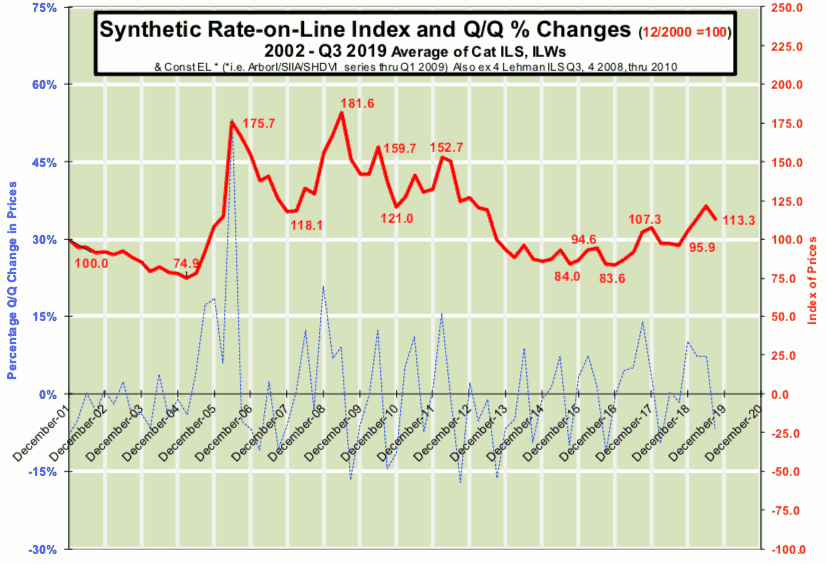

Catastrophe bond and ILS rates-on-line, as measured by a synthetic Index, declined by 7% in the third-quarter of 2019, falling back to levels seen at the beginning of the year, but at the same time ILS remains in hard market territory, the latest data from Lane Financial LLC shows.

In fact, premium rates for ILS and catastrophe bonds as measured by the Lane Financial LLC synthetic ILS rate-on-line Index, lost all of the gains made in the second-quarter to end Q3 back at exactly the level seen at the close of Q1.

At the end of Q1 Lane Financial had said that, at this Index level, ILS and cat bond premium rates were at their best since as long ago as 2012/2013.

So the -7% drop in the index over the last quarter, while a significant shift does not really tell the full story of the ILS and cat bond market rate environment and it’s important to note that rates still remain very attractive right now.

Lane Financial’s synthetic rate-on-line Index, which is constructed using data from catastrophe bond, insurance-linked security (ILS) and ILW markets, to provide an approximation of premiums being paid (or rate-on-line) for ILS and cat bond transactions, is one of the bellweather benchmarks for the sector.

The graphic below shows how the Index ended Q3 2019.

The Index tracks how ILS rates change over time, but the third-quarter of 2019 saw no full 144A natural catastrophe bonds issued during, meaning new price indicators were scarce in the period.

This lack of fresh cat bond issuance can always stimulate price pressure to demand side factors, while also evident in Q3 was pressure on pricing for a number of reasons related to seasonality, as well as hurricane activity with Dorian and some of the Dorian related mark-to-market knock does not seem to have fully recovered across all broker pricing sheets.

As a result, there are other factors to consider that may have contributed to this dip in the synthetic Index at this time of year when fresh cat bond issuance was scarce.

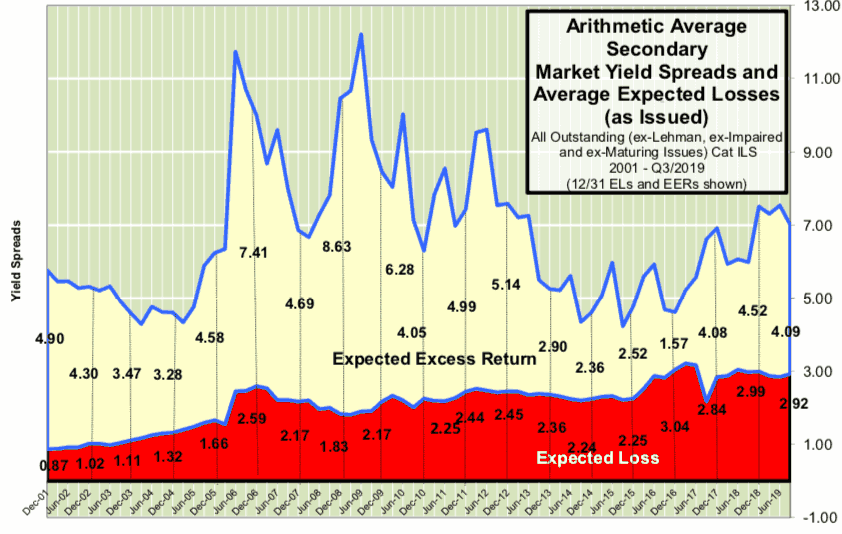

The fact secondary cat bond market dynamics may have played a role in driving the Index down is reflected in Lane Financial’s graphic displaying secondary cat bond yields over expected losses.

