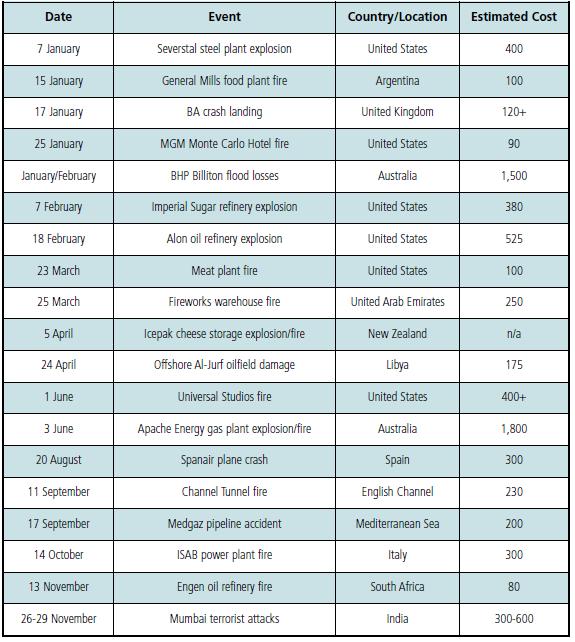

The topics covered by us here at Artemis are mostly devoted to natural catastrophes and the methods utilised for hedging against them to protect the balance-sheet of re/insurers and cedents. Guy Carpenter have published a report looking at the volume of man-made losses and types of events which caused them during 2008. The annual average losses for these types of events is $4.8b, 2008 delivered 46% more than that and final loss figures are around $7b. Nineteen known events resulted in losses of more than $50m each.

Those are large figures, all of which will impact re/insurers in the future (if not already). So what’s being done to hedge exposure to these types of events? Currently not very much. Catastrophe bonds seem limited to natural catastrophes and exchange traded instruments don’t really seem suitable in their current form to help companies trade these risks as a way to get them off the balance sheet.

We thought it would be interesting to begin a discussion on man-made disasters and whether the risk transfer instruments used to hedge against weather and catastrophe risks could be put to some use to help protect companies from the losses incurred from unnatural catastrophes. We’d like to know what you think, so please comment!

You can download the full report from Guy Carpenter here. A list of the major losses mentioned in the report is below.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.