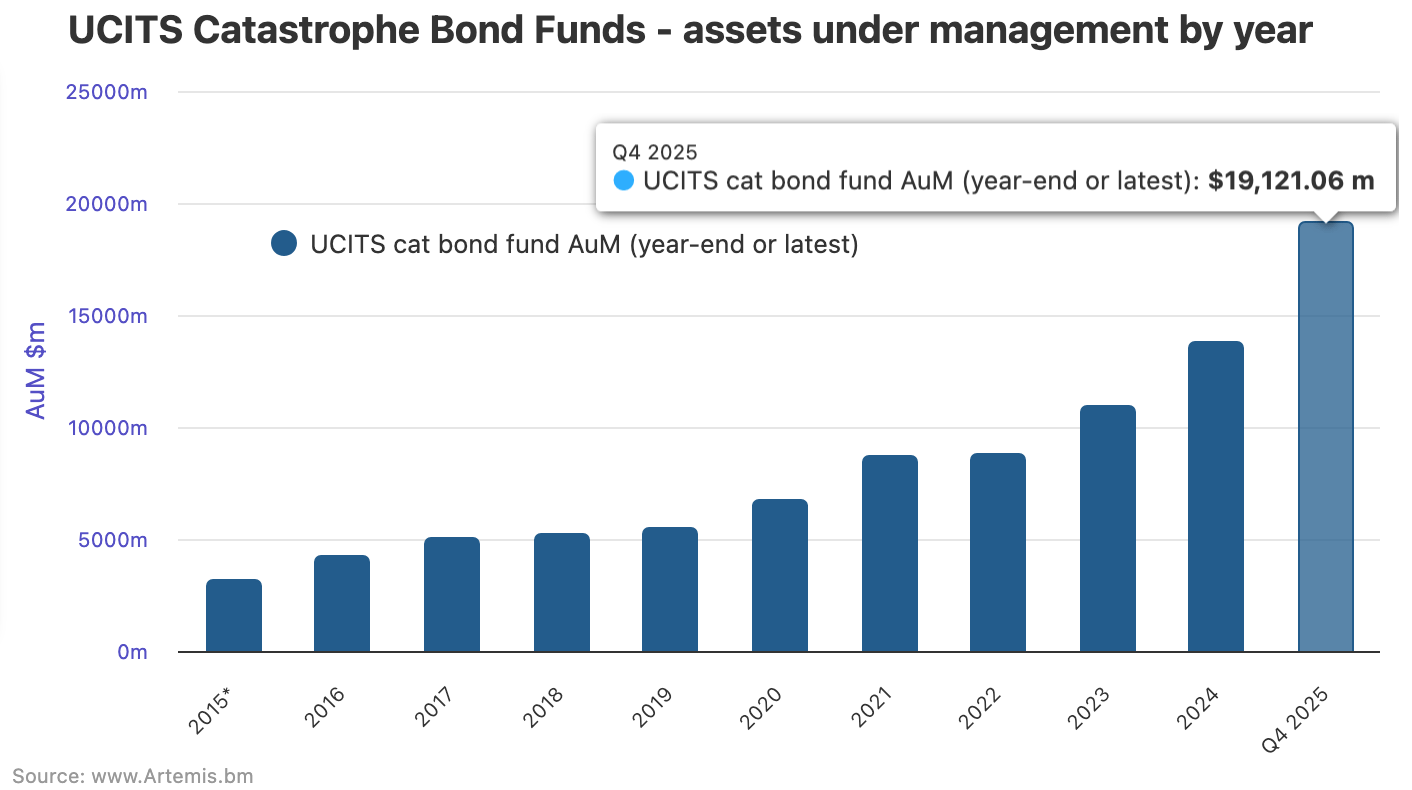

Catastrophe bond funds in the UCITS format closed out a stunning year of growth to reach a significant $19.12 billion of combined assets under management by the end of 2025, representing a record $5.3 billion or almost 39% in growth over the twelve months.

2025 was of course a record year for catastrophe bond issuance, as our latest market report shows.

2025 was of course a record year for catastrophe bond issuance, as our latest market report shows.

The investment manager’s with UCITS catastrophe bond funds met this issuance with increased inflows of investor capital, supporting a growing proportion of the overall cat bond market through this fund structure by the end of 2025.

The number of UCITS cat bond fund strategies on offer also grew throughout the last year, as it remained a very popular fund structure with both managers and their investors.

