Insurance industry losses from the devastating earthquake that struck Turkey and Syria earlier this week are anticipated to fall around the US $1 billion mark, with reinsurance capital set to bear the majority, Fitch Ratings believes.

Rightly, noting the human tragedy that has unfolded first, with upwards of 15,000 deaths now anticipated from the tragic event, Fitch Ratings has provided some insight into how it expects the event will impact re/insurers around the world.

Rightly, noting the human tragedy that has unfolded first, with upwards of 15,000 deaths now anticipated from the tragic event, Fitch Ratings has provided some insight into how it expects the event will impact re/insurers around the world.

Fitch explained that the economic loss from the earthquake is expected to exceed US $2 billion and could reach US $4 billion and more.

However, the insurance industry loss is expected to be far lower, with around US $1 billion covered.

“The vast majority of insured losses will be covered by reinsurance,” Fitch explained. Adding that, “The amount ceded is likely to be insignificant in the context of the global reinsurance market, with no implications for reinsurers’ ratings.”

Commenting on the The Turkish Catastrophe Insurance Pool (TCIP), which provides insurance protection against earthquake damage to residential buildings in urban areas, Fitch notes that the TCIP does not cover human losses, liability claims or indirect losses, such as business interruption.

“Earthquake insurance cover is technically mandatory in Turkiye, but is very often not enforced in practice. As a result, many residential properties are not insured, particularly in many of the affected areas, where low household incomes constrain affordability,” Fitch explained.

While the human costs are significant in Syria as well, given the very low penetration of insurance there, any loss will be negligible it seems.

Fitch expects a significant proportion of the industry loss to come via the TCIP to the reinsurance market.

“The TCIP is heavily reinsured,” Fitch explained. “We estimate that the reinsurance tower provides protection of just over USD2 billion, following the January 2023 reinsurance renewals, with an attachment point of around USD300 million.”

In addition, local and international commercial insurers providing property and business interruption policies to industrial clients in the region impacted by the earthquake are also expected to face claims, factories and infrastructure, including airports and ports, severely damaged.

Fitch said that it also assumes that these covers will have been heavily reinsured.

Finally, the rating agency adds that it also does not expect any significant impact to catastrophe bonds, explained that, “The earthquake risk they cover in the region is mostly limited to the Istanbul area.”

As we previously reported, there is the potential for some minimal exposure for the ILS market, largely through any retrocession arrangements, mainly in terms of aggregate deductible erosion, or via any exposed reinsurer sponsored sidecars that could cede some losses through their quota shares.

Also read:

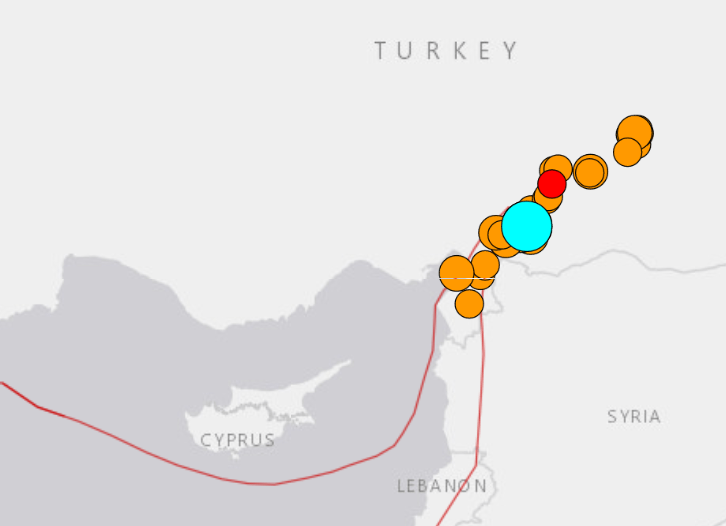

– Turkey hit by M7.8 earthquake. USGS gives 78% chance damages rise above $1bn.

– Turkey earthquake unlikely to impact cat bond performance: Plenum.

– Twelve Capital says private ILS exposure to Turkey quake “very limited”.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.