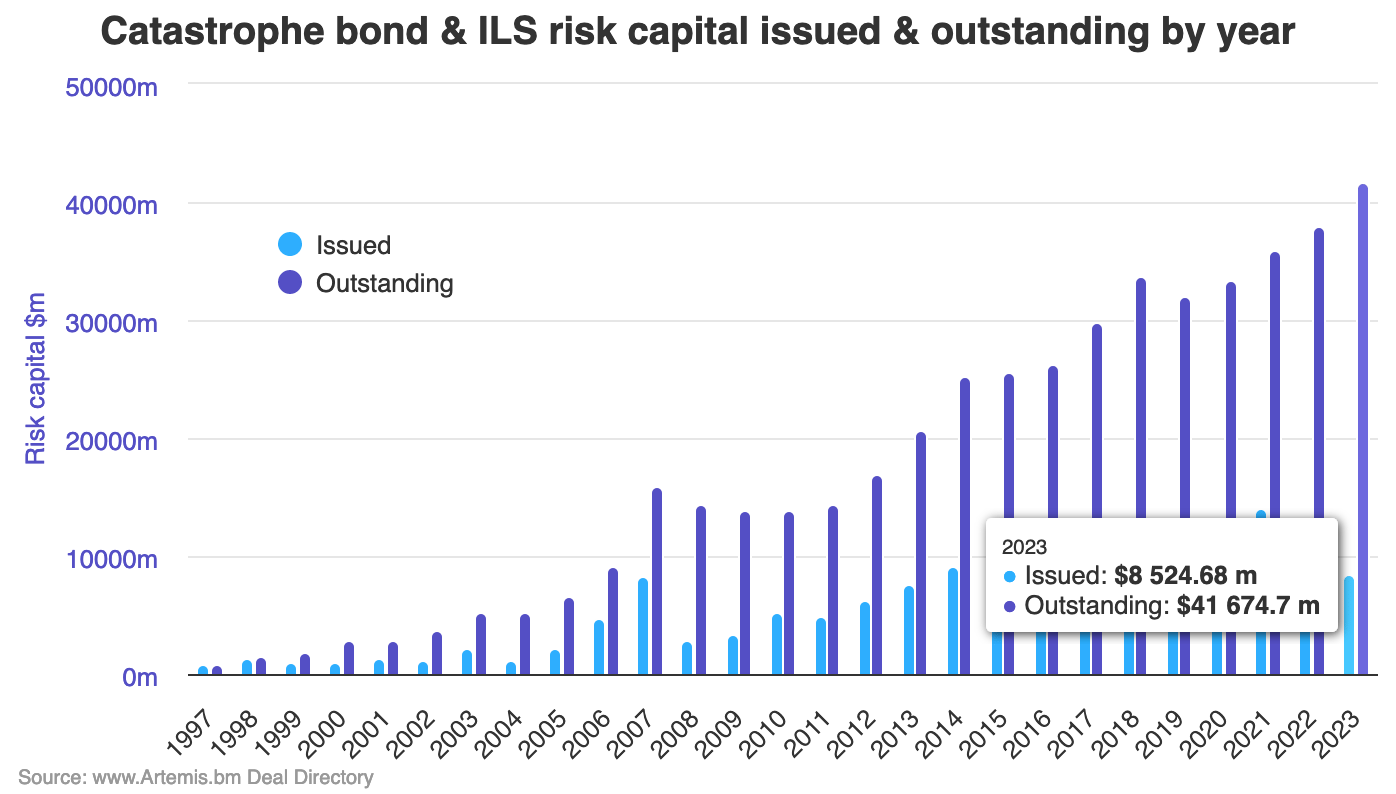

The outstanding catastrophe bond and related ILS market stood at just slightly over $37.9 billion at the end of 2022.

