Claims paid by Japanese domestic insurance firms after the impacts of 2019’s typhoon Faxai, typhoon Hagibis and the heavy rainfall event that closely followed these storms have risen by more than 6%, reaching $10.04 billion, according to the General Insurance Association of Japan (GIAJ).

Image from Kyodo agency (via Japan Today)

As is typical, Japanese primary insurers have updated their estimated losses for these events just following the completion of the April reinsurance renewals.

The new data from the General Insurance Association of Japan (GIAJ) shows that claims payments are happening slowly now, with more work for the Japanese insurers to do and therefore a further increase in these loss figures is still to be expected.

Back in March we reported that the GIAJ’s figures had been updated to show some US $9.2 billion of estimated claims paid from the two typhoons and the heavy rains, which was up 35% on figures released in December 2019.

With currency rates having changed significantly since then, it’s worth restating that total at the current exchange rate, making it $9.45 billion.

The latest data, which is as of April 28th 2020, shows a more than 6% increase in the total expected insurance and reinsurance market loss suffered by Japanese domestic carriers, with the claims paid figure for the typhoons and rains now sitting at around US $10.04 billion.

Typhoon Faxai is now reported to have a claims bill of $4.36 billion attached to it, up over 6.2% on the March figure of $4.1 billion (restated at today’s currency rates).

However, the March figure was based on 381,226 claims payments out of 430,545 claims filed for typhoon Faxai and the GIAJ now states claims payments at only 383,585, so not significant increase and with more to come.

The new claims filed total has not been reported for any of the catastrophe events.

For typhoon Hagibis, generally accepted as the largest Japanese catastrophe loss event of 2019, the GIAJ now reports the claims paid figure as rising over 6.1% to $5.46 billion, up on the $5.14 billion reported in March (restated at today’s rates).

Again, for typhoon Hagibis the claims paying process has slowed significantly, with now 295,186 of claims payments reported made, up slightly on the 290,433 but still a way to go from the March reported figure of 336,410 of claims accepted and filed for Hagibis.

Both typhoons Faxai and Hagibis drove significant losses to reinsurance carriers supporting the Japanese primary carriers, which drive much higher reinsurance renewal rates at April 1st, particularly for loss-affected Japanese wind exposed catastrophe programs.

For the heavy rainfall event from October 2019, which had followed closely behind Hagibis, the GIAJ now puts the total claims paid at $223.4 million, up around 6.6% on March’s restated $209.6 million.

Claims paid for the rainfall event have reached 11,283, again just a slight increase on the March figure of 11,229 and still well below the March claims filed figure of 13,348.

So the total Japanese domestic insurer loss rose by just over 6.2% in just more than one month. But given the slow movement in claims being settled and paid, it looks like the tail of these events will continue to develop.

It’s possible that with the financial year ending for Japanese domestic primary insurers at the end of March and the all-important reinsurance renewals also taking place then, that claims resolution has slowed over that period.

This could pick up over the coming weeks and we may see a more considerable increase in the loss total again when next reported by the GIAJ.

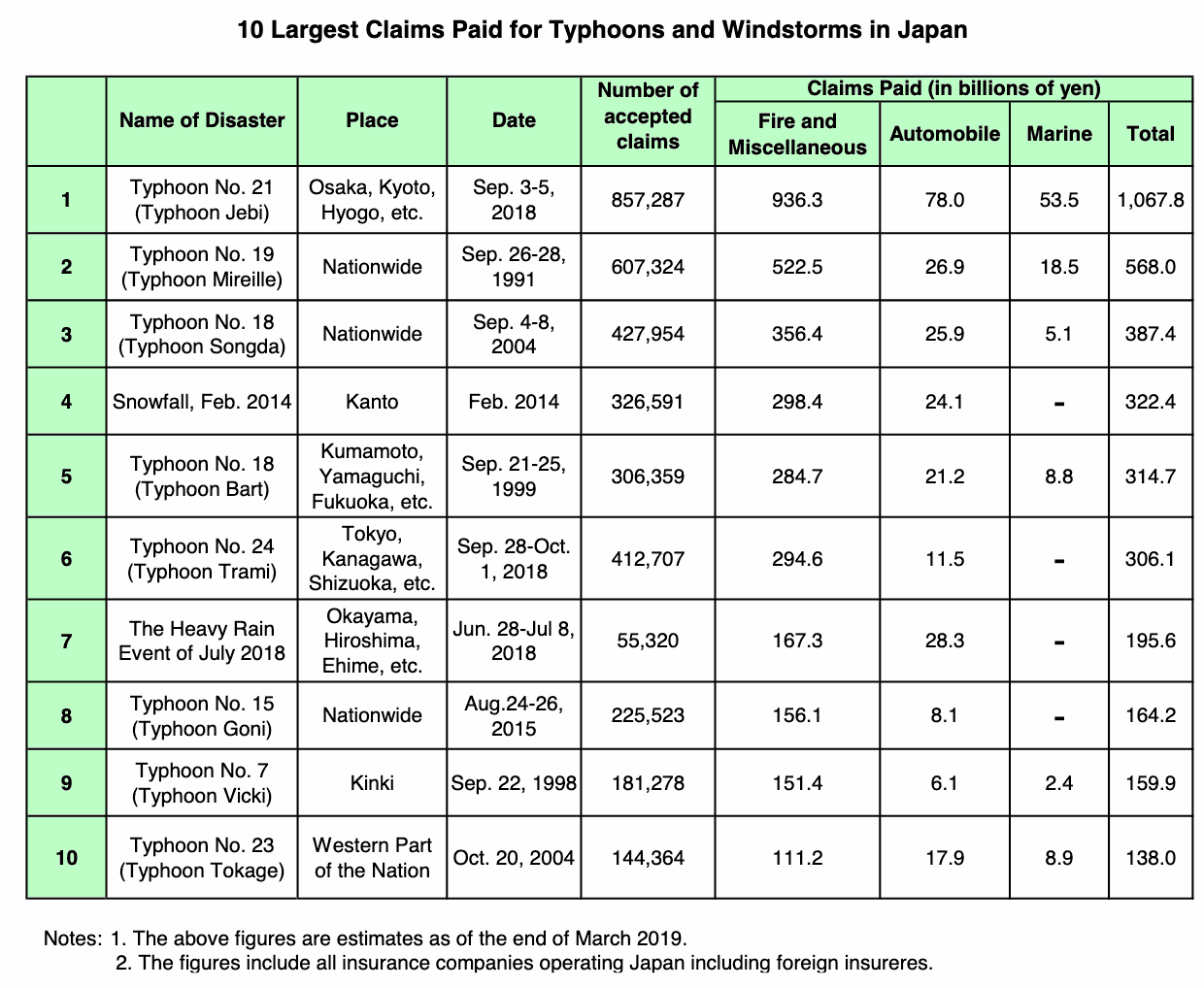

Typhoon Hagibis has now moved one place up the rankings to become the second most costly insured loss event from a Japanese typhoon on record having reached just over JPY 582.6 billion according to the GIAJ’s figures.

Typhoon Faxai remains the fourth most costly typhoon loss event, at just over JPY 465.6 billion.

It’s assumed that these places, of second for Hagibis and fourth for Faxai, are now where these typhoons will sit in the list of the costliest insured Japan typhoon events on record.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.