The overall insurance-linked securities (ILS) fund market averaged a 0.22% return for March 2021, which was above average for the month but seemingly impacted by losses booked by a number of collateralized reinsurance and retrocession focused funds.

After numerous insurance-linked securities (ILS) funds reported negative performance for February, largely due to the winter storms including Uri and the related freezing weather that impacted the United States, we understand some ILS funds established or hardened loss reserves for the event in March as well.

After numerous insurance-linked securities (ILS) funds reported negative performance for February, largely due to the winter storms including Uri and the related freezing weather that impacted the United States, we understand some ILS funds established or hardened loss reserves for the event in March as well.

At the same time, some catastrophe bond positions saw a recovery in their secondary market pricing during March, which benefited some of the pure catastrophe bond funds.

The Eurekahedge ILS Advisers Index was up 0.22% for the month of March 2021, which is above average for that month and actually the first positive March performance for the ILS fund market, as tracked by ILS Advisers, since 2017.

While there weren’t any major natural catastrophe events in March, there were severe thunderstorms in the United States, as well as significant flooding in Australia, both of which have had some erosion effect on certain ILS positions and some ILS fund returns, it seems.

The catastrophe bond fund segment of the market that ILS Advisers tracks recorded the best performance, at an average return of 0.32% as a group.

While pure cat bond funds were helped by some recovery of value in winter storm impacted catastrophe bond positions, they also felt pricing pressure at the same time, due to the continued strong demand for catastrophe bond investments.

The private ILS fund side of the market, that invests in collateralized reinsurance and retrocession contracts, delivered an average return across the group of 0.18% for the month of March.

Here we understand loss impacts from the winter storm caused some increasing of side pockets, reducing returns for a number of strategies, while some ILS funds did feel the effects of severe weather during the month.

Out of the ILS funds tracked by ILS Advisers for this Index, 20 reported a positive March return, while 8 were negative for the month.

The gap between best and worst performing ILS fund was not as wide as often seen, with the worst performer falling to a -1.33% return, and the best delivering a +1.52% return for the month.

April should see a higher return, at least on the private ILS side of the market, while some cat bond funds may be hit by rising losses on a number of positions that were exposed to the winter storms.

However, overall for thee entire month of April 2021, we’d expect a better average ILS fund return than seen for March.

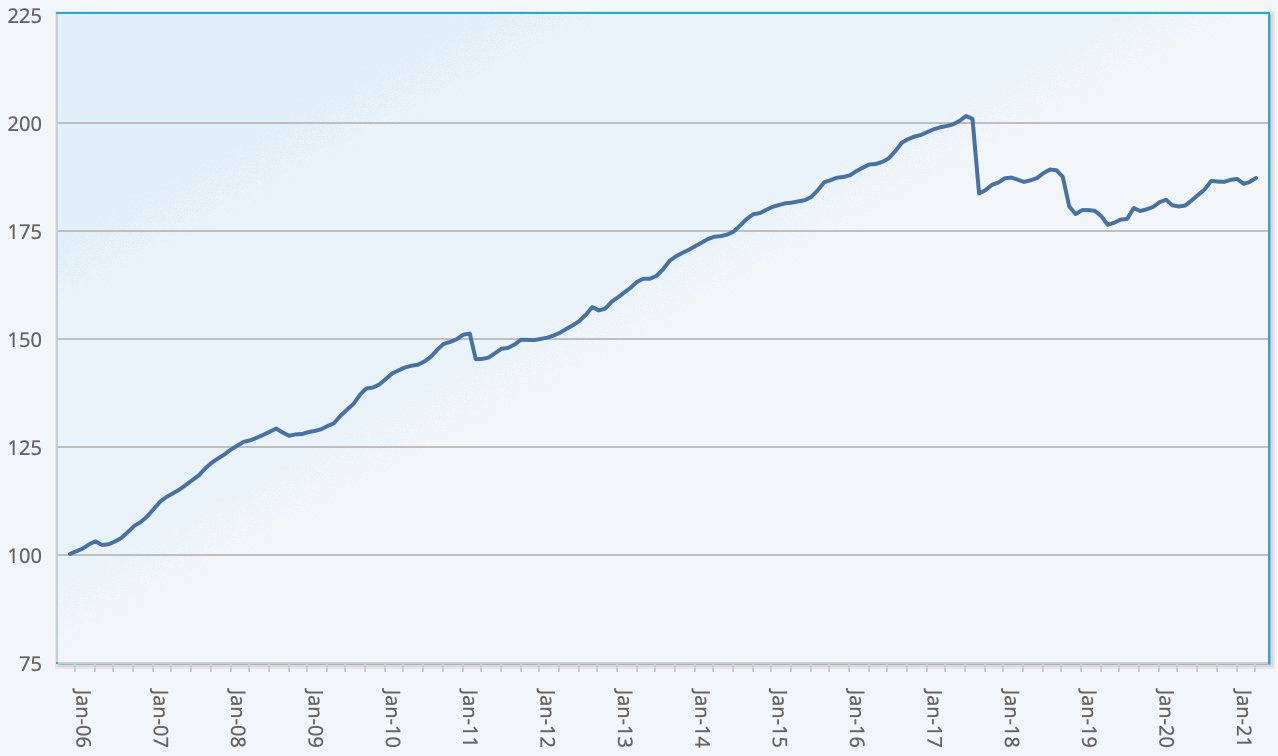

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 32 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.