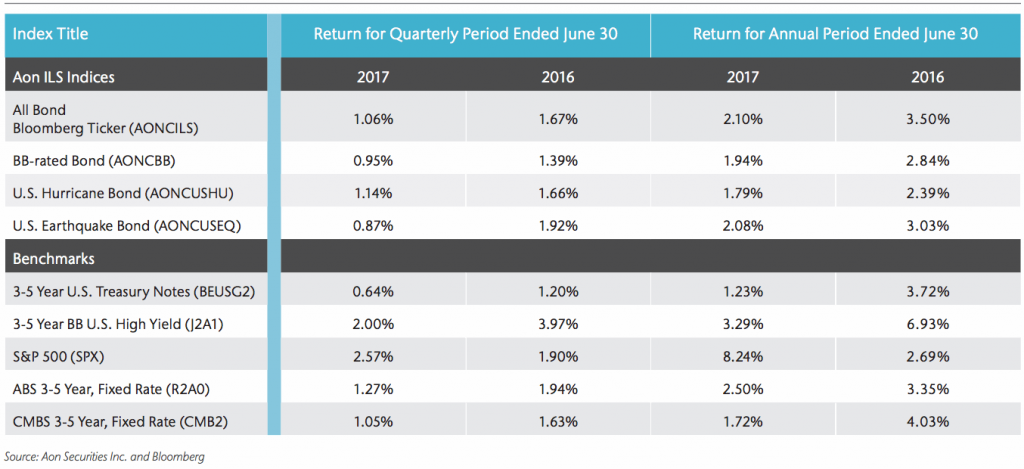

All Aon ILS Indices gained in Q2, but returns down year-on-year

17th August 2017Aon Securities, the insurance-linked securities (ILS) and capital markets arm of insurance and reinsurance broker Aon, reveals that all Aon ILS Indices posted a gain in the second-quarter of 2017, although returns were down when compared with a year earlier.

Read the full article