In reaching just over $19.12 billion of combined cat bond assets under management by the end of December 2025, the now 18 UCITS cat bond funds that have reported data for that date have grown their asset bases strongly through this busy year for the catastrophe bond market.

UCITS catastrophe bond funds grew strongly through 2024, hitting just over $13.8 billion in cat bond assets under management at December 31st 2024, which reflected 26% growth in combined AUM over that year.

2025 saw the UCITS cat bond fund sector outpacing that, adding over $5.3 billion in assets over the twelve-months, so growing the combined cat bond AUM of these funds by an impressive almost 39%.

Also impressively, with the end of 2025 seeing a record fourth-quarter for new catastrophe bond issuance, the UCITS cat bond fund sector grew its asset base by 8% or over $1.37 billion.

Analyse UCITS catastrophe bond fund assets under management using these charts (data kindly shared by our partner Plenum Investments AG, a specialist insurance-linked securities (ILS) fund manager).

2025 was a record year for UCITS cat bond fund sector expansion, as manager’s added a record level of new inflows from investors to support the overall expansion of the asset class.

While the UCITS cat bond fund sector has been growing strongly since 2020, the rate of growth has accelerated in the last two years.

In fact, UCITS cat bond fund assets under management across the group of active fund strategies have grown by approaching 120% since the end of 2022 and by almost 75% since the end of 2023.

UCITS cat bond fund assets of $19.12 billion as of the end of 2025, now stand at more than double the level the sector managed as recently as the end of March 2023.

UCITS cat bond funds have been growing their market share of all catastrophe bonds as well in the last year, contributing an increasing percentage of the outstanding cat bond market’s assets.

Back at the end of Q1 2025, using Artemis’ measure for the outstanding cat bond market, these UCITS funds accounted for more than 29% of cat bond risk capital, which rose to just over 30% of outstanding cat bond risk capital by the end of Q2 2025 and then rose again to almost 32% of the market’s capital and capacity as of the end of Q3 2025.

By year-end 2025, again based on Artemis’ measure for the outstanding cat bond market, the UCITS cat bond funds combined $19.12 billion of AUM contributed 31% of the market. So a slight decline in Q4, but only as overall cat bond issuance was so strong.

For contrast, at the end of 2024 the UCITS cat bond funds only made up 28% of the overall cat bond market capital base.

Helping to drive the expansion of the cat bond asset class and these UCITS funds, has been the fact we’ve now seen three years of double-digit returns.

As we reported earlier this week, the Plenum CAT Bond UCITS Fund Indices had an average return of 9.99% for the period December 27th 2024 to December 26th 2025, so we expect will have just surpassed 10% for the full calendar year.

Two UCITS cat bond funds had more than $4 billion of assets under management at the end of 2025. The Twelve Securis managed Twelve Cat Bond Fund was the largest strategy at $4.55 billion, while the Schroder Capital managed Schroder GAIA Cat Bond Fund had reached $4.05 billion.

But, the fastest growing and the fund that added the most in AUM over the course of last year was the Fermat UCITS Cat Bond Fund, managed by Fermat Capital Management, which grew almost 238% and added almost $1.79 billion in AUM.

In percentage terms, the next fastest growing was the Icosa Cat Bond Fund which expanded 171% to reach $865 million, followed by the Plenum CAT Bond Dynamic Fund that grew 130% to $512 million, the Franklin K2 Cat Bond Fund which grew 93% to $275 million and then the Leadenhall UCITS ILS Fund which grew 82% and ended 2025 at practically $2 billion in assets.

As of December 31st 2025, the three largest UCITS cat bond funds (Twelve Securis, Schroder Capital, Fermat Capital Management) had a combined AUM of $11.14 billion, making up 58% of the total market.

A year earlier, at the end of 2024, the three largest UCITS cat bond funds combined accounted for over 68% of the sector’s AUM.

So the market is becoming increasingly diverse, with many other smaller UCITS cat bond fund strategies also experiencing very positive growth in 2025, helping to further broaden the capital base of the asset class.

This is further evidenced when you look at the top five largest UCITS cat bond funds, which today account for 77% of the sector’s AUM as of December 31st 2025, but a year earlier contributed almost 82% of the sectors assets.

Which implies a continued deepening of market participation and makes room for a growing investor base, with this important fund structure able to support a growing capital pool and becoming more diverse as new UCITS cat bond fund strategies are launched.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.