GC Securities execs see sidecars as big focus for 2026. Flag aggregate capacity challenges

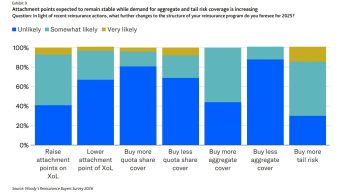

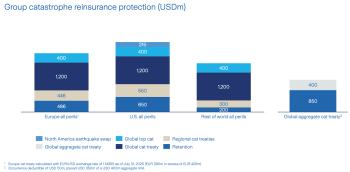

13th January 2026As the reinsurance sidecar market keeps growing, GC Securities is placing significant emphasis on this sector as a major focus for 2026, while the firm also sees a need for greater attention on helping clients secure aggregate capacity for secondary perils, executives from the firm told Artemis in a recent interview.

Read the full article