Global insurance and reinsurance player AXA has secured new reinsurance arrangements for 2020, as it continues to work to lower volatility within its specialty commercial insurance and reinsurance division AXA XL, especially in terms of catastrophe exposures.

AXA reported its 2019 results this morning, as our sister publication Reinsurance News covered earlier today, revealing increased revenues across the business but persistent volatility in the AXA XL unit, which reported a combined ratio of 101.5% for the full-year.

In an effort to continue addressing this and to reduce exposure to catastrophe risks, AXA has purchased two new reinsurance treaties for 2020, one being a quota share covering its property business and another being an aggregate reinsurance cover designed to reduce volatility from large losses.

AXA has also been leveraging alternative sources of reinsurance and retrocessional capacity to help in redcing catastrophe exposure and volatility at AXA XL, with its catastrophe bonds a key component of this strategy.

The company noted the continued steps being taken to reduce earnings volatility at AXA XL in 2020, with property catastrophe exposure expected to shrink by -10% thanks to these steps, among which are the acquisition of new reinsurance covers.

The continued reduction in property catastrophe exposure at AXA XL sees the firm also leveraging growing amounts of capital from third-party investors, as it looks to shift that volatility to those perhaps better able to bear it and diversify it away within their portfolios.

Third-party capital has been a key lever for AXA as it absorbed the XL business and established the best way to lower its exposure to catastrophe risks, enabling the company to also earn fees while reducing volatility.

Alongside this, the companies robust reinsurance program that had previously been simplified to respond to key perils on a per-occurrence basis, while also providing broad aggregate coverage, has now been extended further.

AXA has purchased a 15% gross quota share arrangement, across all property lines within its book, at the January 2020 renewals.

The company has also added a large loss volatility aggregate cover, which is designed to further reduce the exposure of AXA’s results to larger, more frequent catastrophe loss events alongside its core per-occurrence and peril specific reinsurance.

The goal is to help shave volatility off the businesses results, by moderating peak losses and preventing aggregation from becoming an issue when multiple larger catastrophe events occur in a single year.

The quota share means third-party reinsurers will share in AXA’s property performance and losses, helping to moderate the results from that business and make them more predictable as well.

It’s not clear at this stage whether any third-party capital has participated in either of the new reinsurance arrangements, but given AXA XL’s track record in the ILS space and in structuring joint-ventures there is every chance some investor capital is supporting these new treaties.

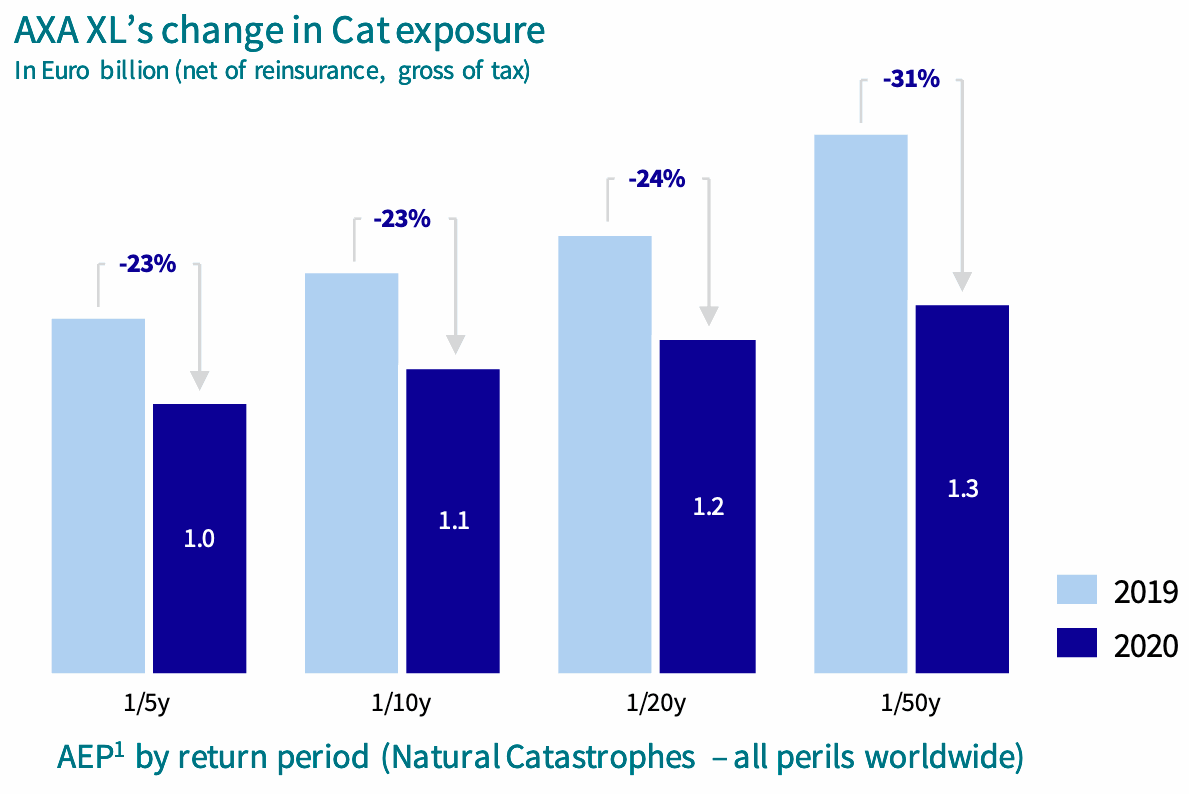

AXA has made significant progress in lowering catastrophe related volatility within the AXA XL book, with a further 10% decline in catastrophe risk for the 2020 calendar year, helped by these new reinsurance arrangements.

You can see how this reduction in volatility plays out at different return periods, year-on-year, in the chart below.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.