The January 2020 reinsurance renewals saw significant variation in market conditions and rates, as capital remained plentiful to help ceding companies secure their coverage requirements, but volatility in areas led to differing outcomes, according to Hyperion X.

Property catastrophe reinsurance saw “relative price stability” at the January 1st 2020 renewals, while there was significant volatility in other areas such as U.S. exposed retrocessional reinsurance and inflationary pressures driving casualty reinsurance.

Capital has again been a huge factor in the renewals, despite the erosion of some insurance-linked securities (ILS) capacity and reduced capacity of some Lloyd’s players.

Other traditional markets have stepped in, in some areas of the market, enabling cedants to secure the reinsurance they needed and pricing was therefore less exposed to hardening in many market segments.

Hyperion X, the data and technology focused unit of the global Hyperion Insurance Group that includes RKH Reinsurance Brokers, has taken a look at market trends and pricing, with its data displaying the different outcomes for property catastrophe reinsurance and retrocession, in particular.

Explaining how capital availability drove market trends at this renewal, the company said, “The sector as a whole benefited from plentiful, albeit volatile capital and below- average insured catastrophe losses. Countering this were diminished investor appetite for some products, a manifest change in reserving trends, and rate adequacy concerns.”

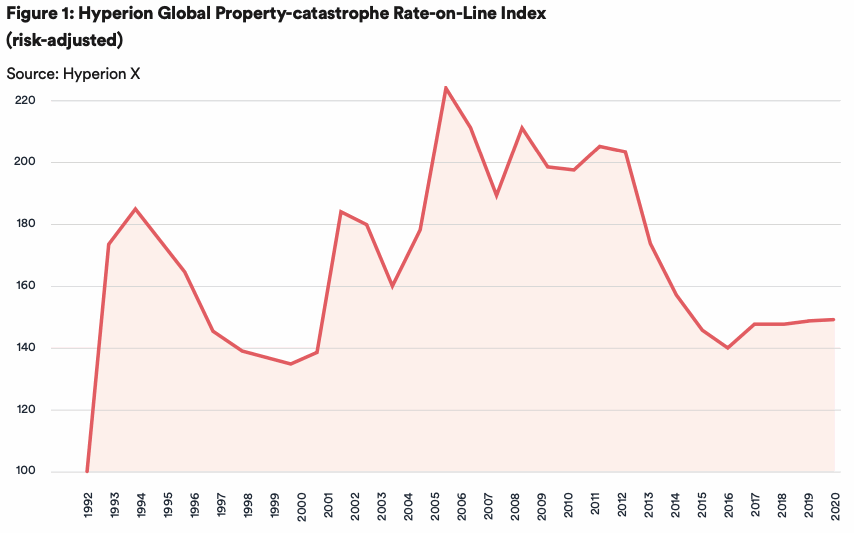

Hyperion X found that global risk-adjusted rates for property catastrophe reinsurance rates-on-line rose by 0.8%

on average.

The increase was stronger in the United States, where rates rose on average by 2%, but pricing was flat to marginally down in Europe, Asia and elsewhere around the world.

This data is based on point estimates within ranges, the company said, so this index data is dependent on loss experience, exposure, and other client-specific conditions. As a result the significant challenges faced by some areas of the market where dislocation have been most severe, in terms of price and availability, notably US wildfire-exposed cover, are masked within the trend data.

Property catastrophe reinsurance rates on line have now been at cyclically low levels for a number of years and relatively stable, helped by the entrance and growth of alternative capital and ILS funds.

While rates have proven very stable, even after the extreme pressure of losses over recent years, Hyperion X notes that a “market litmus test” could come later in 2020.

With the April 1 reinsurance renewals expected to be driven by the “significant consecutive accident year losses in Japan” and the year’s June 1 renewals driven by a Florida market that is still “disproportionately served by third party capital.”

It will be interesting to see whether rate acceleration continues, or even increases into these renewals. Or whether the renewed ability of some ILS funds to raise capital, as well as the growing appetite of some major reinsurance firms to write catastrophe business, together combined to dull rate increases again.

Non-marine retrocession saw the most significant volatility, in terms of price and capacity availability, with an average rate increase of as much as 20% recorded by Hyperion X.

However, there was a wide variation around this figure as well, with some areas of the retro market experiencing price increases of up to 40%, especially for loss affected aggregate layers.

Commenting on market conditions, Elliot Richardson, Chairman, RKH Reinsurance Brokers said, “The market has continued to show its resilience in an environment of increasingly evident risk factors. Given the significant catastrophe losses of 2017 and 2018 and the ensuing capital constraints, our brokers in conjunction with the market have proven their value this year by securing capacity to complete placements at the most favourable terms possible on behalf of our Global clients.”

David Flandro, Managing Director, Analytics, Hyperion X further explained, “The market continues to shift from an environment of redundant reserves and abundant capital to one of increasing reserve deficiencies and investor caution.

“During this phase of the cycle, it is more important than ever that market participants and investors have access to the best information, insights and especially data in order to inform their decision making. Hyperion X are pleased to be able to provide unique access to the most accurate and insightful market data in the business.”

Hyperion X believe that, “It is significant that retrocession, property- catastrophe, and casualty reinsurance rates-on-line are all increasing, albeit on very different trajectories.”

Going forwards, the company believes that reserving trends, investor appetite for ILS and reinsurance, as well as catastrophe loss experience, are all going to be important factors driving outcomes at the global level, as well as trends in the primary market.

Read all of our reinsurance renewal coverage here.

Make sure you register soon for our ILS NYC 2020 conference, as tickets are selling fast!

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.