The above chart clearly shows secondary yields dipped in Q3, in fact falling to below where they began the year. This can’t really be explained through maturities either, as there weren’t sufficient in the period. So it has to be supply-demand dynamics and the influence of other factors (perhaps Dorian) on secondary marks.

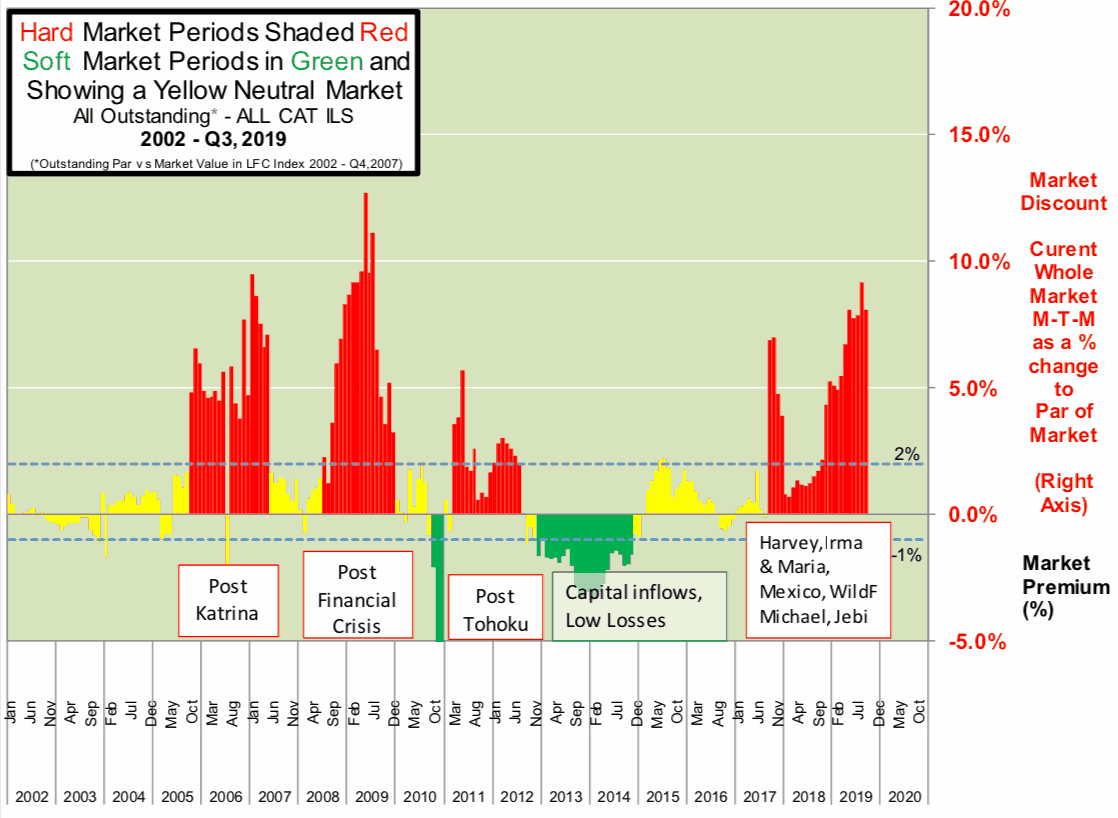

While it’s hard to read too much into the Index this quarter, the ILS market overall remains in hard market territory, according to Lane Financial’s latest data.

The rate of hardening has slowed somewhat in the last quarter, as you can see below, but again that could be down to secondary market factors.

However the market clearly remains in a hard market period, by Lane Financial’s definition and data.

ILS and cat bond total-returns on a quarterly basis are reported to have been the highest since the final quarter of 2017 by Lane Financial, also reflecting the general health of the stock of outstanding and non-impaired cat bonds and ILS.

As Lane Financial said at the end of Q1, when the rate-on-line Index was at the same level as at the end of Q3, “This is the best level in several years. The implication is “gradually acquire ILS now” and express a small sigh of relief.”

Which suggests it remains a good time to get into catastrophe bond investing right now, although it will be interesting to see how the pipeline manifests towards the end of the year and whether that Index stabilises, rises, or perhaps falls further.

You can download Artemis’ series of quarterly catastrophe bond market reports here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.