Global insurance and reinsurance group AXA has reduced its exposure to peak U.S. natural catastrophe events at the January 2021 renewals, lowering its retention for major hurricanes and earthquakes by one-third and its aggregate tower retention as well.

AXA and in particular AXA XL, the commercial property & casualty insurance and reinsurance arm of the AXA Group, has been reducing its natural catastrophe peak exposure at recent rounds of renewals.

The company said in December that its AXA XL division was targeting a reduction in its natural catastrophe exposure over the coming years, aiming to bring its business results to a sustainable and profitable level.

That would include through an active use of retrocession, for the reinsurance book, AXA said, while the company continues to make use of alternative capital within its business operations as well.

A year ago, AXA revealed a strengthened reinsurance program purchased at the 1/1 renewals of 2020.

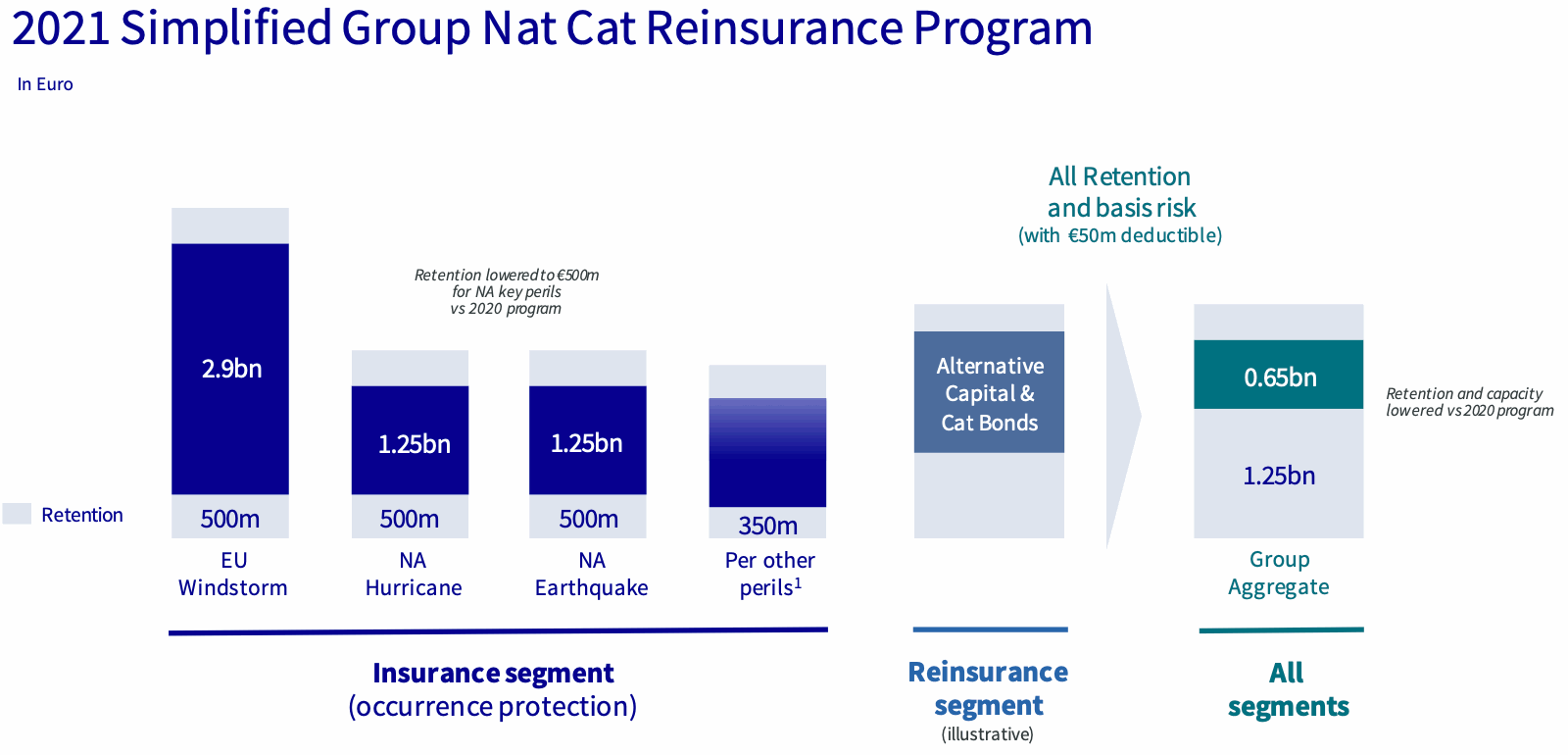

At the January 2021 reinsurance renewal season, AXA has honed that program structure further and significantly reduced its retentions, across US hurricane and earthquake risks, as well as for its main aggregate reinsurance tower.

AXA’s retentions for its reinsurance covering U.S. hurricanes and earthquakes have both dropped by a third, from EUR 750m, to EUR 500m for each of these key peak perils.

In addition, AXA has purchased EUR 1.25bn of reinsurance cover for each of these perils, up from EUR 1bn a year earlier.

The carriers cover for European windstorm and other perils remains static, year-on-year.

Third-party capital remains a key reinsurance and retrocession lever for AXA, in particular for the AXA XL business and this continues to be used to lower its exposure to catastrophe risks, enabling the company to also earn fees while reducing volatility.

The alternative capital and catastrophe bond component of AXA’s retrocessional reinsurance program remains relatively static year-on-year it appears.

A major change has been seen in AXA’s group aggregate reinsurance tower, where the company has reduced its retention, and so the attachment of the protection, while slashing the limit of cover.

For 2020, the new at the time group aggregate reinsurance tower provided EUR 1.25bn of protection, excess of EUR 1.4bn.

For 2021 that’s changed significantly, with now EUR 650m of aggregate catastrophe reinsurance protection set to attach excess of just EUR 1.25bn of qualifying losses for AXA.

Moving that aggregate reinsurance layer lower may have come at a much higher rate-on-line cost, we’d assume. Recall that the company said that reinsurance price increases were up 50% for its own renewal book at 1/1.

AXA’s renewed 2021 reinsurance program can be seen below.

It’s clear AXA is moving to significantly reduce the potential volatility that natural catastrophes can create within its results, ceding much more cat risk to the reinsurance market and presumably paying more in the process, given the greatly reduced retentions.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.