In contrast to the first-quarter of last year all Aon ILS Indices in Q1 2016 reported gains, however, relative to benchmarks the ILS Indices performed with mixed results, says Aon Securities, the capital markets arm of reinsurance broker Aon Benfield.

The Aon ILS Indices are a set of indices calculated using month-end pricing data for outstanding catastrophe bonds and insurance or reinsurance linked securities (ILS), which during 2015 outperformed all fixed-income benchmarks.

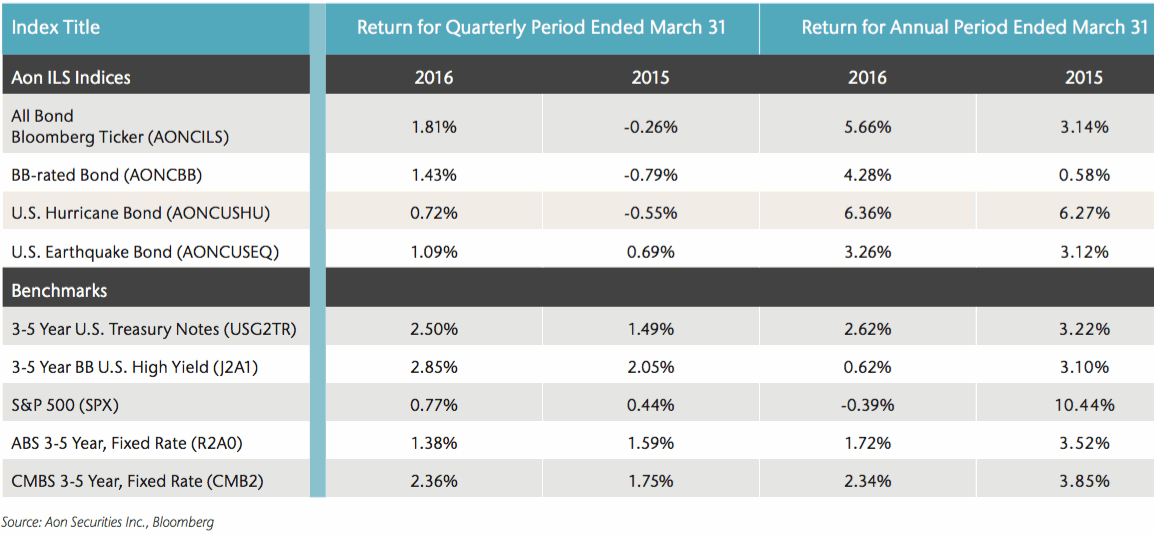

Reinsurance broker Aon Benfield’s ILS unit Aon Securities, in its Q1 2016 ILS market update, explains that all Aon ILS Indices posted gains during the first-quarter of this year, with the All Bond index experiencing the greatest growth, with returns of 1.81%.

The BB-rated Bond index returned 1.43% during the quarter, the second largest growth among the Aon ILS Indices, followed by the U.S. Earthquake Bond index and the U.S. Hurricane Bond index, which returned 1.09% and 0.72% in Q1, respectively.

In comparison, the only Aon ILS Indices that posted a gain during the first-quarter of 2015 was the U.S. Earthquake Bond, at 0.69%, according to Aon.

During the quarter Aon ILS Indices posted mixed results when compared to other benchmarks, but some did outperform both the S&P 500 and the ABS 3-5 Year Fixed Rate Index, which posted returns for the period of 0.77% and 1.38%, respectively.

For the annual return period ending March 31st 2016, all Aon ILS Indices posted an improvement when compared to the previous year, with the most significant increase for the period being the annual return for the BB-rated bond index, which improved from 0.58% to 4.28%.

The Aon All Bond ILS index improved from 3.14% to 5.66% during the annual return period, while U.S. Hurricane Bond and U.S. Earthquake Bond improved to 6.36% from 6.27%, and 3.26% from 3.12%, respectively.

Aon explains that this is the first time since the fourth-quarter of 2013 that all Aon ILS Indices outperformed the prior year’s annual returns.

“The index gains are in part attributable to price appreciation driven by increased demand in the secondary market and the continued absence of a major catastrophe event,” said Aon.

“The 10-year average annual return of the Aon All Bond index, 8.65 percent, further produced superior returns relative to the other benchmarks. This demonstrates the value a diversified book of pure insurance risks can bring to long term investors’ portfolios,” continued Aon.

The uncorrelated and diversifying benefits of the ILS asset class continues to gain momentum and acceptance, helped by its continued outperformance of relative benchmarks, particularly during financial market volatility.

As a result, institutional investors are increasingly looking at the ILS and reinsurance linked investments space as a viable, diversifying investment that serves to cement the attractiveness of catastrophe bonds as a fixed income investment, regardless of lower, but steady available returns.

Also read:

– Aon ILS Indices outperform all fixed-income benchmarks in 2015.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.