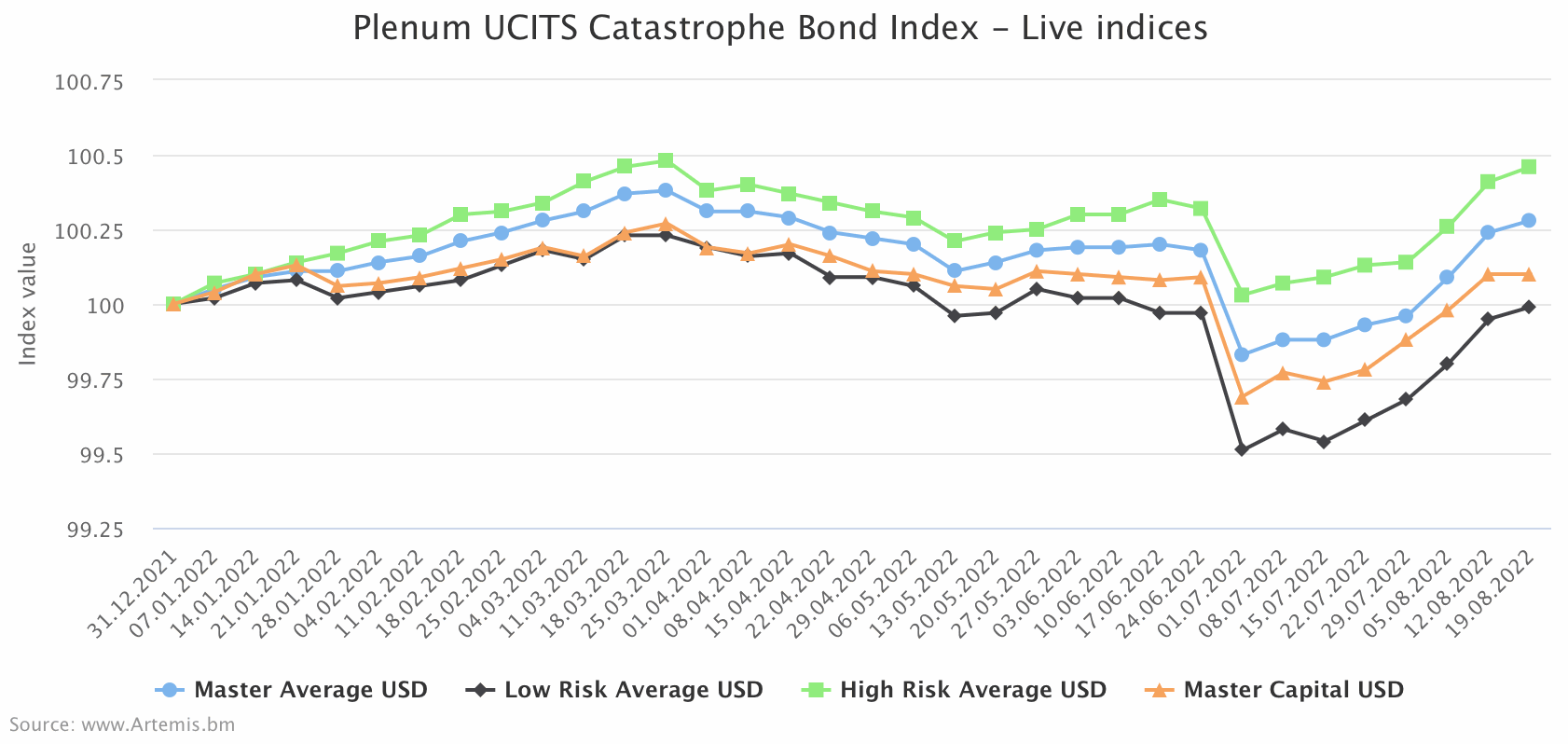

A newly developed set of catastrophe bond fund indices from Swiss asset manager Plenum Investments clearly shows how, in general, cat bond funds and returns have recovered back to June levels, so gaining back most of the value that had been lost due to high selling-pressure in the marketplace.

The Plenum CAT Bond UCITS Fund Indices are a set of indices designed to reflect the returns of all catastrophe bond funds available in the market in UCITS format.

Launched recently by the asset manager, we are now delighted to host a version of the Index charts here on Artemis to broaden awareness of their availability and the insights they can provide to investors, ILS fund managers and other interested parties.

Over on this new Catastrophe Bond Fund Indices page you can view and analyse the four Live UCITS cat bond fund indices, in USD currency, which include low and high risk versions, as well as the Master index average and capital-weighted indices.

This set of Live Cat Bond Fund Indices clearly show the decline that cat bond funds experienced at the end of June 2022, when the selling pressure and spread widening really kicked in and was factored into fund valuations.

These Live Cat Bond Fund Indices from Plenum Investments also clearly display the market recovery as well, with all four of the cat bond fund indices now having risen back to sit slightly above their June 24th levels.

Dirk Schmelzer, Head Portfolio Manager, Managing Partner of Plenum Investments commented on this recovery, “We observe that the selling pressure, that affected the CAT bond market at a point in time when it was already saturated after the influx of new transactions and hence led to significant markdowns end of June, has now dissipated.

