The threat hurricane Dorian posed last week to the insurance-linked securities (ILS), catastrophe bond and collateralised reinsurance market was particularly significant, with scenario loss estimates having shown an event that could have caused further significant impacts to ILS funds and investments.

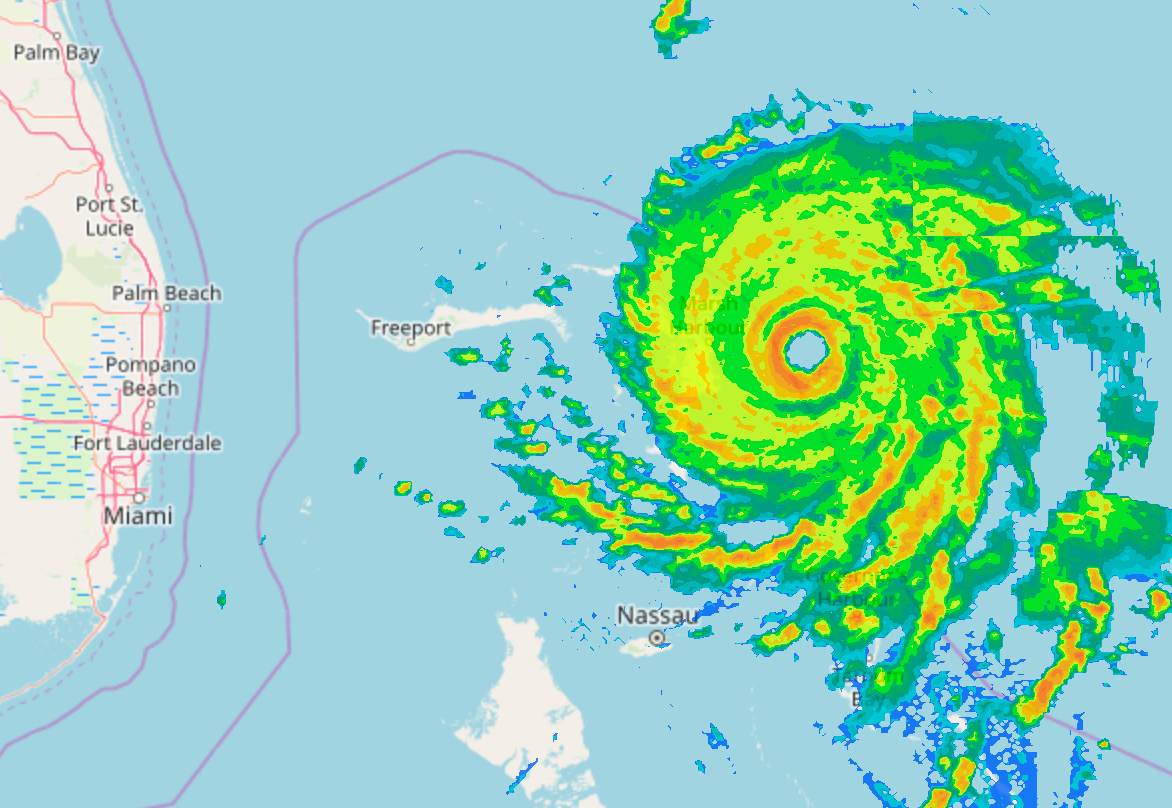

But over the weekend the forecast for hurricane Dorian has shifted, with the forecast path now moving east of the Florida coast and the curve north looking like it could keep the eye of the hurricane offshore of Florida.

But over the weekend the forecast for hurricane Dorian has shifted, with the forecast path now moving east of the Florida coast and the curve north looking like it could keep the eye of the hurricane offshore of Florida.

Last week, the scenarios were significantly worse, with hurricane Dorian forecast to make a direct landfall on mid-Florida as a major storm, then turn north and travel slowly up the Peninsula.

As we explained at the time, modelled estimates for insurance and reinsurance market losses were showing figures in the $10 billion to almost $40 billion range at the time, definitely sufficient to bring a lot of ILS capacity into play and also trap a significant amount more of ILS market collateral.

Coming on the back of 2017 and 2018 losses, which are still unwinding in the ILS market, this worst-case scenario could have made life difficult for some ILS strategies.

