Tremor Technologies, the insurtech with a technology-based programmatic insurance and reinsurance risk transfer marketplace, has launched impressive specific functionality to allow buyers and sellers of retrocession to trade in UNL, parametric and blended products.

Named RetroOS™, Tremor calls the new feature set “A Retrocession Operating System for Reinsurers.”

Through these new features in Tremor’s reinsurance and risk transfer marketplace, the 125 reinsurers already signed up and providing quotes through the system can now buy or sell UNL, parametric and blended retrocession coverage directly on its platform, which the company says can be “faster, better and more competitively than traditional placement.”

On the heels of a record year in 2021 when Tremor expanded the amount of risk transferred through its marketplace to $175 million of premium transacted last year, the company is now looking to help the reinsurers that have already come to appreciate its market, as well as new entrants, to buy and sell their retrocession more effectively as well.

RetroOS consists of three components, RetroUNL, RetroParametric and RetroBlend.

RetroUNL

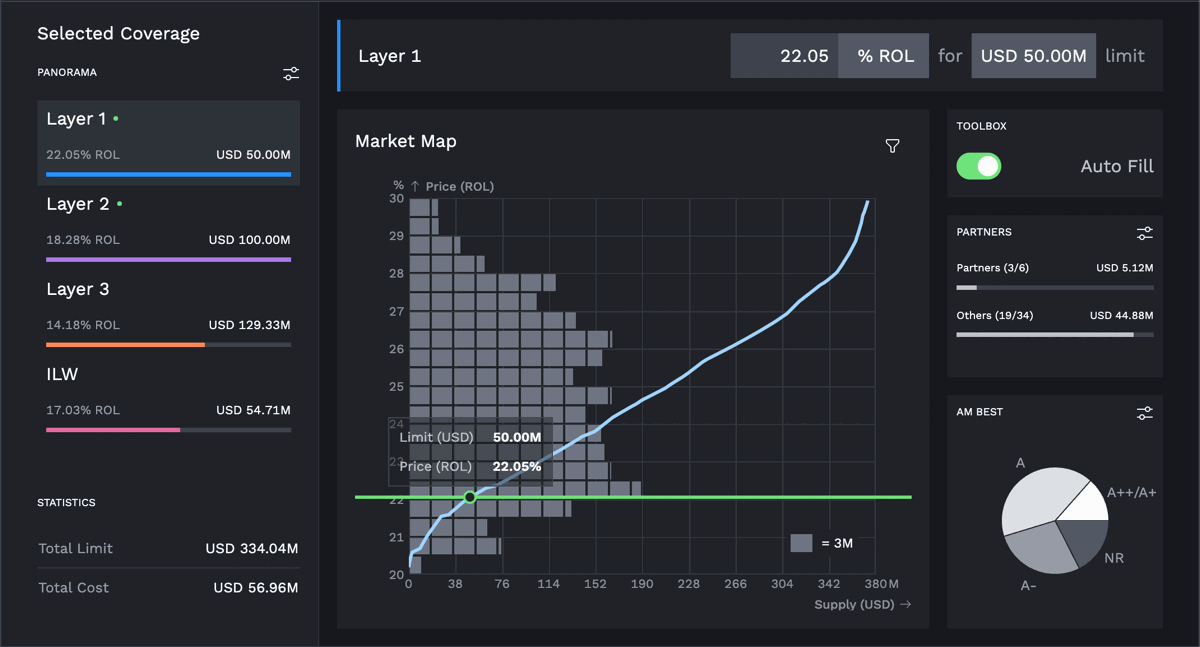

RetroUNL is designed for reinsurers that have a UNL (ultimate net loss, or indemnity) retrocession structure ready to go and they can place it using Tremor’s Panorama platform, enabling them to quickly see the market and get the right coverage at the right price.

This is a fantastic option for many retro buyers, who often buy relatively simple towers of UNL coverage and don’t change their program structure much year after year, perhaps just with tweaks to retention and attachment or exhaustion levels.

This should be a fast way for any reinsurer, or indeed ILS fund, to get an accurate view of market pricing and appetite for its retrocession tower, as well as to place the coverage with the reinsurance capital providers that write retro and are using Tremor’s marketplace platform.

RetroParametric

RetroParametric is an interesting addition for Tremor, being its first pure parametric risk transfer offering.

It will allow reinsurers that are looking to build a portfolio of parametric coverage to list the regions and perils they need, but then optimise trigger and limit once they see the market and its appetite.

“Reinsurers can match a risk portfolio with category 4 hurricane protection in Florida and 8.0 earthquake protection in California, or adjust to category 5 hurricane and 7.7 earthquake to find the best execution for their needs,” Tremor explains.

For buyers this is another value-add feature, allowing those seeking parametric protection to test out the market’s appetite for risks, while securing responsive protection using their well-defined parametric triggers.

It seems likely this feature would work as well for those seeking parametric insurance or reinsurance as well, so we suspect it will be expanded to offer broader risk transfer functionality than just the current retro target.

RetroBlend

RetroBlend is also very interesting, as it will enable reinsurers to access true market pricing for options before they buy, so any that are debating between UNL and parametric can compare and contrast, before buying the right mix of coverage.

“For example, reinsurers could list a $500M xs $500M excess of loss layer on Tremor alongside a Florida hurricane ILW that gives them similar protection, then use Tremor to mix and match between the two types of protection,” the company explained.

Sean Bourgeois, Tremor’s Founder & CEO, commented on the new functionality, “Tremor continues to relentlessly innovate in the reinsurance market offering tools and technologies to buyers and sellers of protection that offer faster, better and more competitive execution. Given how tight the retro market has become, the Tremor team has been hard at work building RetroOS™ this quarter to solve traditional market challenges with modern trading technologies.”

As well as helping insurers buy reinsurance protection across a range of lines of business, Tremor has also offered industry loss warranty (ILW) auctions too.

This new retrocession offering is very comprehensive, while the structured nature of the product offering and how buying and selling works in Tremor’s market should be of particular value in a retro market that has been so dislocated and capacity starved of late.

The other really compelling opportunity for buyers and sellers of retro, is having a marketplace that is always-on and can be traded in outside of the main reinsurance renewal seasons.

It’s also a sign of other products Tremor could offer, such as parametric insurance coverages for peak peril exposures that Tremor could create using very similar technology. That could be a compelling and useful addition, while enabling Tremor to expand its user-base to include insurance buyers and risk managers as well.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.