Rates-on-line for non-marine retrocessional reinsurance contracts were up by as much as 40% in the January 2020 renewals, as the segment experienced significant volatility, according to Hyperion X data.

There was particularly significant volatility in U.S. catastrophe exposed retrocession renewals, as well as loss affected aggregate layers of retro programs.

But capital remained available for many retro cedants, with per-occurrence retro renewals experiencing less firming and better execution of program terms.

As we explained before the renewal, the retro market dislocation has attracted back some players such as Berkshire Hathaway and DE Shaw, while large traditional reinsurers like Everest Re and RenaissanceRe had also been particularly active in quoting, and ILS fund stalwarts such as Aeolus are all said to have increased their appetites.

The increased appetite for retro among major players such as these has helped the renewal market to clear and also suppressed rate increases a little as well, it seems.

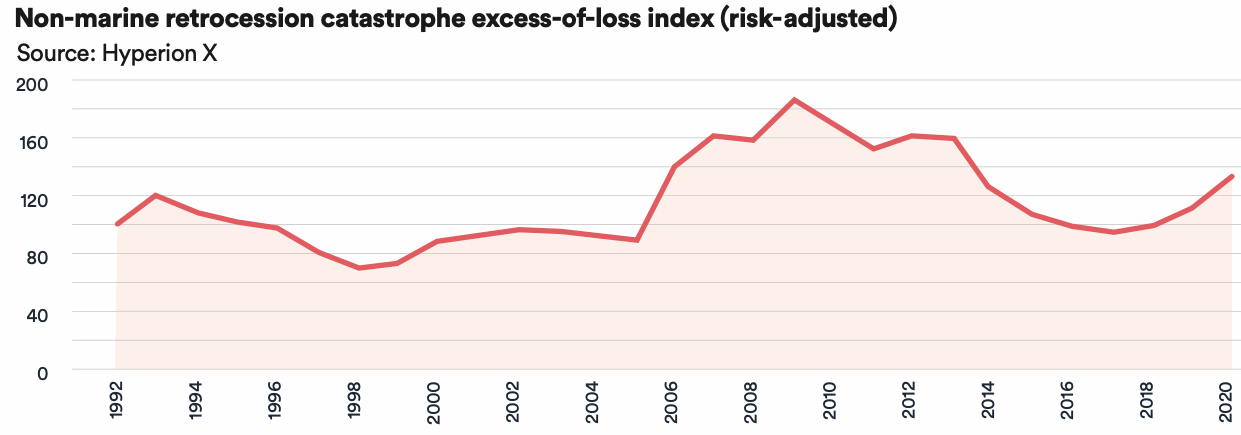

Hyperion X, the data and technology focused unit of the global Hyperion Insurance Group that includes RKH Reinsurance Brokers, has taken a look at market trends and pricing for non-marine retrocession at the renewals and constructed a new Index that tracks retrocession market rates-on-line across years.

The non-marine retro reinsurance market, which has been particularly affected by capital availability and ILS market losses as well as the effects of trapped collateral, experienced the highest levels of volatility, according to Hyperion X.

As a result, risk-adjusted catastrophe excess-of-loss rates-on-line rose by an average of 20%, but there was significant variation around this figure as well.

Hyperion X reports that prices ranged from flat for some regional retrocession covers outside of the U.S. and Japan, but rate increases were as high as 40% for loss affected aggregate retro covers, where this capacity was even available.

As a result, the retrocession market itself diverged, just as reinsurance did from retro at this January 2020 renewal, with loss experience and relationships proving key in cedants ability to secure the capacity they needed.

The firming trend in catastrophe retrocession is clearly evident in the above Index graphic from Hyperion X, which shows how the retro market has been impacted by the successive years of catastrophe losses, the impacts to aggregate and pillared products and the effects of trapped collateral.

The impact of losses to the ILS fund sector helped to drive buyers towards per-occurrence retro in many cases, given the expense and lack of availability of aggregate or pillared retro products.

“Diminishing ILS investor appetite at the margin compelled buyers increasingly to seek coverage on a per occurrence basis, fuelling rate increases in that segment,” Hyperion X explained.

Also read – Wide renewal variation as plentiful but volatile capital drives market: Hyperion X.

Read all of our reinsurance renewal coverage here.

Make sure you register soon for our ILS NYC 2020 conference, as tickets are selling fast!

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.