A number of insurance-linked securities (ILS) and collateralized reinsurance investment funds are facing a negative return for August 2017, as losses and loss expectations from hurricane Harvey resulted in write-downs on investment positions, causing some funds to be negative for the month.

The losses for August are mainly falling to ILS funds that invest in collateralized reinsurance and private ILS structures, we understand, as hurricane Harvey has not hit any catastrophe bonds, aside from the initial mark-to-market impact. It was always going to be more of an issue for private ILS, collateralized reinsurance and retrocession fund strategies, given the flood versus wind impacts.

The losses for August are mainly falling to ILS funds that invest in collateralized reinsurance and private ILS structures, we understand, as hurricane Harvey has not hit any catastrophe bonds, aside from the initial mark-to-market impact. It was always going to be more of an issue for private ILS, collateralized reinsurance and retrocession fund strategies, given the flood versus wind impacts.

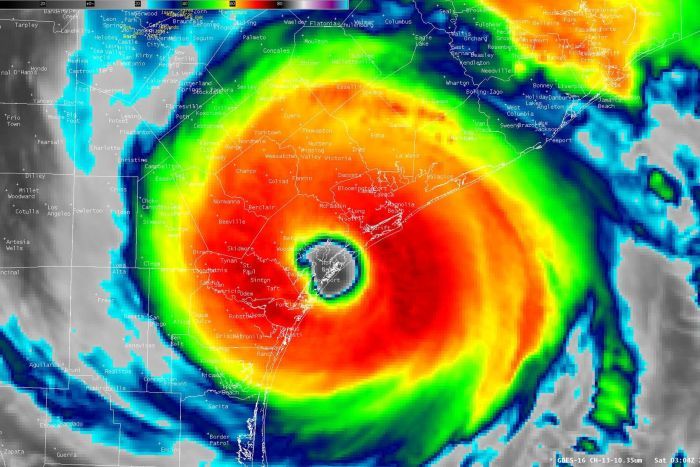

Hurricane Harvey made landfall in Texas near the end of the month though, on August 26th 2017, which was a Saturday and so some of the mark-t0-market impact to catastrophe bond positions will not have worked its way out of every ILS fund net asset value by the end of the month reporting, so some cat bond funds could also report worse performance for the month as well.

Looking at the ILS Advisers insurance-linked securities fund index, that tracks the performance of 32 leading ILS funds, it currently shows a 0.06% return for the month of August 2017, with roughly 85% of funds tracked having reported their monthly returns so far.

Sources said that there could be as many as one-third of the market’s ILS funds that report a negative month for August 2017, with some likely to report their worst single month of performance since the funds launch. We’re already aware of at least four to report a negative return so far.

We’re also told that there are likely to be a number of outliers in August, as a handful of higher risk ILS funds focused on collateralised reinsurance and private ILS positions are set to report very negative returns, according to sources.

It could be that these few funds, we’re hearing four to six so far, have sufficiently negative returns in August 2017 to drag the entire market index down as a result once all reports are in.

The ILS Advisers index is already suggesting that the market as a whole may be close to negative for August and that’s just after hurricane Harvey.

Although it is important to note that much of the downturn in August will be based on mark-to-market impacts and loss estimations, so some value will ultimately flow back to the funds as the scale of the losses become clearer.

September is likely to see the ILS fund market fall to a loss as a whole and the negative performance next month is likely to eclipse whatever we eventually see in August.

September saw the first Mexico earthquake that has caused the complete write-down of a $150 million earthquake exposed tranche of the IBRD / FONDEN 2017 catastrophe bond.

The month also saw hurricane Irma strike the Caribbean and Florida, with industry loss expectations pointing to a much greater impact for reinsurance and ILS fund interests than are expected from hurricane Harvey. One catastrophe bond has already been confirmed as a loss from Irma’s impact and it’s possible we could see some more cat bonds triggered once the industry loss is better understood.

Then the second Mexico quake, this time focused on Mexico City, which is likely to create some small losses for a number of ILS funds, although far from a broad impact.

Finally, add in hurricane Maria’s impacts on the Caribbean and Puerto Rico, which could actually be the most expensive single loss of the month and could cause some impacts to ILS fund assets, and you have a particularly damaging month of September for the ILS fund market.

Considering August looks likely to be close to break-even for the ILS fund market, September is expected to be much worse given the amount of losses suffered from these catastrophe events.

Of course, this is just the ILS fund market we’ve discussed here, but it should be expected that sidecars and other collateralised reinsurance structures will suffer similar performance in August and September, some perhaps even worse if they take quota shares from sponsoring re/insurers that experience particularly heavy losses.

The upshot is losses for ILS end-investors. But every one we have spoken to in recent weeks, since the spate of catastrophe events began, has expressed an understanding that losses are inevitable, this is the job their capital is deployed to do, that they are determined to recapitalise managers funds and they have no intention of exiting the ILS market.

As we wrote before, it’s how the ILS market reacts to losses such as these that really matters. So far the reaction seems responsible and we believe likely to result in further ILS market growth down the line.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.