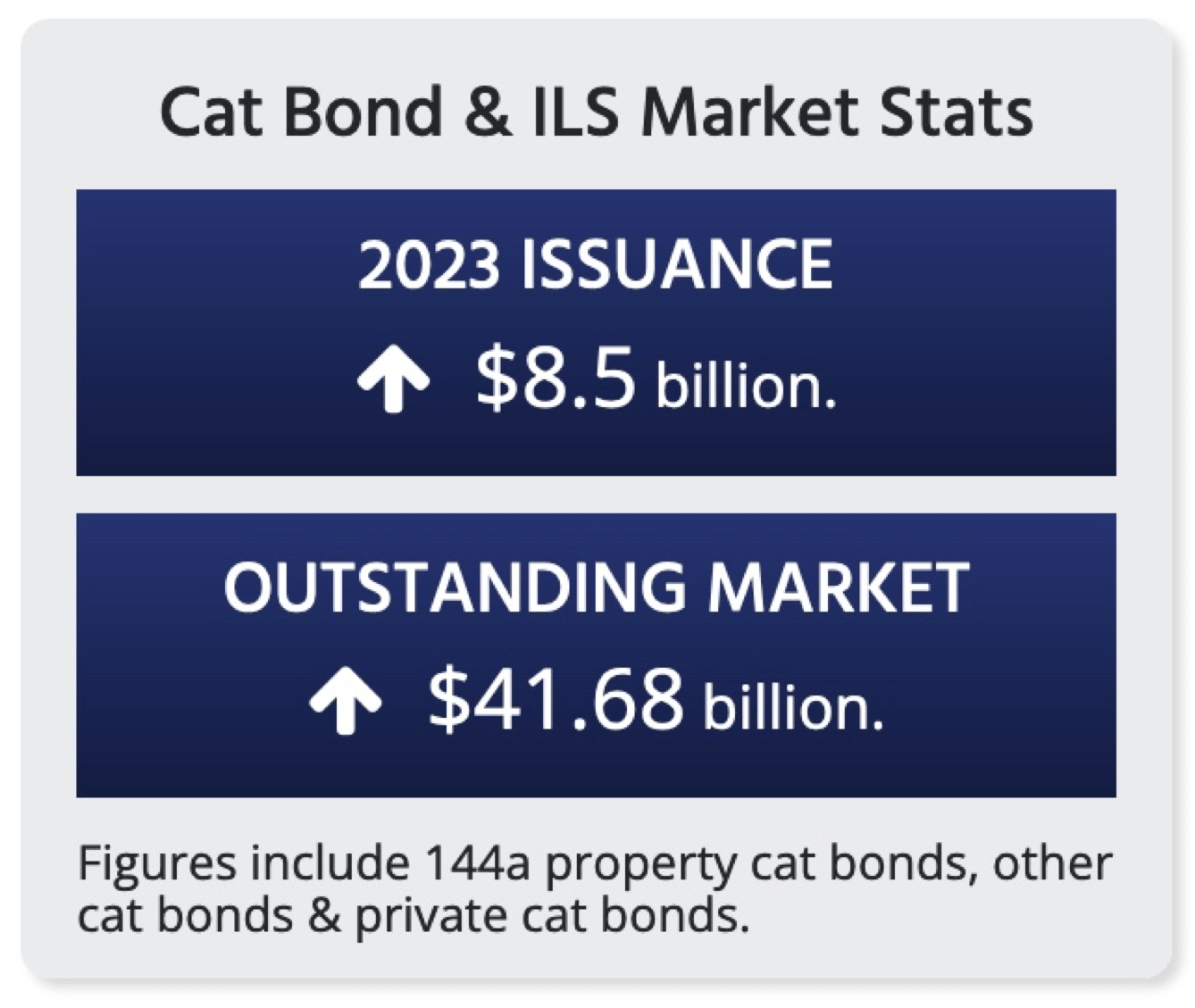

That total has now risen to $41.68 billion, so representing cat bond market growth of close to $4 billion so far in 2023, according to Artemis’ catastrophe bond market data and charts.

That total has now risen to $41.68 billion, so representing cat bond market growth of close to $4 billion so far in 2023, according to Artemis’ catastrophe bond market data and charts.

That chart, which you can see in full further down this article, only includes data on catastrophe bonds that have completed their issuance journey and are now outstanding.

With the cat bond market pipeline remaining active, largely outpacing maturities so far this year, it signals more growth to come and there are another five new catastrophe bonds that have yet to settle listed in our Deal Directory, that will together bring another $825 million of risk capital to market before the mid-year point.

So, of the $8 billion of alternative capital growth that Berenberg’s analysts estimate, it’s possible to assume that $4 billion could be attributable to the cat bond market, based on the outstanding cat bond market’s growth since the end of last year.

The remaining up to $4 billion would therefore have to be counted across other collateralized reinsurance and ILS instruments. So, from ILS funds allocating to reinsurance and retrocession, to reinsurance sidecars, ILW’s and other instruments.

Spreading this across the entire market, it seems feasible for these more private segments of ILS to contribute another roughly $4 billion in new capital flows so far for 2023.

Much of that may be replacing assets under management that had been previously lost, of course, so more of a market catching back up, than a market growing in overall size.

Of course, there are also outflows to consider, as well as the evolving trapped ILS capital situation, as there has been more capital freed up through the first few months of this year, as we’ve reported before.

It’s also worth noting that the capital is not taking market share in any significant way, rather it is absorbing demand for catastrophe reinsurance protection.

The analysts rightly point out that, “Despite early signs that the supply crunch is somewhat easing, this does not appear to be sufficient to derail the strong rate momentum ytd.

“In our view, the main reason for this is that the new capital is merely alleviating some of the high pressure of increased demand for reinsurance.”

Also notable, the analysts highlight that investor activity this year seems to be more concentrated away from the larger investors that have funded a lot of the ILS market’s growth over the last decade.

“Sources report that most of the money coming through the sector is from specialists, as opposed to generalists, including pension and endowment funds, which are choosing to remain on the sidelines and wait for more proof that this new pricing level is adequate before coming back,” the analysts explained.

The analysts also point out that exposure growth will drive rising demand for catastrophe reinsurance. Recall that, Swiss Re forecast US catastrophe reinsurance demand could increase 15% by the end of 2024.

At that rate of increasing demand, this capital being raised will not drive an excess in the marketplace until the pace of new investor flows and equity raises picks up considerably. Which means rates should hold better than in previous periods of reinsurance capital influx.

Important to reiterate, while we’ve seen and reported on pockets of ILS capital raising, the data is hard to verify on the private ILS and collateralized reinsurance side, with the catastrophe bond market the only place we can point to definite market expansion.

While it’s hard to verify whether $8 billion of fresh capital has been raised, it does seem reasonable to state that, taking into account cat bond market expansion, ILS capital raises, other alternative capital structures, plus free up and recycled capital that had been trapped, that the use of alternative capital in reinsurance and retrocession has likely expanded by minimum $6 billion, perhaps as much as $8 billion since December 31st.

By July 1st and just after, once mid-year retrocession buying is completed, could the $8 billion figure even look a little light?

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.