Insurance Australia Group (IAG), the Australian primary insurance group, has renewed its catastrophe reinsurance tower for 2019 at an expanded size of $9 billion of limit to cover increasing exposures, at renewal rates seen as largely flat.

IAG places one of the largest catastrophe reinsurance programs each year and for 2019 the firm has added 12.5% to its coverage limit, taking the program from $8 billion in 2018 to $9 billion for 2019.

The reason for the expansion of catastrophe reinsurance limit secured is that IAG says it expects its underlying aggregate exposure will rise, both in Australia and New Zealand. Hence the additional billion dollars of reinsurance limit secured will provide protection above modelled exposures.

IAG has been steadily increasing the size of its catastrophe reinsurance program, having secured $7 billion of limit in 2017, then $8 billion of limit in 2018 and now $9 billion for 2019.

In addition the firm has added quota share arrangements with Berkshire Hathaway, Munich Re, Swiss Re and Hannover Re, to provide additional underwriting support.

At the 2019 renewals IAG said that it “experienced relatively flat reinsurance rates during the renewal process” resulting in renewal costs that were in line with its assumptions.

92% of the reinsurance program has been placed with A+ or higher rated reinsurers, but as ever it’s likely IAG has an amount of coverage that will have been placed with ILS fund support, either collateralised or through ILS fund managers own rated reinsurers, or fronting partners.

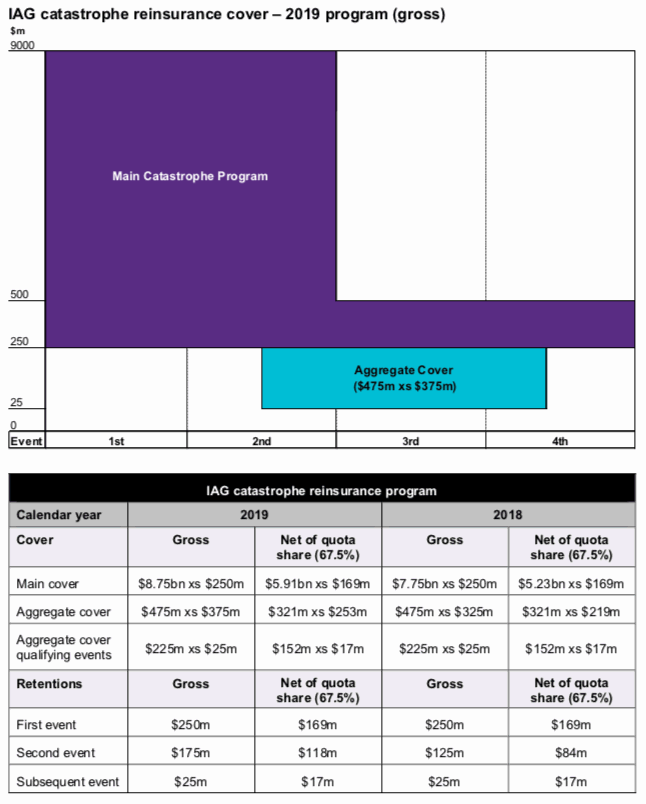

With the renewed program, IAG now has retentions of just $169 million for Australia and New Zealand loss events, while the enlarged per-occurrence tower will cover IAG for really significant events and an aggregate reinsurance tower provides frequency protection.

The program was placed to 67.5%, allowing for the Berkshire Hathaway quota share that provides 20% and the 12.5% quota share arrangement with Munich Re, Swiss Re and Hannover Re.

The main per-occurrence catastrophe reinsurance covers losses up to $9 billion, with one prepaid reinstatement. IAG will retain the first $250 million of each loss ($169 million post-quota share), with three prepaid reinstatements secured for the lower layer of the main program ($169 million excess of $169 million post-quota share).

The aggregate or sideways reinsurance lowers the cost of second events to $175 million and subsequent events to $25 million, $118 million and $17 million after the quota shares.

The aggregate tower provides IAG with $475 million of reinsurance protection excess of $375 million ($321 million excess of $253 million post-quota share), and qualifying events are capped at a maximum $225 million excess of $25 million per event ($152 million excess of $17 million post-quota share).

Reinsurers and ILS funds will have been delighted with the increasing demand for reinsurance shown by IAG, although some may have been hoping for better than flat renewal rates.

You can see IAG’s catastrophe reinsurance tower below:

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.