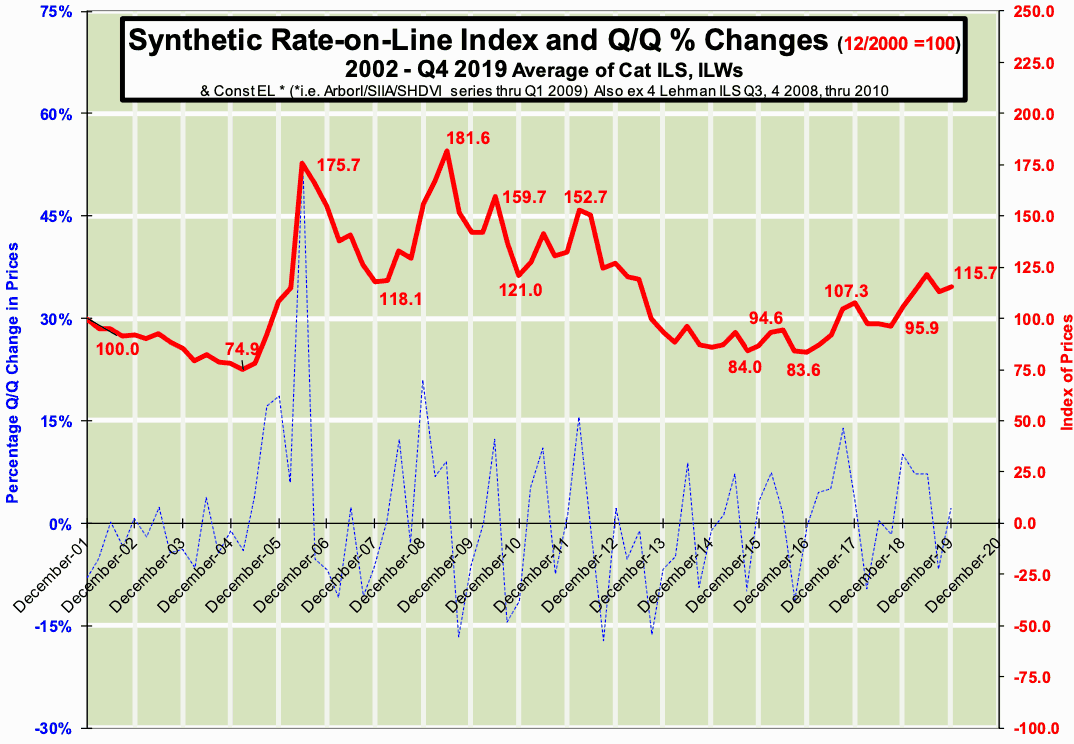

Catastrophe bond and ILS rates-on-line, as measured by a synthetic Index calculated by Lane Financial, rose 2% in the final quarter of 2019, as insurance-linked securities (ILS) remained in hard market territory and yields returned to levels seen earlier in the year.

The latest data from consultancy Lane Financial LLC’s synthetic ILS rate-on-line Index shows that rates in the catastrophe bond market gained back some of those lost through the third-quarter of the year.

Overall, catastrophe bond rates-on-line closed out 2019 roughly 5% up from where they finished the prior year.

The Lane Financial synthetic insurance-linked securities (ILS) rate-on-line index rose by 15% during the final quarter of 2018, as ILS investors demanded more return from their investments in reinsurance linked instruments after the losses of the recent years.

The index then rose by more than 2.5% during Q1 2019, then a further 7% in the second-quarter of 2019, which it then lost in Q3 as the Index dropped back -7% again erasing the Q2 gain.

But the upwards trajectory returned in the fourth-quarter of 2019, with Lane Financial’s cat bond rate-on-line Index rising to end the year up 2%, taking it back to levels last seen in 2013.

Lane Financial’s synthetic rate-on-line Index is constructed with data from catastrophe bond, insurance-linked security (ILS) and industry-loss warranty (ILW) markets, offering an approximation of premiums being paid (or rate-on-line) for ILS and cat bond transactions. It is considered a bellweather benchmark for the sector.

The graphic below shows how the Index ended Q4 2019.

The increase in rates since early 2017 appears relatively consistent and on Lane Financial’s reckoning the catastrophe bond and ILS market remains in hard market territory.

The decline in the Index seen in Q3 2019 seems to have been partly stimulated by price pressure and the lack of primary market issuance during that period, so the recovery in Q4 occurred when fresh issuance came to market at seemingly attractive multiples that helped to boost activity at that time.

Reinsurance market conditions in general continue to stimulate new cat bond issuance, as sponsors are finding value in the cat bond market, especially for harder to secure in the traditional market covers like aggregate retro deals. That could help to boost the Index further in the first-quarter of 2020.

You can download Artemis’ series of quarterly catastrophe bond market reports here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.