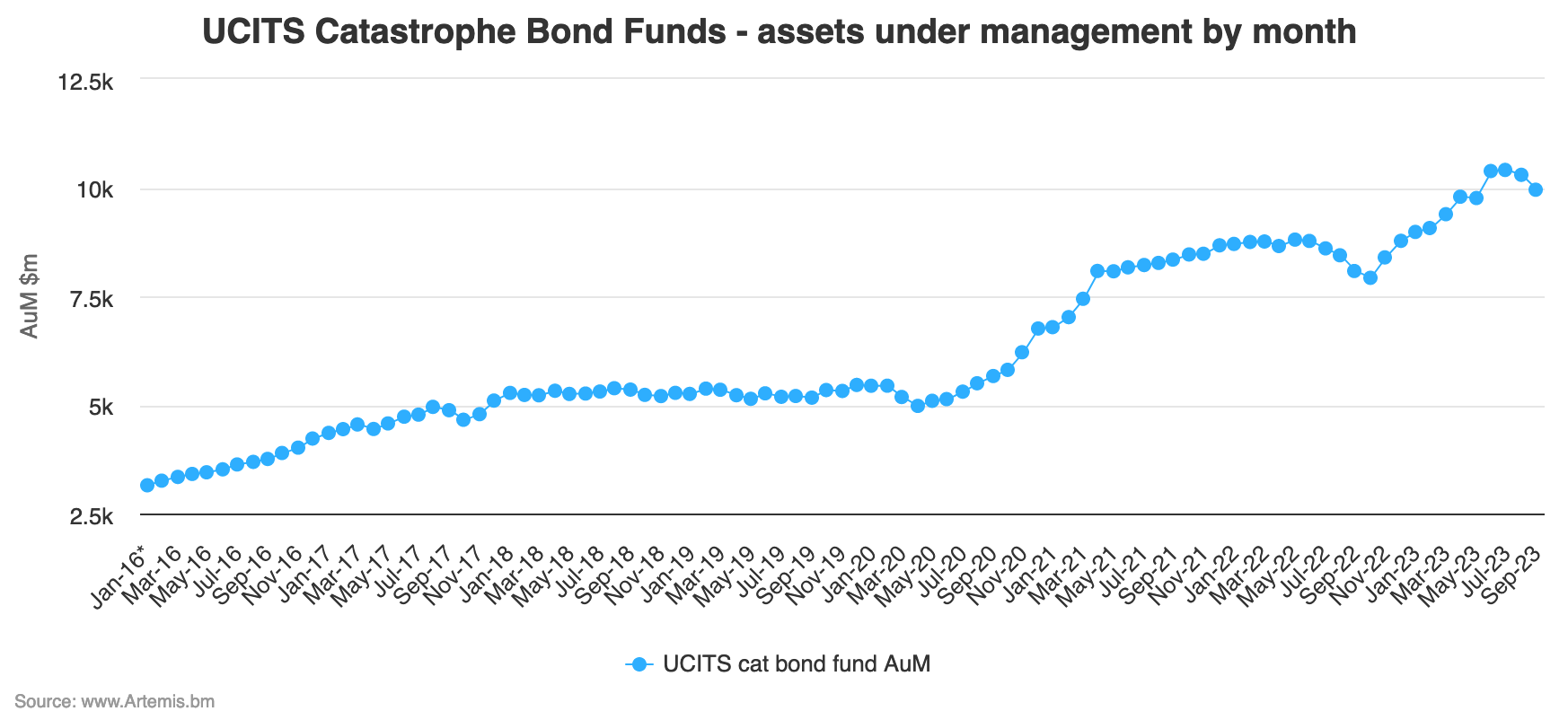

Catastrophe bond funds in the UCITS format experienced some outflows in the third-quarter of the year, with their combined assets under management falling by 4% to just over $9.95 billion in the period.

Overall, the combined assets under management (AUM) of the main UCITS catastrophe bond funds declined by roughly $430 million in the third-quarter of 2023.

Some of this is certainly outflow related, while another much smaller factor in AUM fluctuations could be the time of the year, with issuance slow because of hurricane season but maturities still continuing to roll-off risk during the period, meaning there is less new risk available to invest in and some capital may get returned as a result.

We also understand that shifts in currency rates, the USD in particular, has driven some AUM changes during the last three months.

Back at the end of the first-half of 2023, the combined AUM of the main UCITS cat bond fund strategies had reached a new end-of-quarter high of nearly $10.4 billion by the end of June 2023.

The total AUM actually rose again in July, to reach just slightly over $10.4 billion, before then falling over the next two months.

The chart below shows UCITS cat bond fund AUM by month, with the decline during Q3 clearly evident. Click on the chart to view an interactive version.

While the 15 main UCITS cat bond funds as a group shrank by roughly $430 million over the course of the third-quarter, the top three largest UCITS cat bond funds accounted for most of it, falling by $399 million in the period.

Of these, the Fermat Capital Management managed GAM Star Cat Bond Fund shrank the most, losing roughly 10% over the third-quarter, or nearly $280 million in AUM. This should not be construed as Fermat losing AUM. Rather as an outflow from GAM’s UCITS fund platform.

The Twelve Capital cat bond fund lost almost $82 million in assets over the period, but thanks to the shrinking of the Fermat managed GAM fund, the Twelve Cat Bond Fund ended the third-quarter as the largest of the UCITS cat bond fund strategies for the first time.

Twelve Capital’s UCITS cat bond fund strategy overtook the GAM Star cat bond strategy in September for the first time, as the latter lost around $185 million in assets just that month.

Impressively, the Twelve Capital UCITS cat bond fund strategy has now added almost $530 million in assets over the course of 2023.

Meanwhile, the Schroder GAIA cat bond fund strategy only lost $38 million over Q3, so ended the quarter at almost $2.48 billion in size.

On the other hand, in terms of cat bond funds gaining assets during the third-quarter, the Leadenhall UCITS ILS Fund grew fastest by 9% to reach almost $540 million by the end of September and the Leadenhall Capital Partners cat bond strategy has now added over $205 million in assets in 2023 so far.

HSZ Group’s Maneki cat bond fund grew by the same pace, but starting from a much smaller base size, to reach $33 million at the end of September.

The Plenum CAT Bond Dynamic Fund grew by 4%, to reach $106 million in the quarter.

It’s going to be very interesting to watch how the assets under management of the leading UCITS catastrophe bond funds develop through the fourth-quarter and into early 2024, as issuance of new cat bonds is expected to be high, meaning there should be a strong capital raising opportunity for some insurance-linked securities (ILS) managers.

Those ILS managers will also be raising for their reinsurance focused and private ILS strategies, plus cat bond funds that are not structured in the UCITS format, so it will be interesting to see how much of the investor interest is captured by these UCITS cat bond fund strategies versus other funds.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.