The United States is again on-track to see more than $10 billion in annual insured losses from the severe convective storm peril, extending the streak that has now run since 2008, according to insurance and reinsurance broker Aon.

The last week saw hundreds of millions of dollars more in insurance and reinsurance market losses from severe convective storms, so severe thunderstorms, hail, tornadoes and related straight-line wind damage, according to Impact Forecasting, the catastrophe risk modelling and meteorology unit of broker Aon.

Once again, it was large hail that drove much of the loss and this has been the case throughout 2021 so far, alongside damage from tornadoes and other aspects of severe convective weather events.

From May 6-11 the US Plains, Middle and Lower Mississippi Valley, and Southeast experienced a series of frontal weather systems, with the results being very large hail, damaging straight-line winds, localised tornadoes, and flash-flooding.

May 10th saw flooding rainfall impacting an already saturated central Gulf Coast region, while softball size and larger hailstones pummelled parts of Texas, including areas to the north of the Fort Worth Metro.

Damages are expected well into the hundreds of millions of dollars, with the majority of wind and hail damage set to be covered by the insurance market, Aon said.

The past six to eight weeks has been particularly costly due to the severe convective storm peril across the Southern Plains and Southeast.

Impact Forecasting said, “The U.S. is currently on track to once again surpass USD10 billion in annual insured losses from the SCS peril. This will continue the streak of the peril topping USD10 billion in every year since 2008.”

Hail and other convective storm perils have been drivers of attritional loss impacts through the reinsurance and ILS market each year, with growing consistency it seems.

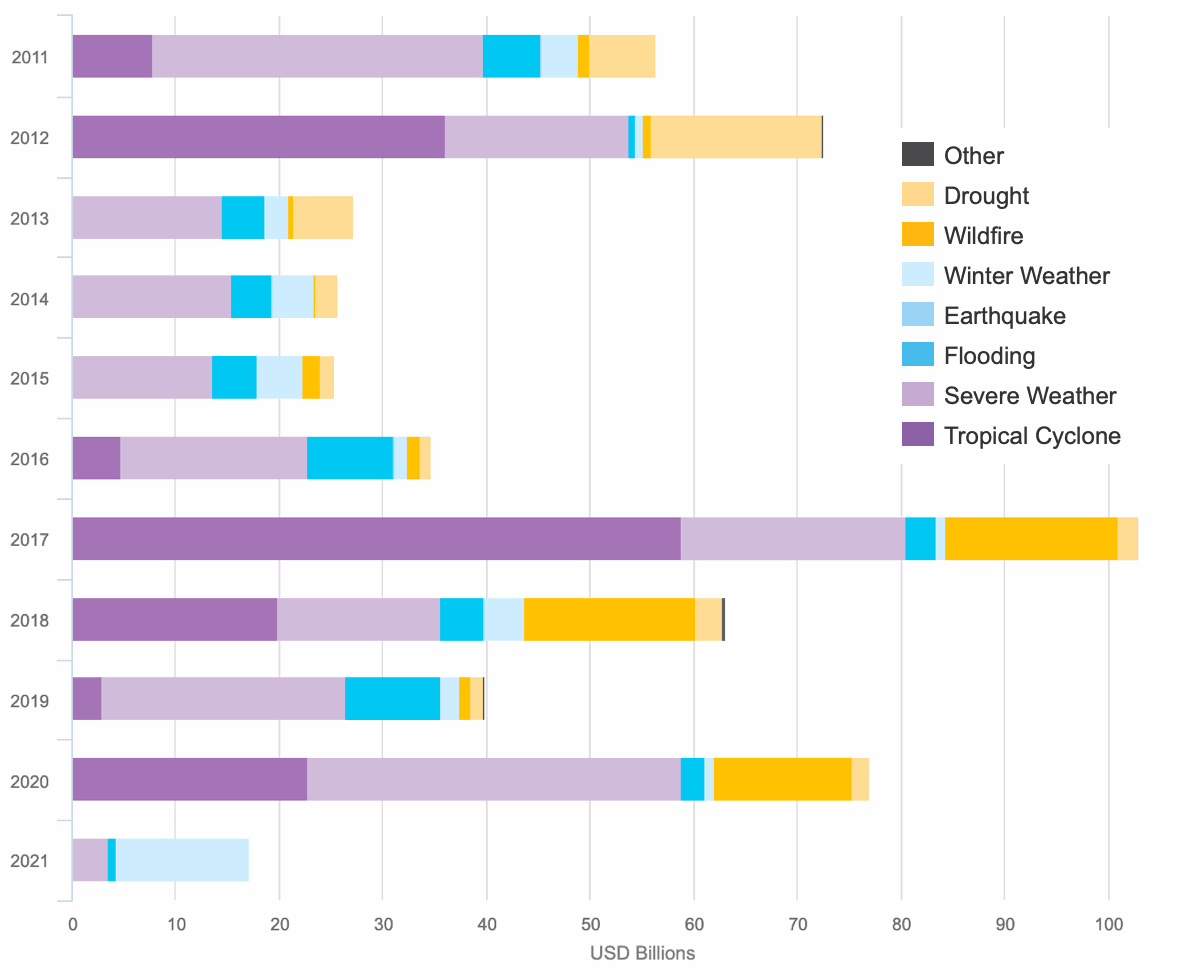

In 2021, winter weather remains the biggest contributor to insurance and reinsurance market losses from weather and catastrophe events, with the US industry loss total currently over $17 billion, according to Impact Forecasting data.

In the chart above, which shows insured catastrophe losses by year, winter weather is the largest component of 2021 insured catastrophe and weather losses so far, followed by the severe weather peril and finally flooding.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.