Now, hurricane Dorian looks more likely to stay offshore of Florida, however there are still serious considerations for the ILS market and there is still some exposure to the storm.

Should hurricane Dorian bring hurricane force-winds to much of the Florida coastline as it travels north, hurricane force winds still extend outwards 45 miles from the eye, then an industry loss large enough to bring some collateralised reinsurance coverage into play is possible.

In addition, there could be losses for ILS funds and ILS investors through quota share arrangements with reinsurance firms, as well as the potential for some reinsurer sponsored sidecar vehicles to take a share of any losses that occur.

Private ILS and collateralised reinsurance deals now exist across the risk spectrum in Florida, as the ILS market has expanded steadily into the state for almost two decades now.

Which means that any loss in Florida that is large enough to bring reinsurance towers into play, is also likely to leak into the ILS market. It could even threaten some of the lower down cat bonds, were Dorian to move nearer to the coastline.

There remains considerable uncertainty over just how far west hurricane Dorian will travel, as it moves north alongside Florida.

The further west, by a matter of miles, the more intense the hurricane force-winds that could be experienced by coastal regions of the state could be.

In addition, there is the storm surge to consider, which could still be sufficient to cause coastal flooding and inundation.

If hurricane Dorian rakes the entire Florida coastline from the middle upwards with hurricane force-winds and a small storm surge, that would still create some reasonable losses to reinsurance layers, we’d imagine.

Then there is rainfall to consider. Dorian is forecast to drop significant rains on her path and the entire coastal area and much of the Peninsula of Florida will be affected.

While rainfall related flood losses can often fall to the NFIP, which of course has its own reinsurance tower and catastrophe bonds in force, Florida is also a region where private flood insurance has been expanding fast.

Hence there could be some leakage of claims to the ILS market from flood programs operated by private insurers in the state. There’s also the wind vs water question that always comes with hurricanes to consider, as that can confuse how claims are accounted for anyway.

But the real wildcard that could ramp up losses for reinsurance and ILS interest may be the scenario that sees hurricane Dorian travelling north, raking the coast of Florida, followed by Georgia, South Carolina and North Carolina.

All four states could experience some hurricane force-winds if Dorian tracks close enough to the coastline, at the least strong tropical storm force winds are likely, plus storm surge and torrential rains.

This is why, even though the hurricane Dorian outlook looks less impactful to the United States and the potential for major reinsurance and ILS market losses looks lessened as of today (Monday), some impacts cannot be discounted at this time and even catastrophe bonds with east coast exposure remain on-watch.

Any wobbles further west could raise the stakes significantly for reinsurers and ILS interests, or if the storm decides to head onshore in any of the states above Florida, so hurricane Dorian deserves a close eye over the next few days.

Rating agency S&P said at the end of last week that reinsurers and alternative capital (ILS) would be likely to bear the brunt of a major hurricane Dorian market loss.

A less significant loss will fall more to the insurers, however if the loss is geographically spread due to coastal impacts all the way up then the aggregation of this could push more into reinsurance programs.

S&P also noted that any material ILS market loss will test the resolve of investors once again, so Dorian even if not a significant market loss may be sufficient to strengthen the desire for further rate increases in 2020 and cause further upwards rate pressure at the January renewals.

Hurricane Dorian will have given everyone a scare and caused some reflection on portfolios and their pricing adequacy. At the end of last week the reinsurance and ILS market was looking down the barrel of a third Florida hurricane loss year in a row, which may have caused some strengthening of pricing resolve, whether the loss occurs or not now.

Uncertainty reigns though and with hurricane Dorian set to wobble, as major hurricanes tend to, there could be a nervous few hours ahead as the storm begins its turn to the north, with the timing of that turn still everything in terms of how large a U.S. impact it causes.

It’s important to also mention the devastating impact to property and lives in the Bahamas, which Dorian has slammed as a significant Category 5 storm.

While the insurance and reinsurance market loss from Dorian’s fury in the Bahamas won’t trouble the industry particularly, the human element of this disaster will likely be of tragic proportions in the islands and all thoughts should be with the communities bearing the brunt of what remains a ferocious storm.

Find our latest on hurricane Dorian here.

You can always visit our 2019 Atlantic hurricane season page for the latest and we will update you as new information is reported to us.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.