Realistic reinsurance RoE’s fall to 4.5%, challenges to continue: Willis Re

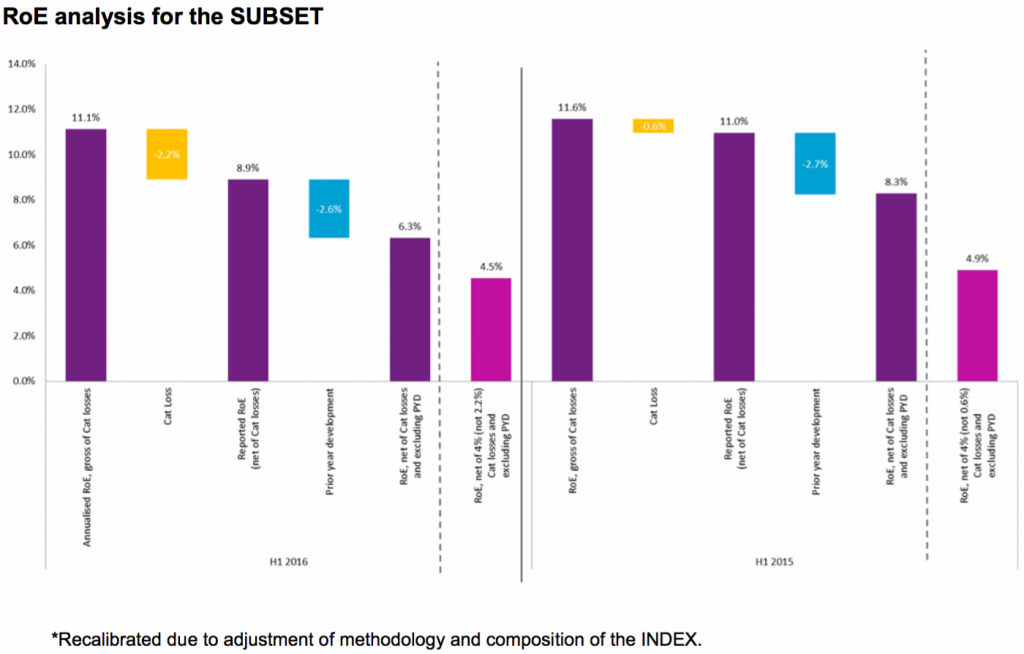

7th September 2016The realistic or underlying return on equity (RoE) of a group of reinsurance firms tracked by Willis Re fell to 4.5% in the first-half of 2016, as higher natural catastrophe losses and ongoing competitive threats continue to erode reinsurer profits.

Read the full article