The General Insurance Association of Japan (GIAJ) has updated its numbers on recent catastrophes, now saying that domestic insurers in the country have paid out US $6.83 billion in claims for typhoon Faxai, typhoon Hagibis and a heavy rainfall event that closely followed these storms.

Typhoon Faxai claims payments have now reached $3.06 billion as of December 9th, which is not a particularly significant increase since the $2.5 billion that the GIAJ reported as of November 5th.

Typhoon Faxai claims payments have now reached $3.06 billion as of December 9th, which is not a particularly significant increase since the $2.5 billion that the GIAJ reported as of November 5th.

Typhoon Hagibis meanwhile is now reported to have resulted in $3.62 billion of claims payments by domestic Japanese insurance companies, which is perhaps lower than would have been anticipated for the first report from the regulator.

These figures may support the growing thesis that typhoons Faxai and Hagibis may not drive as significant a level of insurance and reinsurance market loss as at first thought.

Increasing amounts of anecdotal evidence are pointing to the industry losses from these Japanese typhoons coming out below where they were first estimated by some and Hagibis in particular is beginning to look like it will not prove as significant a reinsurance market loss as 2018’s Jebi.

Risk modellers estimates for typhoon Hagibis extend up to $16 billion , while the CEO of reinsurer RenaissanceRe has said Hagibis could result in as much as a $15 billion market loss.

Another indicator emerged last week, as reinsurance giant Swiss Re only pegged the typhoon Hagibis industry loss at $8 billion.

$8 billion does seem particularly low and we suspect will rise in time, but the market opinion seems to be settling around the $10 billion to $12 billion maximum for Hagibis, hence these figures from the GIAJ may support this as they are lower than where Jebi was reported a few months following that event.

On typhoon Faxai, so far the GIAJ reports that 400,623 claims have been accepted, with 370,907 claims payments made, amounting to around US $3.06 billion.

On typhoon Hagibis, claims continue to be filed and clearly have some way to go, as the total accepted has only reached 290,329, with 264,359 claims payments made, amounting to the US $3.62 billion loss so far reported.

So, the average size of claim is higher with Hagibis than with Faxai, which could reflect the greater severity of this storm loss.

However, there will be some months of claims reports to follow so it’s hard to tell where this could settle at this current stage.

On top of the two typhoons, the GIAJ reports that 12,463 claims have been accepted after the heavy rainfall event in October that followed closely behind Hagibis, resulting in 10,976 and claims payments of approximately $150 million.

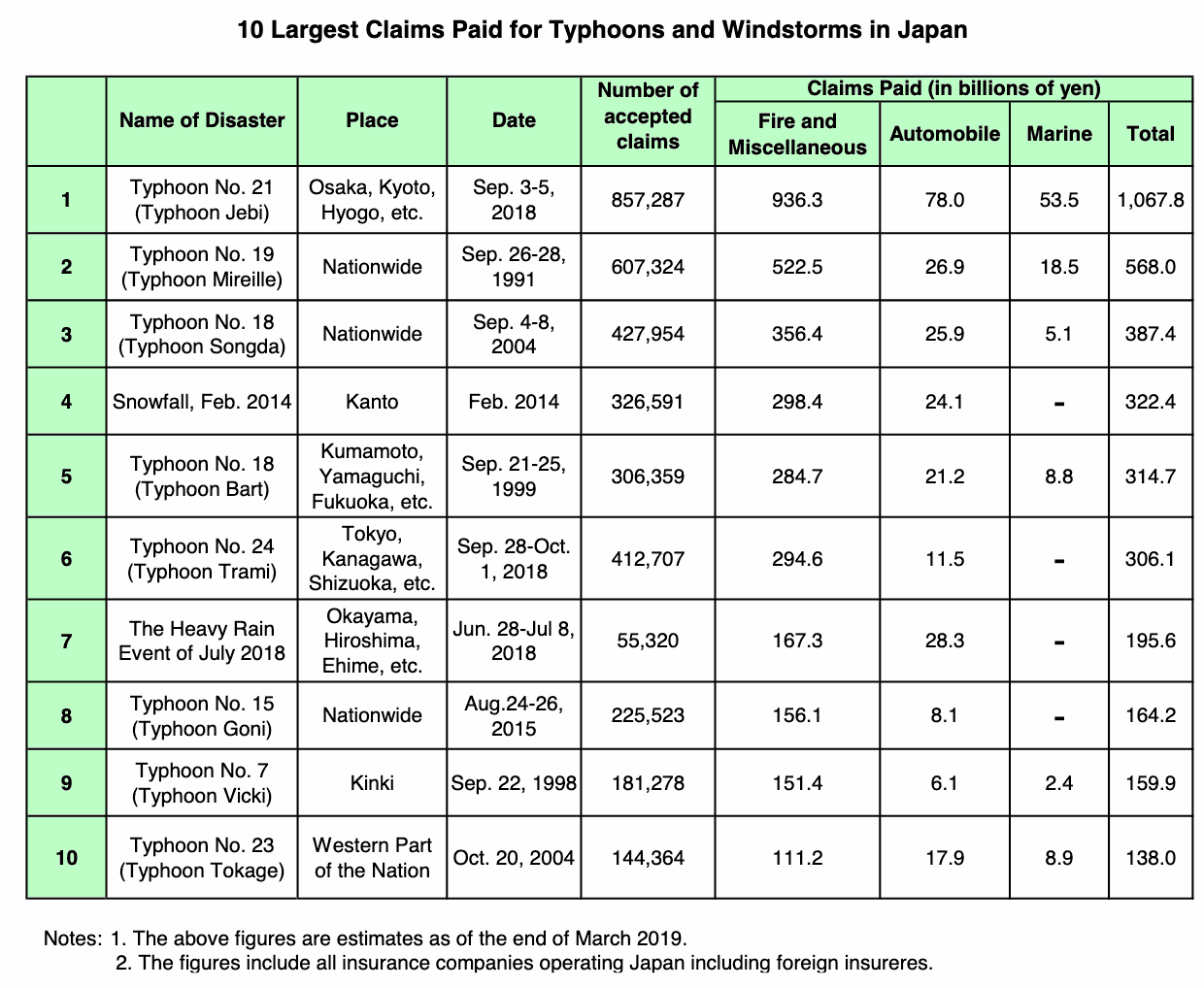

On the latest claims estimates from the GIAJ, Hagibis is already the third most costly typhoon in Japanese history, while Faxai is already the fifth most costly.

There is every chance that these two storms continue to move up the list to fill two of the top four slots for the most costly Japanese wind insurance and reinsurance market loss events on record, with 2018’s typhoon Jebi and 1991\s Mirielle the other two storm at the top of the list.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.