The Texas Windstorm Insurance Association (TWIA) is likely to target $200 million or perhaps greater of protection from an Alamo Re II Ltd. catastrophe bond issuance for 2020, as the capital markets look set to continue playing an important role in its reinsurance program.

As we explained back in February, TWIA had lifted its target for 2020 reinsurance and catastrophe bond coverage to $2.1 billion.

Budgeting for around $93 million of reinsurance costs in 2020, TWIA was hoping at the time that overall rate-on-line for its 2020 reinsurance program would fall somewhere between 4.25% and 4.5%.

There’s every chance that may now have increased slightly, but board meeting documents show that TWIA continues to aim for a $2.1 billion reinsurance and cat bond program, attaching above $2.1 billion of losses to the insurer.

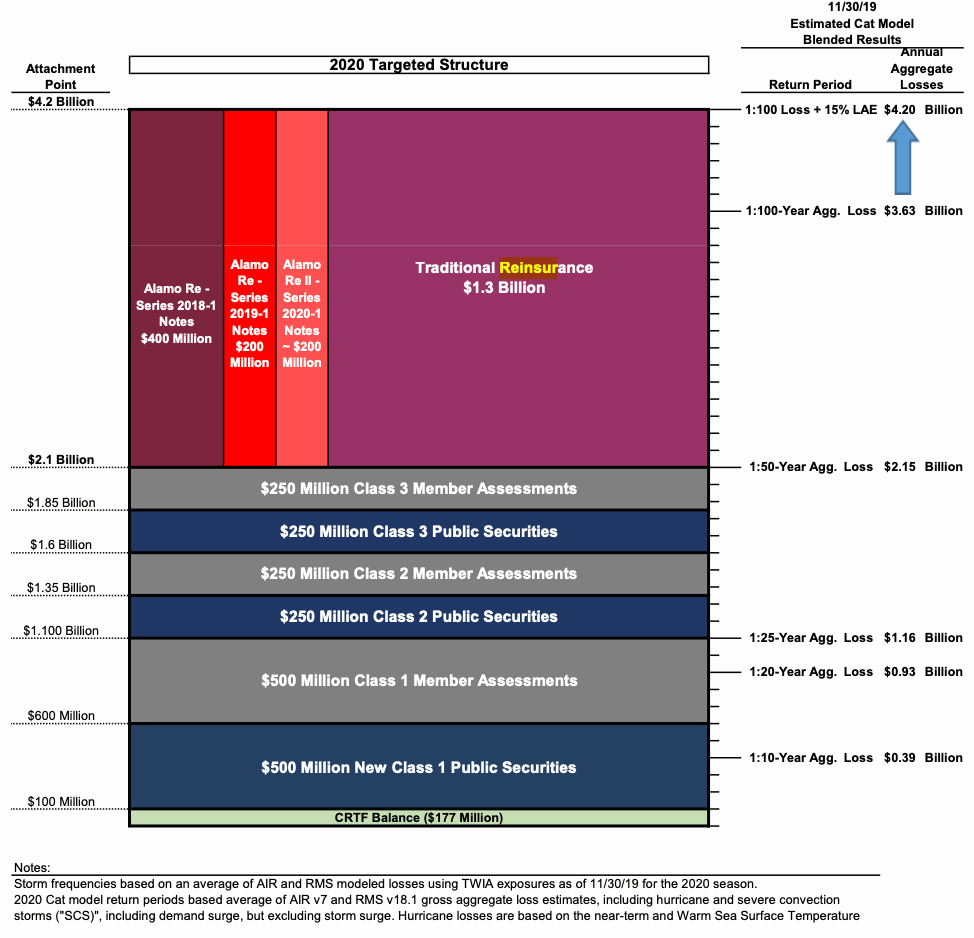

As in previous years, the goal is to again cover TWIA for losses up to a 1-in-100 year probable maximum loss hurricane event and for the 2020 catastrophe year that 1-in-100 loss level means requiring coverage up to $4.2 billion, including loss adjustment expenses.

Reinsurance and Alamo Re catastrophe bonds will sit atop $2.1 billion of funding from the Catastrophe Reserve Trust Fund, member assessments and pre or post-event debt funding sources.

In 2019, TWIA’s reinsurance arrangements consisted of $1.1 billion of traditional reinsurance and $1 billion of catastrophe bonds, $400 million of Alamo Re Ltd. (Series 2017-1) catastrophe bonds, $400 million of Alamo Re Ltd. (Series 2018-1) catastrophe bonds, $200 million from its more recently issued Alamo Re Ltd. (Series 2019-1) cat bond deal.

For 2020, the target currently is for $1.3 billion of traditional reinsurance, plus the still in-force $400 million of Alamo Re Ltd. (Series 2018-1) catastrophe bonds and $200 million of Alamo Re Ltd. (Series 2019-1) cat bonds.

Which only leaves $200 million still to secure, through a proposed fresh Alamo Re II Series 2020-1 catastrophe bond deal that would provide annual aggregate coverage like the rest of TWIA’s reinsurance tower. A new Alamo Re II Ltd. special purpose insurer is expected to be registered for the issuance, we understand.

$200 million is the proposed size, we understand, meaning that TWIA could opt to upsize on the cat bond issuance of pricing and terms are conducive, while securing a little less traditional reinsurance instead.

TWIA is likely to launch such a cat bond in the coming weeks, as it will require this coverage to be in force ready for the hurricane season, we assume.

You can see the proposed TWIA 2020 reinsurance and funding tower below. We’ll update you if and when an Alamo Re II Ltd. (Series 2020-1) catastrophe bond is launched to the market.

As ever, TWIA will mix its sources of reinsurance capital depending on availability, price and efficiency, as it looks to secure its reinsurance tower in the most effective manner possible.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.