Catastrophe risk modeller RMS has now weighed in with its estimate of insurance and reinsurance industry losses likely to come from recent hurricane Zeta’s impacts to the United States and it’s a little higher than other modeller estimates.

RMS said that it expects hurricane Zeta’s onshore insured losses will be between $3 billion and $5 billion, which includes $200 million to $300 million of flood insurance losses for the NFIP.

RMS said that it expects hurricane Zeta’s onshore insured losses will be between $3 billion and $5 billion, which includes $200 million to $300 million of flood insurance losses for the NFIP.

In addition, RMS said that it expects up to $500 million of insurance market losses from damage to offshore assets as well.

RMS breaks this all down as between $2.8 billion and $4.7 billion of insurance and reinsurance market losses from wind and storm surge damage to the United States.

This is the most comparable figure with other risk modellers announcements with hurricane Zeta, such as Karen Clark & Company saying the figure would be close to $4.4 billion, AIR saying they will be between $1.5 billion and $3.5 billion, and CoreLogic saying they will be between $2.5 billion and $4 billion.

As we explained previously, the estimates so far suggested that, overall, hurricane Zeta’s insurance and reinsurance market losses will settle below $5 billion, if you include Mexico and offshore exposures as well.

Adding in RMS’ estimate, it seems possible the total insurance and reinsurance market impact could reach slightly above the $5 billion once all damage and claims are calculated and assessed.

RMS said that its estimate for hurricane Zeta includes a 5% reduction in insured onshore losses for ptential overlap with the impacts of Hurricane Sally, which damaged some of the same region earlier this season.

“We do expect some overlap between Zeta and Sally as the industry settles losses from these two events, but not to the degree of Delta and Laura a few weeks ago. Our Development Team found that approximately 20% of zip codes impacted by Zeta were also impacted by Sally, particularly at lower wind speeds. The overlap in the worst-affected areas of these two storms appears to be minimal. Thus, we expect a smaller loss reduction factor compared to the Delta and Laura events, largely attributed to structures in the overlapping region that sustained some, but not total damage from Sally, followed by additional damage from Zeta,” explained Jeff Waters, Senior Product Manager, RMS North Atlantic Hurricane Models.

RMS said that residential property is likely to drive the majority of the losses, but that its estimate considers property damage and business interruption to residential, commercial, industrial, and automobile lines of business, along with post-event loss amplification (PLA) and non-modeled sources of loss.

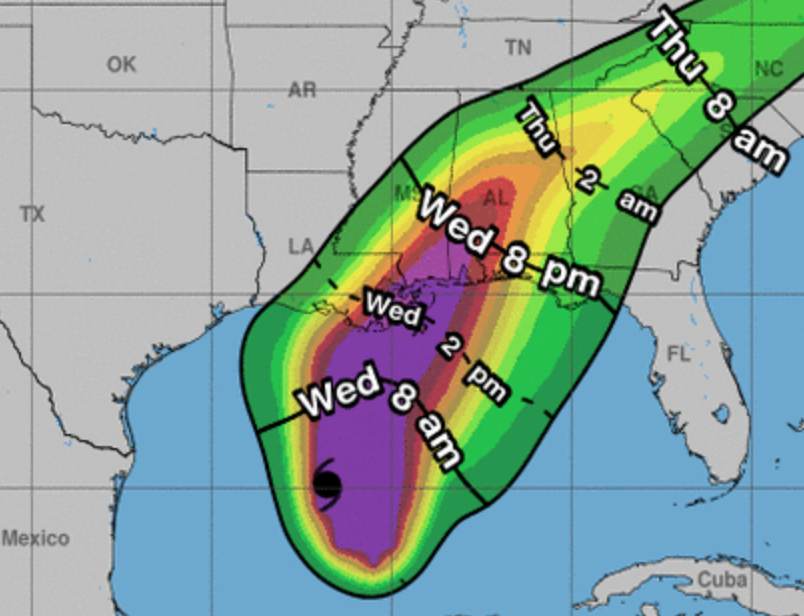

RMS noted that Zeta’s impacts continued well inland of the Gulf Coast, as the hurricane’s rapid forward speed brought strong tropical winds to a wide area.

“Power outages and treefall-driven impacts were two key factors in Zeta. The storm’s fast forward speed brought damaging winds well inland, particularly in areas with an abundance of trees, including metro Atlanta. This, combined with already saturated soil conditions, led to one of the most significant power outages of the season. Some fallen trees also directly damaged buildings and vehicles. We expect these factors to amplify insured losses,” Rajkiran Vojjala, Vice President, Model Development explained.

RMS said that Gulf of Mexico offshore energy losses, to offshore platforms, rigs, and pipelines, are expected to be below $500 million, although hurricane Zeta did expose a significant number of state lease platforms to high winds and waves along the Louisiana coast.

“Despite encountering cooler waters and strong wind shear in its approach, Zeta managed to intensify before making landfall in Louisiana, nearly achieving major hurricane status. The storm’s fast forward motion–common for events that occur later in the season–reduced material water-driven impacts along the Gulf coast. However, that rapid movement brought hurricane-force winds well inland before Zeta finally weakened. In this unprecedented 2020 season, Zeta is another reminder that the season is far from over,” concluded Pete Dailey, Vice President, Model Development.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.