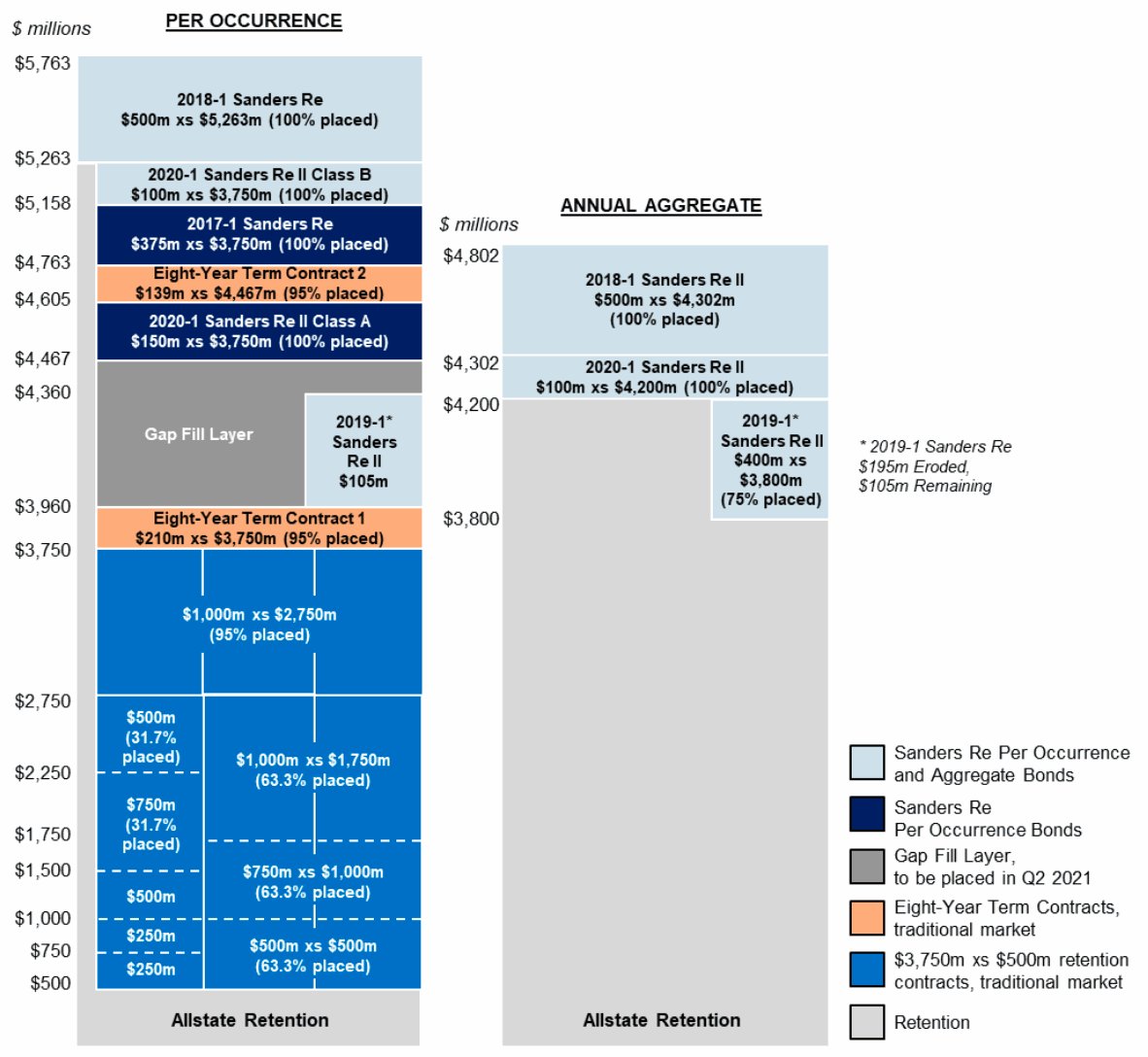

Allstate lifts Nationwide reinsurance tower to $9.5bn. Agg cat bonds attach at $4bn in 2025

1st May 2025US primary insurer Allstate has lifted the top of its main occurrence Nationwide Excess Catastrophe Reinsurance Program to a new high of $9.5 billion at its recent renewal, with catastrophe bond coverage a growing component, while its retention has also increased to now $1 billion across the tower.

Read the full article