Youi is the latest insurer in Australia to reveal that its aggregate reinsurance protection will cover its losses from the severe flooding that struck the country in recent weeks, while the latest industry loss estimate for the flood event has now reached AU $2.22 billion.

Youi’s aggregate reinsurance protection was already in play prior to the flood events that have impacted the Southeast Queensland and New South Wales regions of Australia, so this event will extend its recoveries under that treaty.

Meanwhile, the latest industry loss estimate from the Insurance Council of Australia (ICA) has put the total claims value at AU $2.22 billion.

However, analysts and sources suggest the eventual industry loss total will likely surpass AU $3 billion, once all claims are counted.

In an interview with the Australian Financial Review, Youi CEO Hugo Schreuder explained that the insurer has already counted over 5,000 claims from policyholders after the floods.

He explained that as Youi had hit the trigger on its aggregate reinsurance treaty prior to the flooding, the insurers losses should be limited to just $2 million for each event.

Schreuder also explained that Youi anticipates the flooding being treated as four catastrophe events for reinsurance purposes, which is similar to the statement made by insurer Suncorp, which said it expects to claim across multiple reinsurance treaties after the flood catastrophe.

Youi’s CEO also discussed the need for property insurance price rises in Australia, as insurers are not covering their losses. He also suggested reinsurance pricing may rise further and that the recent flood event could exacerbate this.

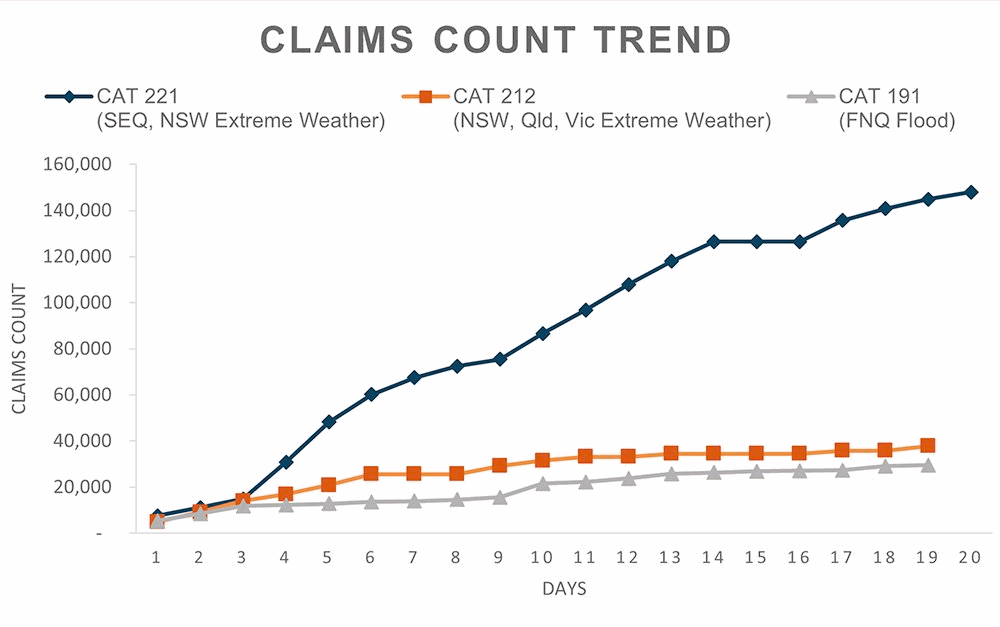

The latest data from the ICA pegs another 2% increase in claims and industry losses from the flood events, with now 147,993 claims reported and the latest estimate being AU $2.22 billion.

The influx of claims is now beginning to slow down it seems, as residents have largely been able to return to their homes and file claims for any property damage experienced.

There will likely be a continued increase, although at slower pace, but now the insurance and reinsurance market loss assessment will continue and estimates of industry losses likely get more accurate over time, as disclosures from insurers and the wider market make it easier to understand the final exposure the industry faces.

Insurance-linked securities (ILS) market exposure will remain relatively limited, although some ILS funds likely participate in the aggregate reinsurance towers of many of Australia’s larger insurers, so some impact to the ILS market from this flood event is to be expected.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.