“The market has found a new equilibrium and CAT bond funds are returning to their normal performance patterns and starting to generate solid returns in line with the progress of the hurricane season.”

Click on the chart below to be directed to an interactive version:

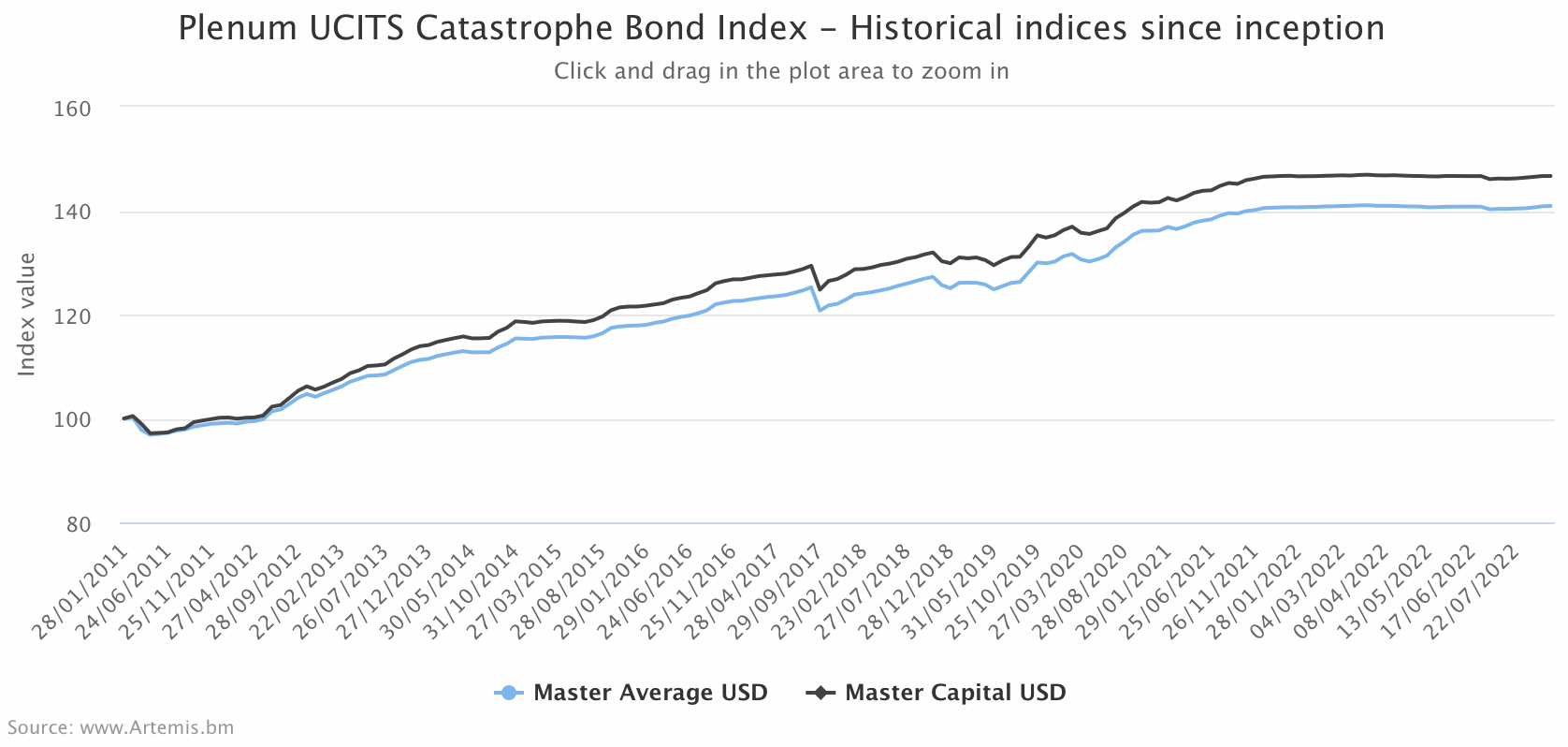

We also, thanks to our partnership with Plenum Investments, have a historical Cat Bond Fund Index available for you to analyse.

This features the values of the master average and capital-weighted cat bond fund indices since their inception, from January 1st 2011 to date.

We’ve also added a useful feature to allow you to zoom into this chart, so you can analyse performance of cat bond funds over a shorter time-frame (just click and drag on the chart plot area).

Click on the chart below to visit the interactive versions:

We will be updating these cat bond fund indices on a weekly basis going forwards, providing another useful data service for our global readership, in partnership with Plenum.

Nico Rischmann, Managing Partner of Plenum Investments stated, “The comparability of the results is what makes our study special. Since different risk models and assumptions are used in natural catastrophe business, comparability is only possible if all funds are analyzed using a risk model recognized in the reinsurance industry.

“It is the first step towards more transparency and creates a comprehensive basis for making fund selection decisions, especially when it comes to dealing with tail risks efficiently and risk-bearing capacity of investors.”

Analyse the UCITS cat bond fund indices here.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.