The recent devastating earthquakes in Turkey are estimated as likely to cause an insurance and reinsurance market loss of around US $2.4 billion by catastrophe risk modeller Karen Clark & Company.

Karen Clark & Company (KCC) also puts the economic impact of the property losses from the two M7.8 and M7.5 earthquakes at close to US $20 billion, the majority of which coming from the first and larger M7.8 quake event.

Karen Clark & Company (KCC) also puts the economic impact of the property losses from the two M7.8 and M7.5 earthquakes at close to US $20 billion, the majority of which coming from the first and larger M7.8 quake event.

This compares to the recent estimate from Verisk (AIR), which said that economic losses from the earthquakes that struck Turkey would likely be above US $20 billion, while the insurance and reinsurance industry faces a bill of above US $1 billion.

KCC noted that the widespread damage to buildings, particularly close to the quake epicenter, is in part attributed to intense ground motion acceleration, that the modeller says was “much more intense than the buildings were designed to withstand.”

However, KCC also noted that “Much of the damage stems from poor construction practices and lax enforcement of building codes.”

KCC provided additional information on the impacts of the earthquake:

Across 10 of Turkey’s 81 provinces, the earthquake destroyed or heavily damaged more than 41,000 buildings, most of which were poorly designed or constructed. Of those 41,000 buildings, many were mid-rise multi-family residences constructed of reinforced concrete, though many commercial and industrial buildings were also completely destroyed. More than 35,000 people are reported dead from the earthquake, a number that’s expected to rise as search and rescue efforts continue. The death toll is now considerably higher than the 2011 Tohoku (19,759) and the 1999 Ismit (18,373) earthquakes.

Historically in Turkey, reinforced concrete buildings tend to fail because of poor concrete quality and lack of sufficient longitudinal and transverse reinforcement. In addition, buildings in the region are more likely to have open ground floors, making them more susceptible to soft story failure. And finally, weak links between columns and beams can lead to pancake collapse. Following the Izmit earthquake of 1999, Turkish authorities attempted to enforce building codes for new construction with more rigor, but most of Turkey’s buildings were constructed before that change.

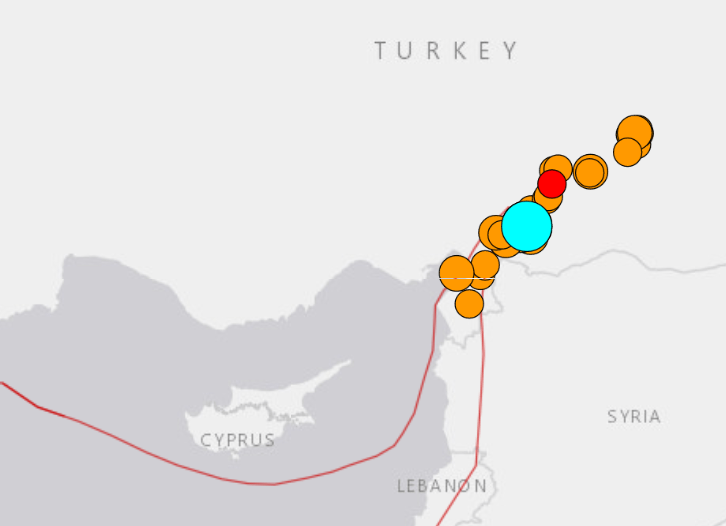

The most affected areas in Turkey are Gaziantep, Kahramanmaras, Malatya, Osmaniye, Iskenderun, Antakya, and Adana, with significant damage in Sanliurfa and Diyarbakir as well.

Also read:

– Turkey earthquake unlikely to impact cat bond performance: Plenum.

– Twelve Capital says private ILS exposure to Turkey quake “very limited”.

– Turkey quake industry loss could reach $1bn, fall largely to reinsurance: Fitch.

– Verisk (AIR) pegs Turkey quake economic loss at $20bn+, insured at $1bn+.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.