Australian primary insurance giant Suncorp said this morning that it is treating the recent severe flooding in Australia as four events for reinsurance purposes and that it expects to trigger its aggregate catastrophe reinsurance, its drop-down protection and the main catastrophe excess-of-loss tower.

Suncorp had previously said it was likely to trigger its aggregate reinsurance, having stated that its maximum retained loss from this event would be around $75 million, which reflects the remaining deductible to trigger reinsurance recoveries under its aggregate excess-of-loss cover.

Now, in an update to the stock exchange, Suncorp said that its reinsurance recoveries are likely to be more extensive.

As of March 14th, Suncorp said that it has received over 34,000 insurance claims, roughly 60% of which are from Queensland and around 40% from New South Wales. More than 80% of the total claims received relate to residential property damage, the insurer said.

The company explained, “The severe weather was over a period of 15 consecutive days through late February and early March and has resulted in four separate natural hazard events being recognised.”

The reason the floods are being counted as four separate loss events will be to maximise the responsiveness of Suncorp’s reinsurance tower, given the hours clauses that are in place for different types of treaty and coverage.

“Based on early provisional forecasts, Suncorp’s net retained loss from these events has remained unchanged at around $75 million, with recoveries being triggered under a combination of Suncorp’s various reinsurance covers including Aggregate Excess of Loss (AXL) treaty, dropdown covers, main catastrophe program and the quota share arrangement in the Queensland home portfolio,” the insurer continued.

Adding that, “Following these events, Suncorp remains well protected for the remainder of the year.”

Reflecting the strength of Suncorp’s reinsurance arrangements, the company said that after the flood losses its estimate of natural hazard costs for the full year has only increased to around $1.1 billion, up from $1.075 billion.

Suncorp’s rival IAG had previously said that its aggregate reinsurance would likely provide it with AU $95 million of reinsurance support. It’s now a week since that statement and with claims having continued to rise rapidly, it’s possible that IAG may be able to recover more at this stage.

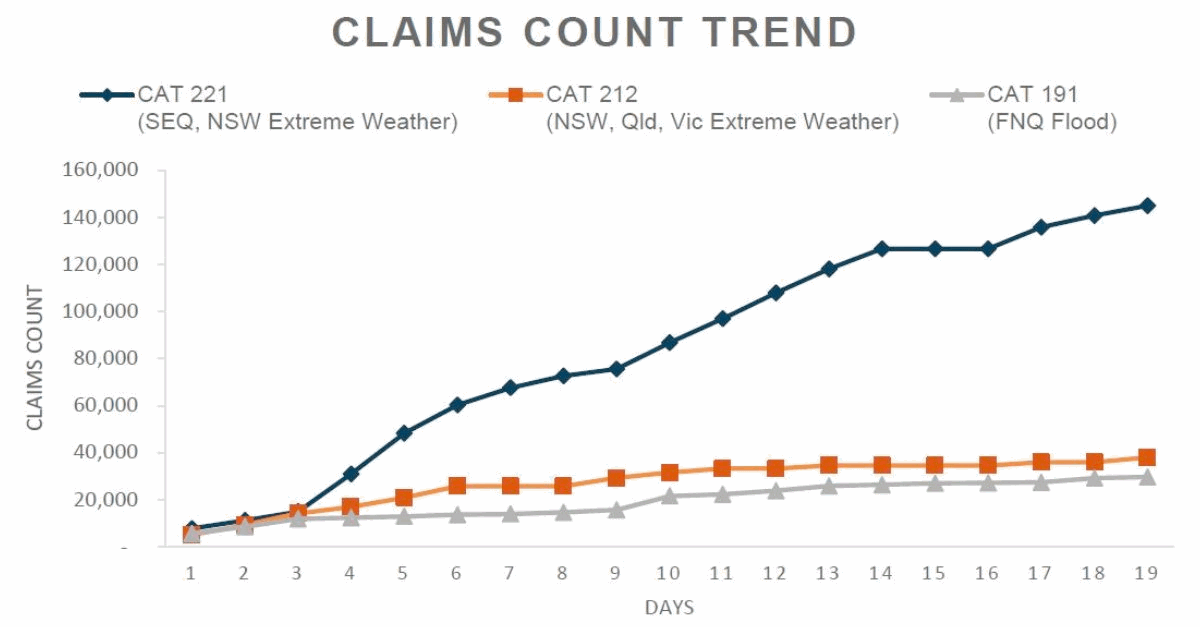

The insurance industry loss estimate for the flooding that affected Southeast Queensland and New South Wales, Australia over recent weeks has now risen another 3% to AU $2.174 billion as of this morning, according to the Insurance Council of Australia (ICA).

Claims continued to rise, with now 144,906 lodged with insurers, another 3% increase.

Claims in New South Wales continue to outpace Queensland in recent days, as the flooding in the Sydney area has been driving the fastest increase it seems.

Also read:

Storms and floods see IAG utilise $95m of its aggregate reinsurance.

Australian flood loss seen up to A$2bn, with reinsurers on the hook.

Reinsurance to trigger as Australian flood claims quickly rise.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.